Title: Demystifying Kentucky Division Orders: Everything You Need to Know Introduction: Kentucky Division Orders play a crucial role in the oil and gas industry by outlining the distribution of royalties among landowners and mineral interest owners. This comprehensive guide provides an in-depth understanding of Kentucky Division Orders, their significance, types, and key terms associated with them. 1. What are Kentucky Division Orders? Kentucky Division Orders refer to legally binding documents that establish the percentage of interest each royalty owner or mineral interest owner holds in a specific oil or gas well. These orders outline the allocation and distribution of revenues generated from the production of oil and gas. 2. Significance of Kentucky Division Orders: — Allocation of Royalties: These documents ensure fair distribution of royalties among landowners, mineral rights owners, and other entitled parties. — Clarifying Ownership Rights: Division orders establish and confirm the legal rights of royalty owners and help prevent any disputes related to ownership interests. — Accuracy and Efficiency: Kentucky Division Orders provide a structured system for payment, ensuring accurate calculations and timely disbursement of funds. 3. Different Types of Kentucky Division Orders: — Unitized Division Orders: Used in fields where multiple landowners and mineral interest owners collectively own a reservoir or a field. Unitization helps streamline operations and ensures efficient management of the resources. — Standard Division Orders: Applicable in cases where a single landowner or mineral interest owner owns the rights to a well or lease. These orders outline the specific interest percentage and terms for that particular owner. 4. Key Terms Associated with Kentucky Division Orders: — Royalty Interest: The percentage of revenue that the landowner or mineral rights owner is entitled to receive on the production of oil and gas. — Decimal Interest: It represents the fraction or decimal fraction of the total royalty interest of a landowner or mineral interest owner. It determines the proportion of royalties they will receive. — Grantee/Assignee: The individual or entity authorized to receive royalty payments as specified in the Kentucky Division Order. — Pugh Clause: A provision in the division order that allows for the release of undeveloped or non-producing lands from the contract. — Drilling and Leasehold Costs: Expenses incurred during the drilling and development of the well, which may be shared or deducted from the royalties. Conclusion: Kentucky Division Orders are essential documents that ensure equitable distribution of royalties among landowners and mineral interest owners. Understanding the various types and key terms associated with division orders is crucial for all parties involved in the oil and gas industry. By providing clarity and establishing legal rights, Kentucky Division Orders promote transparency, accuracy, and efficient financial management in the industry.

Kentucky Division Orders

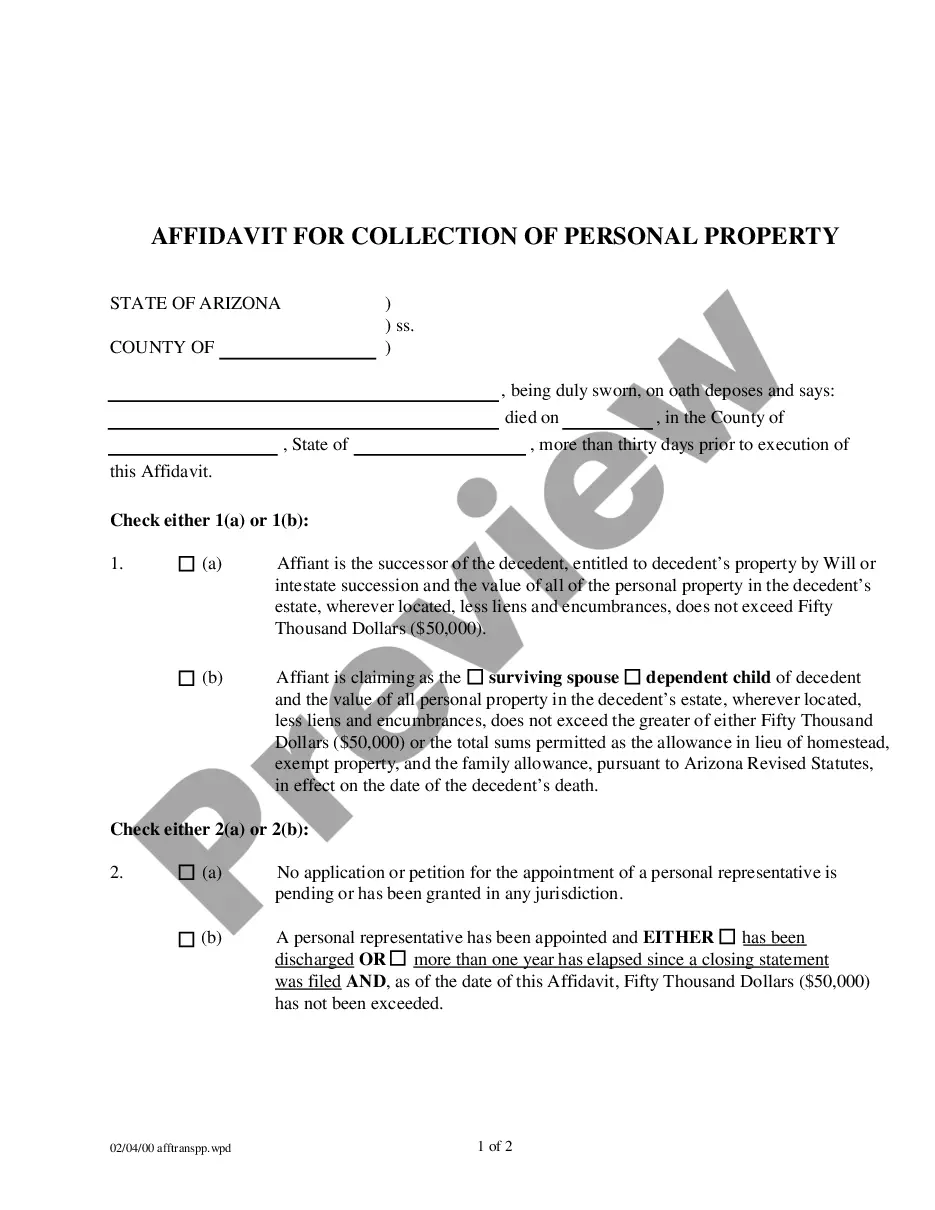

Description

How to fill out Kentucky Division Orders?

Choosing the best lawful file design can be quite a have difficulties. Obviously, there are tons of templates accessible on the Internet, but how would you obtain the lawful kind you require? Make use of the US Legal Forms website. The assistance provides 1000s of templates, such as the Kentucky Division Orders, that can be used for company and personal needs. All the forms are checked by professionals and satisfy state and federal requirements.

If you are presently registered, log in in your bank account and click the Acquire switch to obtain the Kentucky Division Orders. Make use of bank account to look with the lawful forms you possess purchased in the past. Visit the My Forms tab of your own bank account and obtain one more version of your file you require.

If you are a whole new end user of US Legal Forms, allow me to share basic recommendations so that you can follow:

- Very first, ensure you have chosen the correct kind for your area/area. You are able to check out the form making use of the Review switch and read the form outline to guarantee it will be the best for you.

- If the kind is not going to satisfy your needs, take advantage of the Seach discipline to find the correct kind.

- When you are certain that the form is acceptable, go through the Acquire now switch to obtain the kind.

- Choose the pricing plan you want and enter the needed information and facts. Build your bank account and buy the order utilizing your PayPal bank account or charge card.

- Select the document formatting and obtain the lawful file design in your gadget.

- Comprehensive, change and print and signal the acquired Kentucky Division Orders.

US Legal Forms is definitely the greatest catalogue of lawful forms for which you will find a variety of file templates. Make use of the service to obtain appropriately-created documents that follow condition requirements.