Title: Exploring Kentucky Farm Lease or Rental — Cash: Types and Detailed Description Introduction: A Kentucky Farm Lease or Rental — Cash refers to a legally binding agreement between the landowner (lessor) and the tenant (lessee) for the temporary use of agricultural land in Kentucky. It entails the exchange of cash rent as the primary form of payment from the lessee to the lessor in return for the productive use of the farmland. This comprehensive overview will delve into the various types of Kentucky Farm Lease or Rental — Cash agreements, highlighting their key features and benefits. 1. Fixed Cash Rent Lease: In a Fixed Cash Rent Lease, the lessee pays a predetermined amount of cash rent for the use of the Kentucky farm, usually on an annual basis. This lease type provides stability for both parties, as the cash rent remains constant regardless of crop yield or market fluctuations. 2. Share Rent Lease: Unlike the Fixed Cash Rent Lease, a Share Rent Lease involves the sharing of income between the landowner and tenant based on a mutually agreed-upon ratio or percentage. The tenant contributes a portion of the harvested crop or livestock, rather than paying a fixed cash rent, which fosters a shared risk and reward arrangement between the parties. 3. Crop Share Lease: Within a Crop Share Lease arrangement, the tenant shares a percentage of the harvested crop with the landowner. This type of lease relies on the lessee's expertise and cultivation methods to yield a successful harvest, with the landowner benefiting directly from the productivity of the land. 4. Livestock Share Lease: Under a Livestock Share Lease, the tenant agrees to share a portion of the livestock production, such as offspring or proceeds from sales, with the landowner. This type of lease is particularly prevalent in livestock farming, allowing the landowner to participate in the livestock's profitability. 5. Flexible Cash Rent Lease: A Flexible Cash Rent Lease incorporates adjustments in the cash rent based on various factors such as crop prices, yields, and input costs. This type of lease promotes a fair distribution of risk and reward by accounting for market conditions and expenses. Benefits of Kentucky Farm Lease or Rental — Cash: i. Clear financial expectations: The use of cash rent eliminates uncertainties related to market fluctuations, facilitating better financial planning for both parties. ii. Flexibility in lease structures: Different types of rental agreements allow for customized arrangements, accommodating the needs and preferences of involved parties. iii. Shared risk and reward: Share Rent and Crop/Livestock Share Leases promote collaboration and shared financial responsibility, aligning the interests of the landowner and tenant. iv. Ability to support sustainable farming practices: Cash rent leases can incentivize lessees to adopt sustainable and environmentally friendly farming techniques, benefiting the land's long-term productivity. In conclusion, Kentucky Farm Lease or Rental — Cash offers various lease types, each catering to different agricultural practices and risk preferences. By understanding these lease types and their implications, both landowners and tenants can form mutually beneficial agreements that foster successful farming practices while ensuring fair compensation for land use. Keywords: Kentucky Farm Lease, Kentucky Farm Rental, Kentucky Cash Rental, fixed cash rent lease, share rent lease, crop share lease, livestock share lease, flexible cash rent lease, farm lease types, farm rental types, sustainable farming practices.

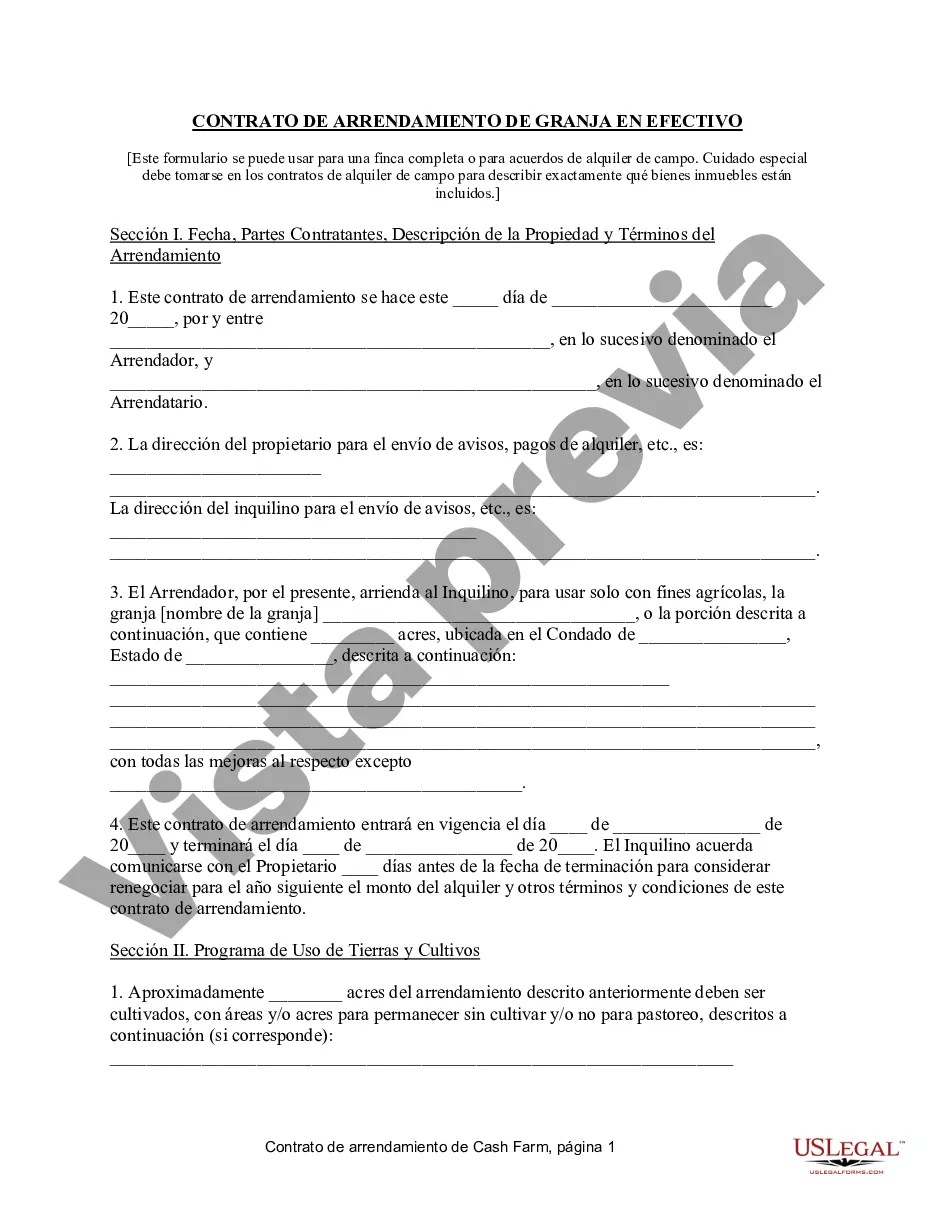

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kentucky Finca Arrendamiento o Renta - Efectivo - Farm Lease or Rental - Cash

Description

How to fill out Kentucky Finca Arrendamiento O Renta - Efectivo?

Are you presently in the position the place you need paperwork for possibly company or personal reasons just about every working day? There are tons of legitimate papers templates accessible on the Internet, but locating types you can rely is not straightforward. US Legal Forms provides thousands of form templates, such as the Kentucky Farm Lease or Rental - Cash, that are written to satisfy federal and state needs.

In case you are presently knowledgeable about US Legal Forms internet site and get a merchant account, basically log in. Next, you may down load the Kentucky Farm Lease or Rental - Cash design.

Unless you offer an account and need to begin using US Legal Forms, adopt these measures:

- Discover the form you require and make sure it is for that proper city/region.

- Take advantage of the Preview option to review the shape.

- Look at the outline to ensure that you have chosen the proper form.

- In the event the form is not what you are searching for, make use of the Search area to find the form that suits you and needs.

- When you get the proper form, simply click Purchase now.

- Select the pricing prepare you want, submit the necessary information and facts to generate your bank account, and pay for the transaction with your PayPal or charge card.

- Select a practical document file format and down load your version.

Find all of the papers templates you have bought in the My Forms menus. You can get a further version of Kentucky Farm Lease or Rental - Cash whenever, if required. Just click the essential form to down load or printing the papers design.

Use US Legal Forms, by far the most comprehensive variety of legitimate varieties, to save efforts and steer clear of blunders. The service provides expertly created legitimate papers templates which you can use for a range of reasons. Generate a merchant account on US Legal Forms and commence producing your daily life a little easier.