The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

Louisiana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

Description

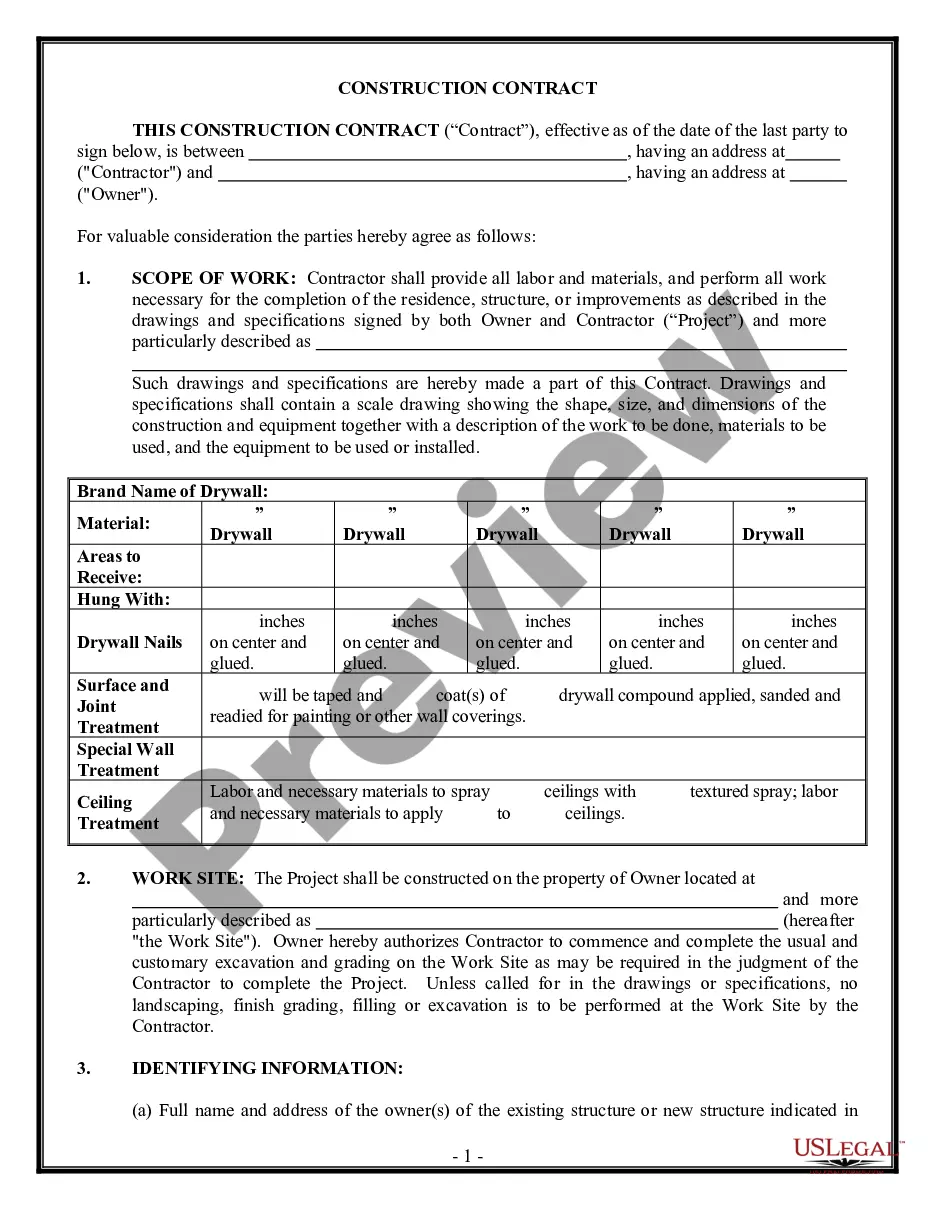

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

If you require to acquire, download, or print legal document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the website's straightforward and user-friendly search functionality to find the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Louisiana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account within just a few clicks.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of your legal form and download it to your device.

- If you are currently a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Louisiana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Utilize the Review option to examine the form's content. Remember to check the details.

- Step 3. If you are dissatisfied with the form, use the Search bar at the top of the screen to find alternative versions of your legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Naming a trust as a beneficiary of an IRA can create several challenges, such as increased taxation and the necessity of complying with specific IRS requirements. A Louisiana Irrevocable Trust that does not meet these guidelines may face immediate tax liabilities, which can deplete the inherited funds. Additionally, the distribution process through a trust can introduce delays, making access to funds less straightforward for your beneficiaries. Evaluating these concerns with a legal professional can provide clarity.

Yes, a Louisiana Irrevocable Trust can be named as a beneficiary of a retirement account like an IRA. This setup allows the trust to receive the retirement funds, which can be beneficial in managing those assets after the account holder's death. However, be mindful of the IRS rules that apply, as they can affect taxation and distribution timelines. Consulting with an expert can help clarify how your trust affects your retirement planning.

Naming a trust as an IRA beneficiary can introduce complexities, including tax implications and the potential loss of stretch benefits. The Louisiana Irrevocable Trust may not fit into certain IRS requirements, which could lead to early distributions and unfavorable tax treatment. Furthermore, a trust may complicate the withdrawal process, making it more cumbersome for beneficiaries. It's important to consider all factors before making this decision.

When a Louisiana Irrevocable Trust is designated as the beneficiary of an Individual Retirement Account (IRA), the IRA assets typically pass directly to the trust upon the account holder's death. The trust then manages these assets according to its terms, which can provide control over how and when distributions are made to beneficiaries. It's essential to ensure that the trust complies with IRS regulations to avoid tax complications. Consulting with a professional can help navigate these rules effectively.

Yes, an irrevocable trust can inherit an IRA, provided it is properly named as the beneficiary. Naming a Louisiana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account allows you to control how and when the funds are disbursed after your passing. However, careful planning is essential to navigate tax implications and ensure that the trust meets IRS requirements.

The beneficiary of an Individual Retirement Account is the person or entity designated to receive the account's assets upon the account holder's death. You can name individuals, multiple people, or a Louisiana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. Understanding your options is crucial, as this decision impacts how your assets are managed and distributed.

Naming a trust, such as a Louisiana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, can provide benefits for estate planning. It allows for controlled distribution of funds, prevents mismanagement by heirs, and may offer tax advantages. However, it is essential to consult with an estate planning attorney to discuss the implications and ensure your goals are met.

Filling out a beneficiary designation involves a few straightforward steps. First, gather the necessary information about the trust if you are naming a Louisiana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. Next, clearly write the name of the trust and include any specific details, like the trust's identification number. Finally, review your designation to ensure accuracy, as this document guides how your assets will be distributed.

Yes, an irrevocable trust can be named as the beneficiary of an IRA, but various factors must be considered. A Louisiana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can effectively manage the distribution of funds after your passing. However, understanding the IRS rules governing distributions is crucial to avoid undesirable tax outcomes. Working with legal professionals can help you navigate these considerations.

Naming a trust as an IRA beneficiary can lead to complex tax consequences. Often, it subjects the account to less favorable tax treatment compared to leaving the funds directly to individuals. Furthermore, a Louisiana Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account may not provide the same benefits concerning required minimum distributions. It's important to assess your individual situation and seek professional guidance.