Title: Understanding the Louisiana Investment Letter Promising not to Violate Exemption of Intrastate Offering Introduction: The Louisiana Investment Letter Promising not to Violate Exemption of Intrastate Offering is an important legal document that aims to establish compliance with state securities laws. This letter is usually required from issuers who wish to conduct an intrastate offering within Louisiana and ensures that they adhere to specific regulations set forth by the state's securities commission. In this article, we will explore the key aspects of this letter, its significance, and any additional types or variations that may exist. 1. Definition and Purpose: The Louisiana Investment Letter Promising not to Violate Exemption of Intrastate Offering serves as a declaration by the issuer that they will not engage in any activities that would violate the exemption granted by the state for intrastate offerings. It acts as a commitment to abide by the specified guidelines and rules governing such offerings within Louisiana, aiming to protect investors and maintain the integrity of the state's securities market. 2. Key Components: — Identification of the issuer: The letter includes information about the company or entity issuing the securities, such as its legal name, address, and contact details. — Description of the offering: This section outlines the nature of the offering, including the types of securities being offered, the intended use of the funds raised, and any relevant details that potential investors should be aware of. — Exemption affirmation: The issuer explicitly states that they are aware of Louisiana's intrastate offering exemption requirements and take responsibility for complying with them fully. — Liability disclaimer: The letter may include a clause stating that the issuer will be held liable for any misrepresentations or violations of the exemption, and that investors reserve the right to pursue legal action if necessary. 3. Importance of Compliance: Compliance with the Louisiana Investment Letter Promising not to Violate Exemption of Intrastate Offering is crucial for both issuers and investors. For issuers, it ensures avoidance of potential legal consequences, including fines or penalties, while investors benefit from the additional layer of protection against fraudulent activities and insufficient disclosure. 4. Additional Types or Variations: While there may not be different types of Louisiana Investment Letters specifically, variations might arise concerning the specific nature of the intrastate offering. For instance, letters could differ based on the type of securities being offered (equity, debt, or convertible notes), the industry of the issuer, or the overall structure of the offering (e.g., public offerings versus private placements). Conclusion: The Louisiana Investment Letter Promising not to Violate Exemption of Intrastate Offering is a crucial document that emphasizes an issuer's commitment to adhering to state securities laws and protecting the interests of investors. By clearly outlining the terms and conditions of the intrastate offering within Louisiana, this letter ensures compliance and promotes confidence in the state's investment landscape.

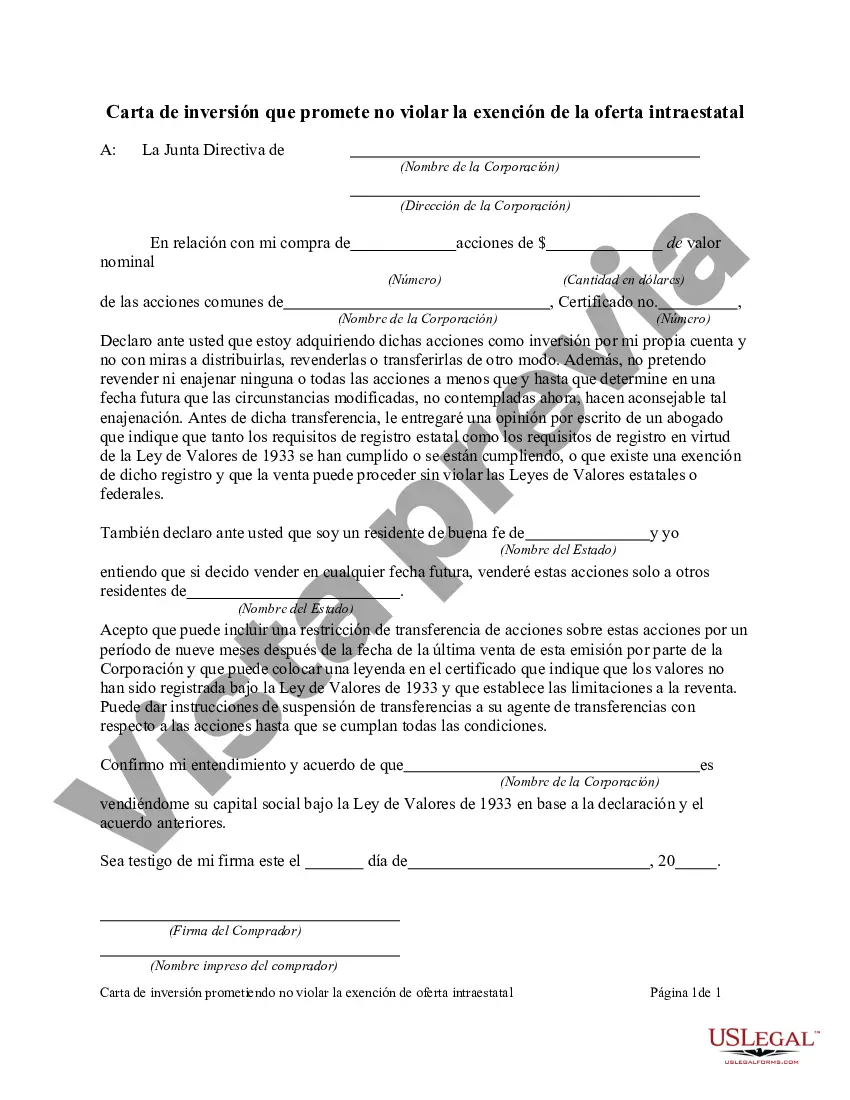

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Louisiana Carta de inversión que promete no violar la exención de la oferta intraestatal - Investment Letter Promising not to Violate Exemption of Intrastate Offering

Description

How to fill out Louisiana Carta De Inversión Que Promete No Violar La Exención De La Oferta Intraestatal?

If you want to full, download, or print out legal file layouts, use US Legal Forms, the greatest collection of legal types, that can be found online. Use the site`s simple and easy convenient lookup to get the files you need. Numerous layouts for organization and specific uses are categorized by categories and claims, or key phrases. Use US Legal Forms to get the Louisiana Investment Letter Promising not to Violate Exemption of Intrastate Offering in a number of click throughs.

If you are currently a US Legal Forms buyer, log in to the account and click on the Acquire option to find the Louisiana Investment Letter Promising not to Violate Exemption of Intrastate Offering. You can also accessibility types you earlier saved within the My Forms tab of your account.

If you use US Legal Forms the first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the form for that right city/country.

- Step 2. Take advantage of the Review option to look through the form`s articles. Never forget to see the description.

- Step 3. If you are unhappy with all the form, take advantage of the Research discipline towards the top of the display to get other variations of your legal form web template.

- Step 4. Once you have discovered the form you need, select the Acquire now option. Opt for the prices prepare you like and include your accreditations to register to have an account.

- Step 5. Approach the purchase. You can utilize your credit card or PayPal account to complete the purchase.

- Step 6. Pick the structure of your legal form and download it on the gadget.

- Step 7. Full, edit and print out or indication the Louisiana Investment Letter Promising not to Violate Exemption of Intrastate Offering.

Every single legal file web template you buy is yours forever. You may have acces to each and every form you saved with your acccount. Go through the My Forms area and select a form to print out or download yet again.

Contend and download, and print out the Louisiana Investment Letter Promising not to Violate Exemption of Intrastate Offering with US Legal Forms. There are millions of specialist and state-certain types you may use for your personal organization or specific demands.