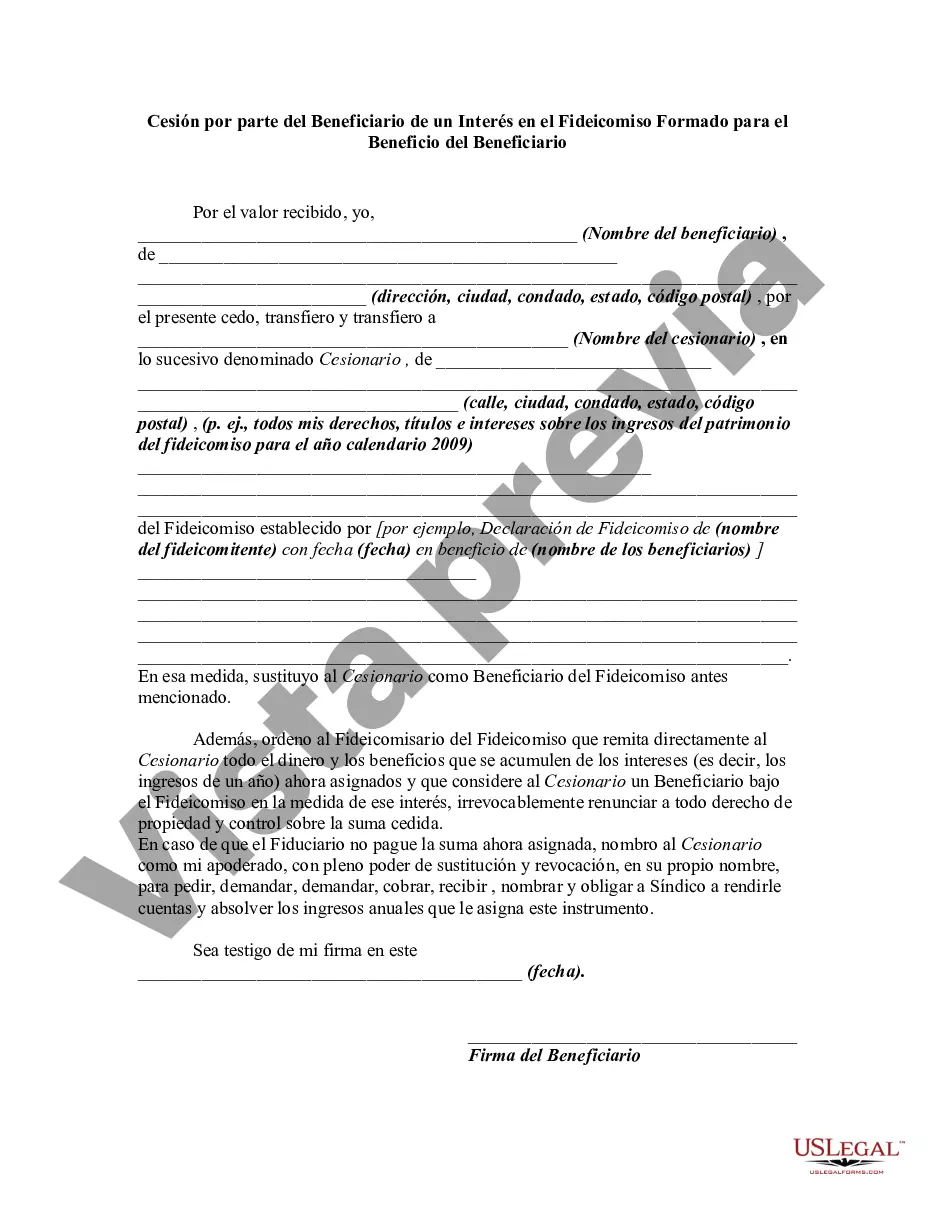

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Louisiana Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary refers to a legal document that allows a beneficiary of a trust in Louisiana to transfer or assign their interest in the trust to another party. This assignment enables the beneficiary to transfer their rights, benefits, and responsibilities associated with their interest to the assignee. The Louisiana Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a crucial legal tool when beneficiaries wish to allocate or sell their interest in the trust. This assignment can be used for various types of trusts, including revocable trusts, irrevocable trusts, testamentary trusts, living trusts, and special needs trusts. By executing this assignment, the beneficiary relinquishes their ownership rights, including any income, assets, or distributions derived from the trust. The assignee becomes the new owner and beneficiary of the assigned interest and assumes all responsibilities and entitlements associated with it. The Louisiana Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary typically includes essential information such as the names and addresses of the beneficiary and assignee, details of the trust, assignment terms, effective date, and signatures of all parties involved. It must comply with the specific legal requirements set forth by Louisiana state law. It is important to note that the assignment does not terminate the trust itself, but merely transfers the beneficiary's rights and interests to another party. The assignee will assume the beneficiary's position and become entitled to receive future distributions, benefits, and any other rights specified within the trust agreement. The assignee may also assume any restrictions or conditions imposed on the trust. By utilizing the Louisiana Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, individuals can effectively transfer their beneficial interests in a trust, providing flexibility and options for beneficiaries who may wish to assign their rights to someone else. This assignment allows for the proper distribution of assets and ensures the continuity of the trust's purpose and objectives. In summary, the Louisiana Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legally binding document that enables a beneficiary of a trust to assign their interest to another party. This assignment can be used for different types of trusts and allows for the transfer of rights, benefits, and responsibilities from the assignor to the assignee. It is crucial to follow the specific legal requirements of Louisiana state law when executing this assignment to ensure its validity and enforceability.Louisiana Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary refers to a legal document that allows a beneficiary of a trust in Louisiana to transfer or assign their interest in the trust to another party. This assignment enables the beneficiary to transfer their rights, benefits, and responsibilities associated with their interest to the assignee. The Louisiana Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a crucial legal tool when beneficiaries wish to allocate or sell their interest in the trust. This assignment can be used for various types of trusts, including revocable trusts, irrevocable trusts, testamentary trusts, living trusts, and special needs trusts. By executing this assignment, the beneficiary relinquishes their ownership rights, including any income, assets, or distributions derived from the trust. The assignee becomes the new owner and beneficiary of the assigned interest and assumes all responsibilities and entitlements associated with it. The Louisiana Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary typically includes essential information such as the names and addresses of the beneficiary and assignee, details of the trust, assignment terms, effective date, and signatures of all parties involved. It must comply with the specific legal requirements set forth by Louisiana state law. It is important to note that the assignment does not terminate the trust itself, but merely transfers the beneficiary's rights and interests to another party. The assignee will assume the beneficiary's position and become entitled to receive future distributions, benefits, and any other rights specified within the trust agreement. The assignee may also assume any restrictions or conditions imposed on the trust. By utilizing the Louisiana Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, individuals can effectively transfer their beneficial interests in a trust, providing flexibility and options for beneficiaries who may wish to assign their rights to someone else. This assignment allows for the proper distribution of assets and ensures the continuity of the trust's purpose and objectives. In summary, the Louisiana Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legally binding document that enables a beneficiary of a trust to assign their interest to another party. This assignment can be used for different types of trusts and allows for the transfer of rights, benefits, and responsibilities from the assignor to the assignee. It is crucial to follow the specific legal requirements of Louisiana state law when executing this assignment to ensure its validity and enforceability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.