Louisiana Donation or Gift to Charity of Personal Property refers to the act of donating or giving away personal property for charitable purposes in the state of Louisiana. It involves a voluntary transfer of ownership of personal assets, such as artwork, vehicles, furniture, jewelry, or other valuable possessions, to a qualified charitable organization. In Louisiana, there are different types of donation or gift options available for individuals who wish to contribute their personal property to charity. Some of these options include: 1. Cash Donations: This involves donating money or cash equivalents directly to a charitable organization. It is the simplest and most common form of charitable giving. 2. In-Kind Donations: These are non-cash donations of personal property, such as clothing, books, household items, or electronics. The donated items must be in good condition and relevant to the mission of the charitable organization. 3. Real Estate Donations: This type of donation involves gifting or transferring ownership of real property, such as land, houses, or commercial buildings, to a charitable organization. Real estate donations may provide tax benefits for the donor. 4. Appreciated Securities: Donating appreciated stocks, bonds, or mutual funds to a charity can offer tax advantages. By donating these assets, the donor can avoid paying capital gains tax on the appreciation while still receiving a charitable deduction for the full fair market value of the securities. 5. Planned Giving: This involves making a donation through a planned strategy, such as including a charitable bequest in a will, creating a charitable trust, or setting up a charitable gift annuity. Planned giving options provide flexibility and potential tax benefits to the donor, benefiting both the charitable organization and the donor's estate. To ensure that the donation or gift to charity of personal property is properly executed in Louisiana, it is important to follow the guidelines set by the Internal Revenue Service (IRS) and comply with the state's tax regulations. Donors should consult with their tax advisor or attorney to understand the specific tax implications, reducibility limits, and documentation requirements associated with their donations. Overall, Louisiana Donation or Gift to Charity of Personal Property encompasses a range of options for individuals looking to support charitable causes by giving away their personal belongings. Such acts of generosity not only benefit the recipient organizations but also provide potential tax benefits and a sense of fulfillment for the donor.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Louisiana Donación o regalo a la caridad de propiedad personal - Donation or Gift to Charity of Personal Property

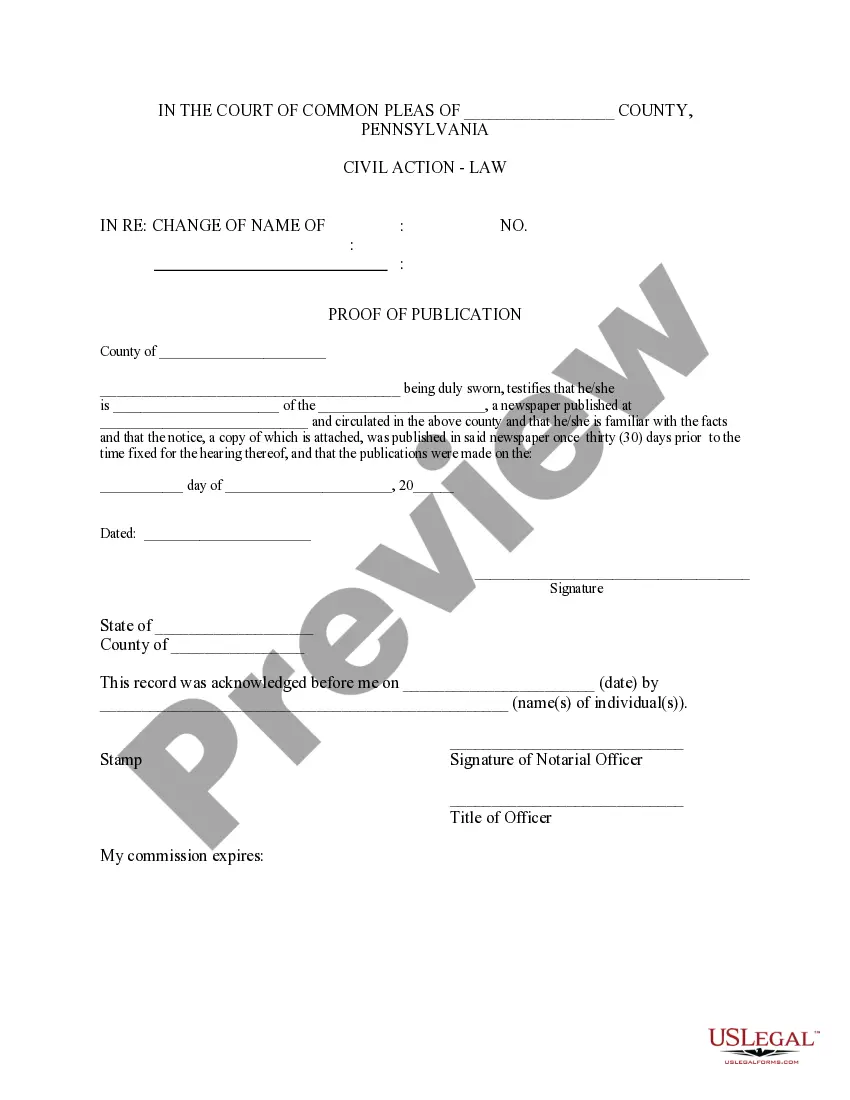

Description

How to fill out Louisiana Donación O Regalo A La Caridad De Propiedad Personal?

US Legal Forms - one of several biggest libraries of legal types in the States - provides a wide array of legal record web templates you can download or produce. While using web site, you will get thousands of types for company and individual uses, categorized by groups, says, or search phrases.You will discover the newest models of types just like the Louisiana Donation or Gift to Charity of Personal Property in seconds.

If you already have a registration, log in and download Louisiana Donation or Gift to Charity of Personal Property through the US Legal Forms collection. The Acquire switch can look on each and every form you view. You gain access to all formerly saved types inside the My Forms tab of your own account.

If you want to use US Legal Forms for the first time, listed here are easy directions to help you get started out:

- Be sure you have picked out the best form to your city/state. Go through the Review switch to review the form`s articles. See the form description to actually have selected the right form.

- If the form doesn`t match your specifications, take advantage of the Look for field on top of the screen to find the one that does.

- Should you be content with the shape, affirm your decision by clicking on the Buy now switch. Then, choose the costs strategy you favor and give your references to sign up for the account.

- Process the purchase. Make use of bank card or PayPal account to complete the purchase.

- Pick the structure and download the shape in your gadget.

- Make modifications. Load, revise and produce and signal the saved Louisiana Donation or Gift to Charity of Personal Property.

Every single web template you added to your account lacks an expiration particular date and is also your own permanently. So, if you would like download or produce another copy, just go to the My Forms segment and click on about the form you need.

Obtain access to the Louisiana Donation or Gift to Charity of Personal Property with US Legal Forms, probably the most substantial collection of legal record web templates. Use thousands of skilled and express-certain web templates that meet your small business or individual requirements and specifications.