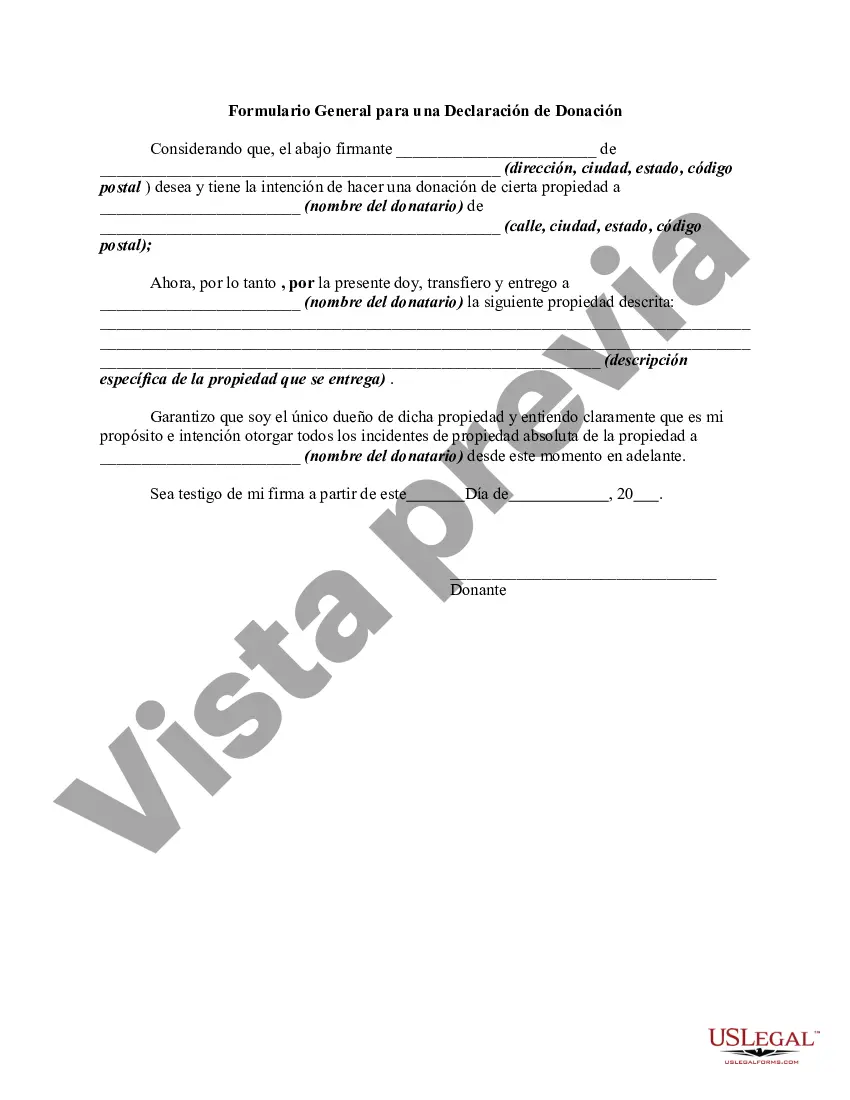

The following form is a general form for a declaration of a gift of property.

The Louisiana Declaration of Gift is a legal document that allows an individual, referred to as the donor, to transfer ownership of certain assets or property to another person, known as the done, without any consideration or compensation. This declaration represents an irrevocable act of giving, wherein the donor willingly relinquishes their rights and transfers ownership to the done. Louisiana has specific laws and regulations governing the Declaration of Gift, and the document must comply with the requirements outlined by the state. It is crucial to consult an attorney who specializes in Louisiana estate planning and gift laws to ensure the proper execution and validity of such a declaration. Within Louisiana, there are different types of Declaration of Gift, each intended to cater to specific circumstances and assets. The most common types include: 1. Louisiana Declaration of Immovable Property Gift: This type of declaration is used when transferring ownership of real property, such as land, buildings, or houses, from the donor to the done. It requires a comprehensive description of the property, including its legal description, physical address, and any encumbrances or conditions associated with the transfer. 2. Louisiana Declaration of Movable Property Gift: This type of declaration applies to the transfer of movable property, which includes personal belongings or assets that are not immovable property. It covers a wide range of assets, such as vehicles, jewelry, artwork, stocks, bonds, cash, or any other valuables that can be physically moved. 3. Louisiana Declaration of Donation Inter Vivos: This declaration is commonly used when the donor wishes to make a gift during their lifetime. It enables the donor to maintain control and use of the gifted assets until their death if desired. 4. Louisiana Declaration of Testamentary Donation: Unlike the Declaration of Donation Inter Vivos, this type of declaration comes into effect only upon the donor's death. It allows individuals to include gifts to specific beneficiaries in their last will and testament, ensuring the proper distribution of assets according to their wishes. 5. Louisiana Declaration of Gift of Usufruct: This type of declaration involves transferring only the right to use and enjoy a property or asset without transferring its ownership. The usufructuary receives the benefit of using the asset while the donor retains ownership or, in some cases, designates another person, known as the naked owner, to retain ownership rights. Overall, the Louisiana Declaration of Gift provides individuals with a legal framework to make irrevocable transfers of property or assets to others. It is important to consult with a qualified attorney to ensure compliance with state laws and to accurately document the transfer process to protect the rights and interests of both the donor and done.The Louisiana Declaration of Gift is a legal document that allows an individual, referred to as the donor, to transfer ownership of certain assets or property to another person, known as the done, without any consideration or compensation. This declaration represents an irrevocable act of giving, wherein the donor willingly relinquishes their rights and transfers ownership to the done. Louisiana has specific laws and regulations governing the Declaration of Gift, and the document must comply with the requirements outlined by the state. It is crucial to consult an attorney who specializes in Louisiana estate planning and gift laws to ensure the proper execution and validity of such a declaration. Within Louisiana, there are different types of Declaration of Gift, each intended to cater to specific circumstances and assets. The most common types include: 1. Louisiana Declaration of Immovable Property Gift: This type of declaration is used when transferring ownership of real property, such as land, buildings, or houses, from the donor to the done. It requires a comprehensive description of the property, including its legal description, physical address, and any encumbrances or conditions associated with the transfer. 2. Louisiana Declaration of Movable Property Gift: This type of declaration applies to the transfer of movable property, which includes personal belongings or assets that are not immovable property. It covers a wide range of assets, such as vehicles, jewelry, artwork, stocks, bonds, cash, or any other valuables that can be physically moved. 3. Louisiana Declaration of Donation Inter Vivos: This declaration is commonly used when the donor wishes to make a gift during their lifetime. It enables the donor to maintain control and use of the gifted assets until their death if desired. 4. Louisiana Declaration of Testamentary Donation: Unlike the Declaration of Donation Inter Vivos, this type of declaration comes into effect only upon the donor's death. It allows individuals to include gifts to specific beneficiaries in their last will and testament, ensuring the proper distribution of assets according to their wishes. 5. Louisiana Declaration of Gift of Usufruct: This type of declaration involves transferring only the right to use and enjoy a property or asset without transferring its ownership. The usufructuary receives the benefit of using the asset while the donor retains ownership or, in some cases, designates another person, known as the naked owner, to retain ownership rights. Overall, the Louisiana Declaration of Gift provides individuals with a legal framework to make irrevocable transfers of property or assets to others. It is important to consult with a qualified attorney to ensure compliance with state laws and to accurately document the transfer process to protect the rights and interests of both the donor and done.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.