A secured transaction is created when a buyer or borrower (debtor) grants a seller or lender (creditor or secured party) a security interest in personal property (collateral). A security interest allows a creditor to repossess and sell the collateral if a debtor fails to pay a secured debt.

The Truth-in-Lending Act (TILA) is part of the Federal Consumer Credit Protection Act. The purpose of the TILA is to make full disclosure to debtors of what they are being charged for the credit they are receiving. The Act merely asks lenders to be honest to the debtors and not cover up what they are paying for the credit. Regulation Z is a federal regulation prepared by the Federal Reserve Board to carry out the details of the Act. TILA applies to consumer credit transactions. Consumer credit is credit for personal or household use and not commercial use or business purposes.

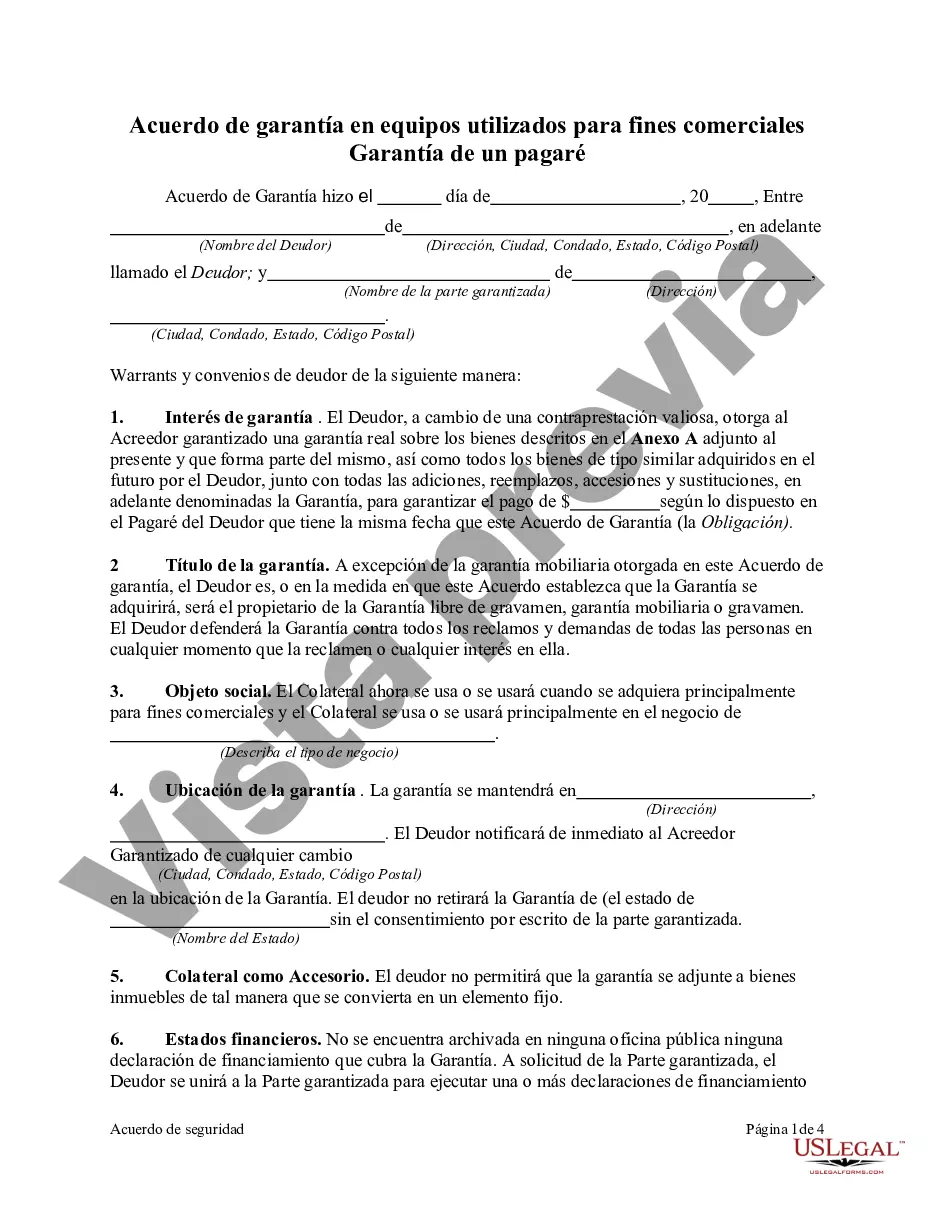

A Louisiana Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legally binding contract that establishes a lien on specific equipment or assets owned by a borrower to secure a promissory note. This agreement offers protection and assurance to the lender, as it serves as collateral in case the borrower defaults on their loan obligations. The Louisiana Security Agreement in Equipment for Business Purposes — Securing Promissory Note outlines the terms and conditions agreed upon by both parties regarding the equipment being used as collateral. It details pertinent information such as the borrower's and lender's identification, description of the equipment or assets being secured, and the terms of the promissory note. This type of security agreement can be categorized into different forms: 1. Absolute Security Agreement: An absolute security agreement implies an outright transfer of ownership of the equipment or assets to the lender in the event of default by the borrower. It provides the lender with the ability to possess, sell, or dispose of the equipment to recover the outstanding debt. 2. Conditional Security Agreement: A conditional security agreement allows the borrower to retain ownership of the equipment or assets while providing the lender with a security interest. If the borrower defaults on the loan, the lender can reclaim the collateral and sell it to recover the debt. 3. Floating Lien Security Agreement: A floating lien security agreement covers a group of assets or equipment instead of specific items. This type of agreement allows the borrower to use different equipment as collateral over time, as long as the agreed-upon value of the collateral is maintained. It is crucial to note that a Louisiana Security Agreement in Equipment for Business Purposes — Securing Promissory Note must comply with the relevant state laws and regulations to ensure its validity and enforceability. Both parties should seek legal advice and carefully review the terms before entering into such an agreement to protect their interests.A Louisiana Security Agreement in Equipment for Business Purposes — Securing Promissory Note is a legally binding contract that establishes a lien on specific equipment or assets owned by a borrower to secure a promissory note. This agreement offers protection and assurance to the lender, as it serves as collateral in case the borrower defaults on their loan obligations. The Louisiana Security Agreement in Equipment for Business Purposes — Securing Promissory Note outlines the terms and conditions agreed upon by both parties regarding the equipment being used as collateral. It details pertinent information such as the borrower's and lender's identification, description of the equipment or assets being secured, and the terms of the promissory note. This type of security agreement can be categorized into different forms: 1. Absolute Security Agreement: An absolute security agreement implies an outright transfer of ownership of the equipment or assets to the lender in the event of default by the borrower. It provides the lender with the ability to possess, sell, or dispose of the equipment to recover the outstanding debt. 2. Conditional Security Agreement: A conditional security agreement allows the borrower to retain ownership of the equipment or assets while providing the lender with a security interest. If the borrower defaults on the loan, the lender can reclaim the collateral and sell it to recover the debt. 3. Floating Lien Security Agreement: A floating lien security agreement covers a group of assets or equipment instead of specific items. This type of agreement allows the borrower to use different equipment as collateral over time, as long as the agreed-upon value of the collateral is maintained. It is crucial to note that a Louisiana Security Agreement in Equipment for Business Purposes — Securing Promissory Note must comply with the relevant state laws and regulations to ensure its validity and enforceability. Both parties should seek legal advice and carefully review the terms before entering into such an agreement to protect their interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.