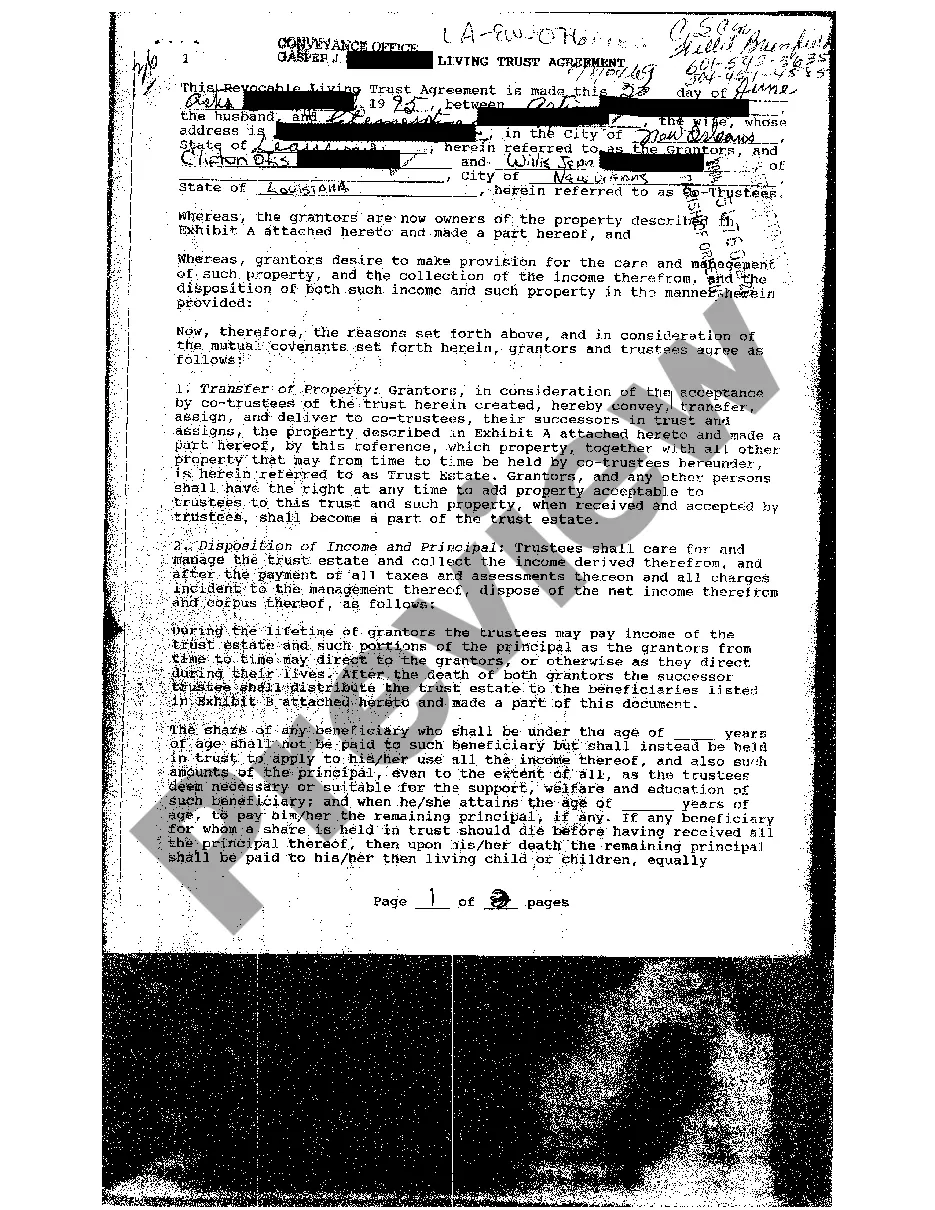

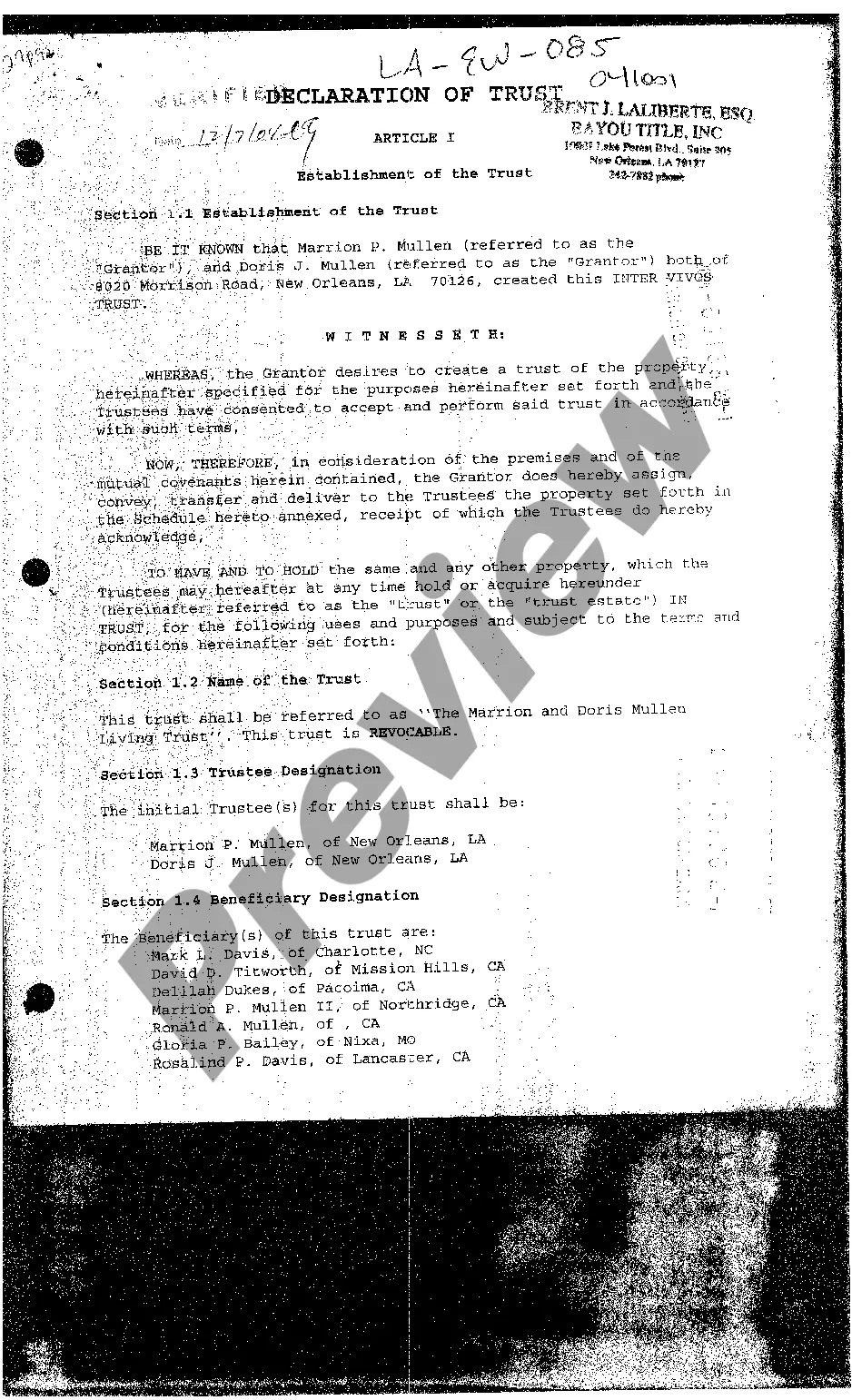

Louisiana Living Trust Agreement

Description

How to fill out Louisiana Living Trust Agreement?

You are invited to the largest collection of legal documents, US Legal Forms. Here you can obtain any template like Louisiana Living Trust Agreement forms and keep them (as numerous as you desire). Prepare formal documents in merely a few hours, instead of days or weeks, without needing to spend a fortune on a lawyer.

Obtain the state-specific template with a few clicks and feel assured knowing that it was created by our skilled attorneys.

If you’re already a subscribed customer, simply Log In to your account and click Download adjacent to the Louisiana Living Trust Agreement you wish to acquire. Since US Legal Forms is an online service, you’ll consistently have access to your downloaded templates, regardless of the device you’re using. View them within the My documents section.

- If you do not have an account yet, what are you hesitating for.

- Review our instructions below to get going.

- If this is a state-specific template, confirm its relevance in your state.

- Examine the description (if available) to determine if it’s the correct template.

- Explore more content with the Preview feature.

- If the template fulfills all your needs, simply click Buy Now.

- To create an account, choose a pricing option.

- Utilize a credit card or PayPal account to register.

- Store the document in the format you need (Word or PDF).

- Print the document and complete it with your/your organization’s details.

- After you’ve filled out the Louisiana Living Trust Agreement, send it to your attorney for confirmation. It’s an additional step but a crucial one to ensure you’re completely protected.

- Join US Legal Forms now and acquire a large number of reusable templates.

Form popularity

FAQ

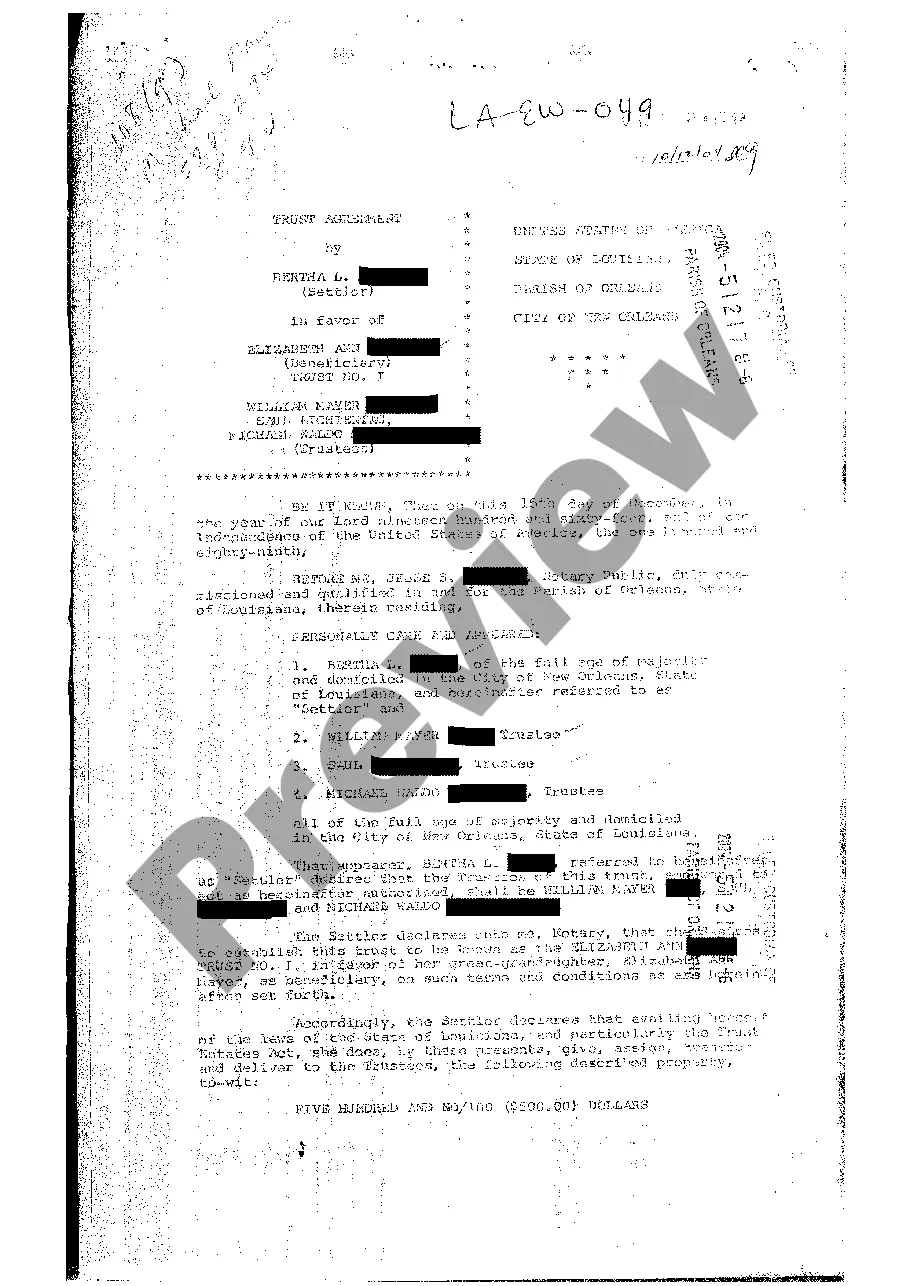

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.

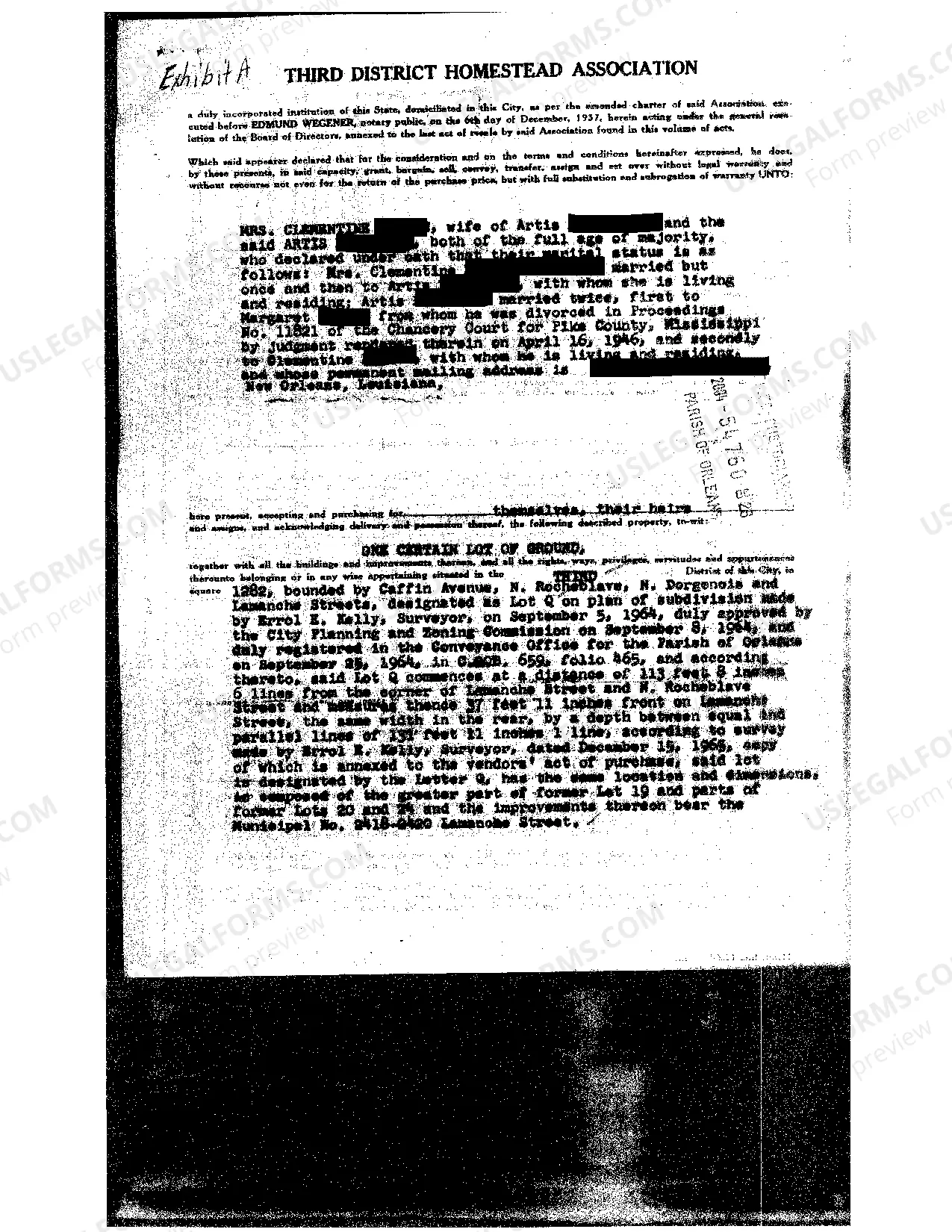

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

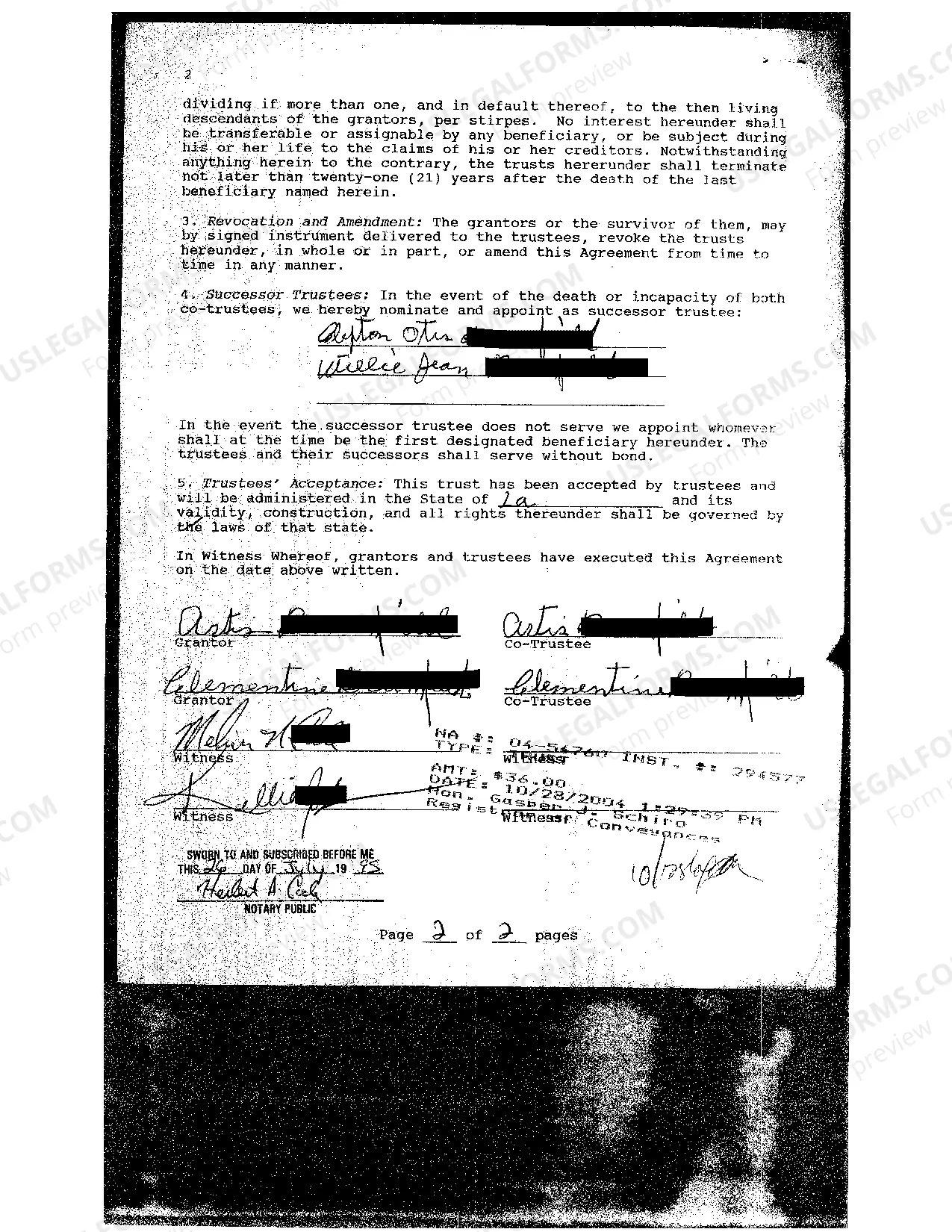

Decide which type of trust you want. Take stock of your property. Pick a trustee. Create a trust document, either by yourself using a computer program or with the help of a lawyer. Sign the trust in front of a notary public. Put your assets inside the trust.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

The trustee is the person who owns the assets in the trust. They have the same powers a person would have to buy, sell and invest their own property. It's the trustees' job to run the trust and manage the trust property responsibly.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).