A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty of the payment of a debt is different from a guaranty of the collection of the debt. A guaranty of payment is absolute while a guaranty of collection is conditional.

Louisiana Guaranty of Collection of Promissory Note

Description

How to fill out Guaranty Of Collection Of Promissory Note?

Should you require to complete, download, or print authorized document templates, utilize US Legal Forms, the leading collection of legal forms that can be accessed online.

Employ the site's straightforward and user-friendly search feature to locate the documents you seek.

Numerous templates for both business and personal applications are organized by categories and states, or keywords.

Every legal document template you acquire is yours forever. You have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, print the Louisiana Guaranty of Collection of Promissory Note with US Legal Forms. There are numerous specialized forms available for both commercial and personal needs.

- Utilize US Legal Forms to obtain the Louisiana Guaranty of Collection of Promissory Note with just a few clicks.

- If you are an existing US Legal Forms customer, sign in to your account and then click the Acquire button to obtain the Louisiana Guaranty of Collection of Promissory Note.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

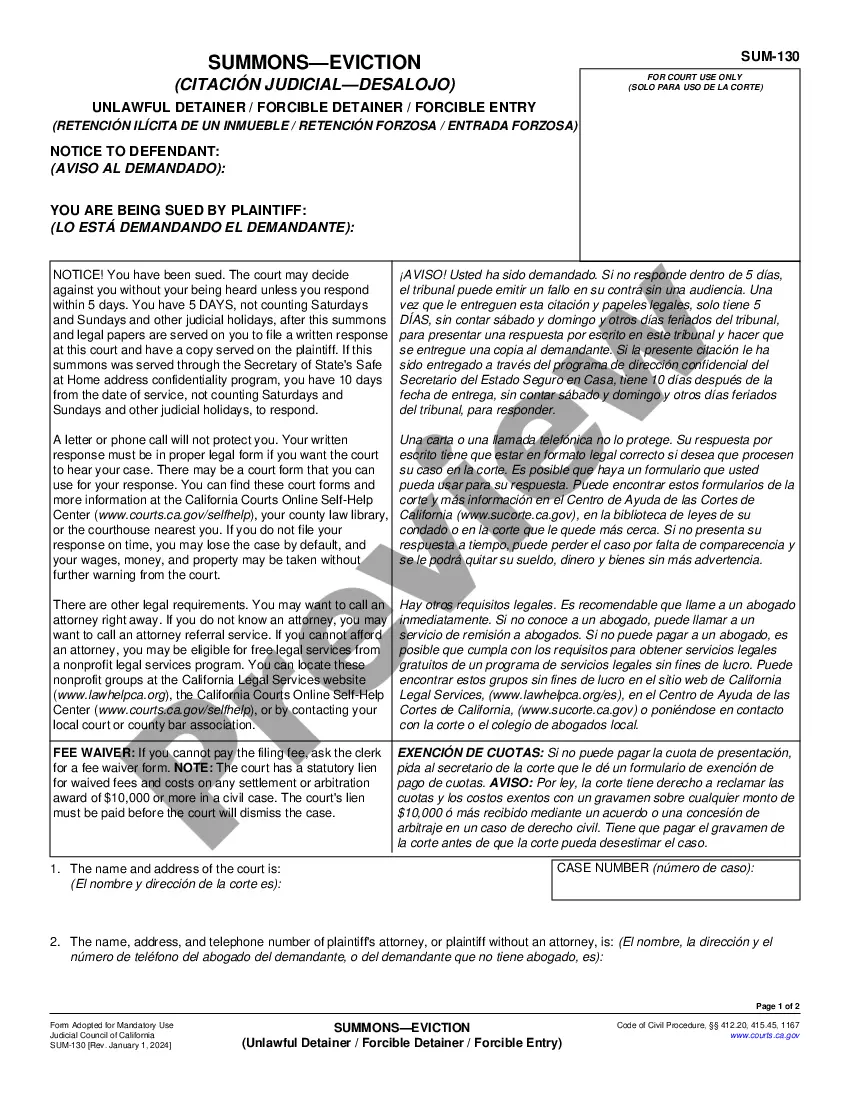

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Remember to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other forms of the legal document format.

- Step 4. Once you have located the form you need, click the Get now button. Select your preferred payment plan and enter your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the transaction.

- Step 6. Retrieve the format of the legal document and download it onto your device.

- Step 7. Complete, revise, and print or sign the Louisiana Guaranty of Collection of Promissory Note.

Form popularity

FAQ

In the context of a promissory note, the primary party liable for payment is usually the maker, also known as the borrower. This individual is responsible for repaying the amount specified in the note, according to the agreed terms. If you're considering using a Louisiana Guaranty of Collection of Promissory Note, it is essential to understand that this guaranty can provide a way for lenders to ensure payment if the maker defaults. Ultimately, having this protection can help facilitate a smoother borrowing process.

Filling out a promissory note requires clarity and detail. You should start with the date, then list both the borrower and lender’s information. Next, specify the amount and the agreed-upon interest rate, followed by the repayment terms. This process helps to leverage the Louisiana Guaranty of Collection of Promissory Note for protection in the future.

The format of a promissory note should be clear and structured. It usually begins with the title, followed by the date, the parties involved, the amount, and repayment terms. Properly formatting your note is vital, especially when relying on the Louisiana Guaranty of Collection of Promissory Note for legal validation.

The entry of a promissory note is the recorded acknowledgment of the debt. This entry typically includes details like the amount, interest rate, dates, and the responsible parties. Accurate entries are crucial because they establish clarity and enforce the terms under the Louisiana Guaranty of Collection of Promissory Note.

To fill out a promissory demand note, start by writing the date at the top. Next, include the names and addresses of both the borrower and the lender. Clearly state the amount borrowed and the repayment terms, along with the signature of the borrower. Utilizing the Louisiana Guaranty of Collection of Promissory Note ensures that you have legal protection if issues arise.

The 90-day rule in Louisiana refers to the timeframe in which certain claims must be filed, notably in property sales or changes in ownership. This rule helps set a clear limit for legal actions and ensures that disputes are resolved promptly. Utilizing the Louisiana Guaranty of Collection of Promissory Note can assist in maintaining compliance and protecting your rights throughout these processes.

To guarantee a promissory note, you typically require a guarantor who agrees to take on the debt responsibility if the borrower defaults. This often involves a formal agreement outlining the terms. Incorporating a Louisiana Guaranty of Collection of Promissory Note into your agreements can provide added security and peace of mind in these transactions.

In Louisiana, an exception of no cause of action can be filed to challenge the legal sufficiency of a claim. This acknowledgement prevents cases from going forward if they do not present valid legal grounds. Understanding how this exception operates is vital when engaging in the legal process. The Louisiana Guaranty of Collection of Promissory Note ensures you start from a place of clarity in your agreements.

Yes, a promissory note can indeed go to collections if the borrower fails to repay the debt. In such cases, the lender has the right to pursue collections to recover the owed amount. Implementing a Louisiana Guaranty of Collection of Promissory Note can help establish clear terms and conditions, reducing the likelihood of default.

While there are numerous quirky laws in Louisiana, most often they reflect the state's unique culture and history. For example, certain laws regarding French speakers may seem bizarre but serve to highlight local heritage. Regardless of these odd regulations, the Louisiana Guaranty of Collection of Promissory Note offers a serious approach to financial agreements that adhere to current legal standards.