Closed-end transactions involve a fixed amount to be paid back over a period of time such as a note or a retail installment contract.

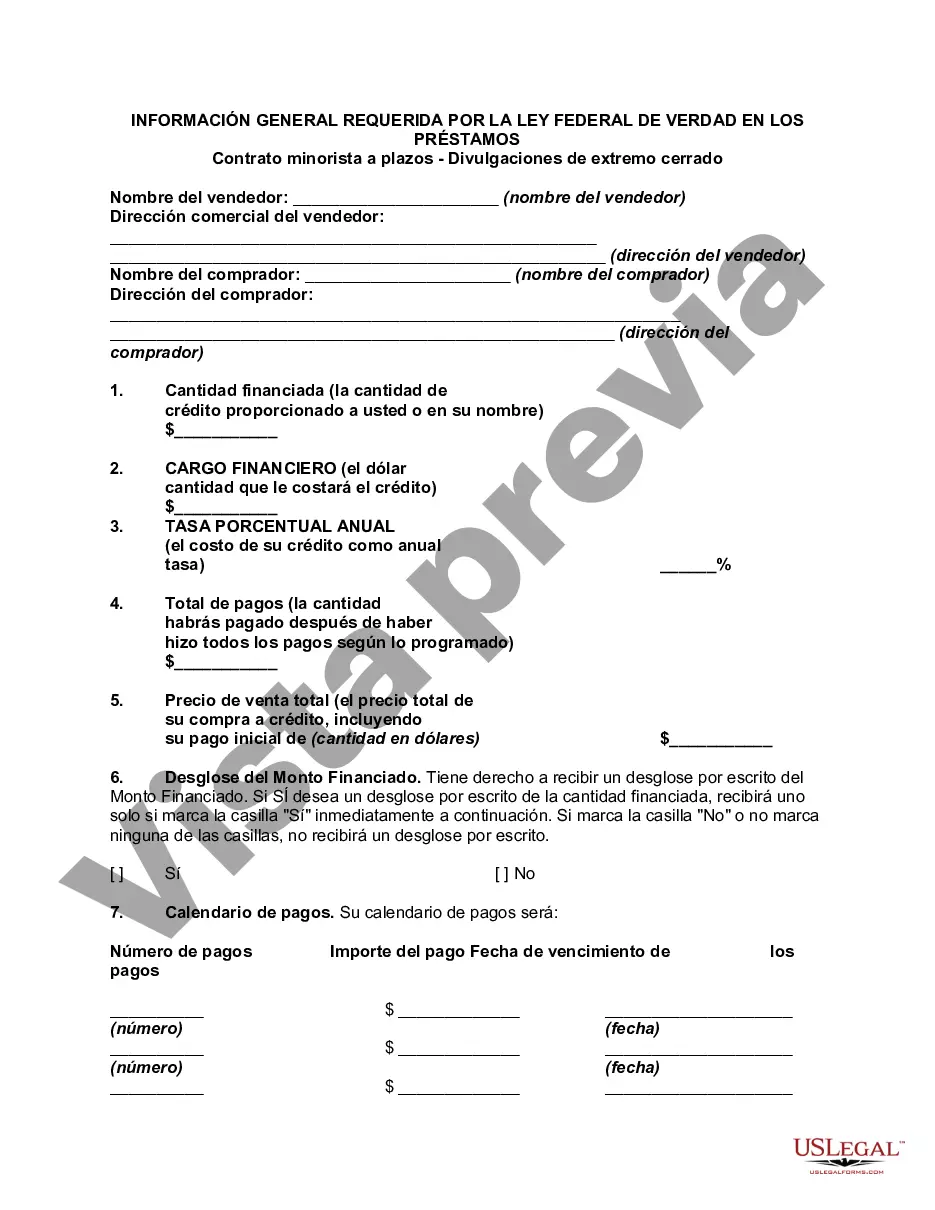

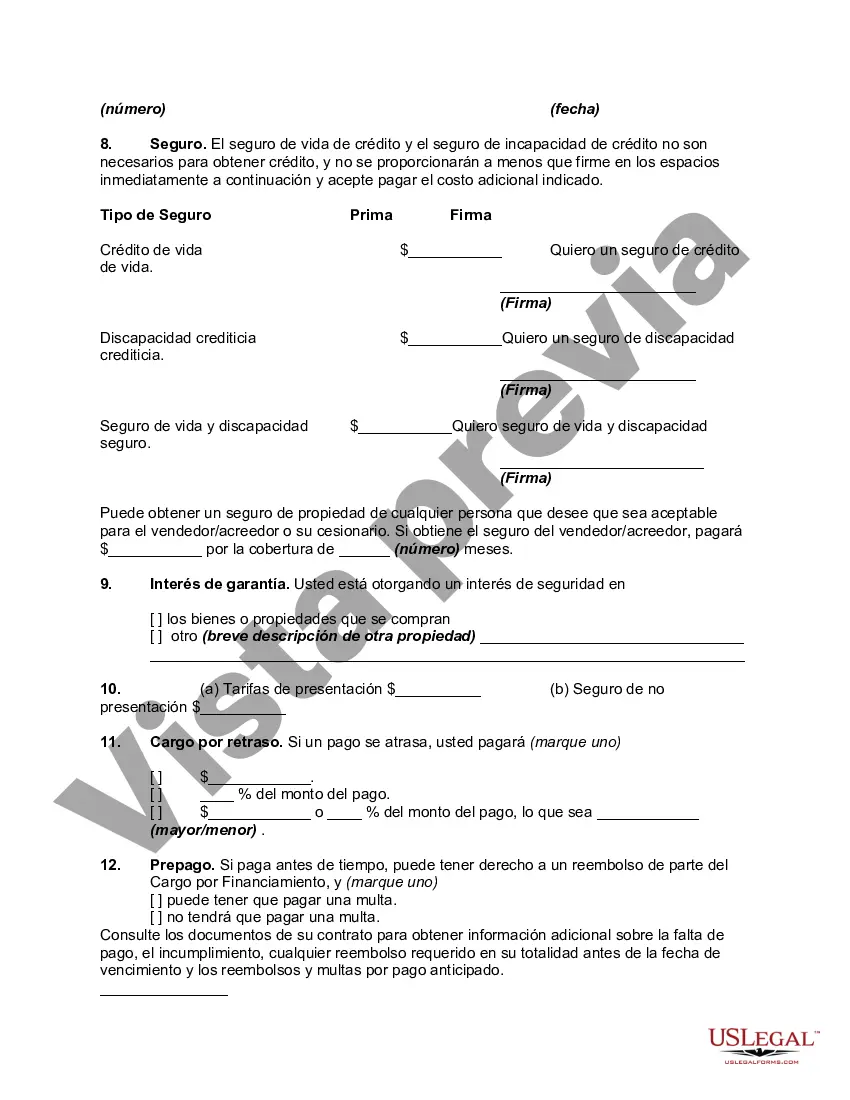

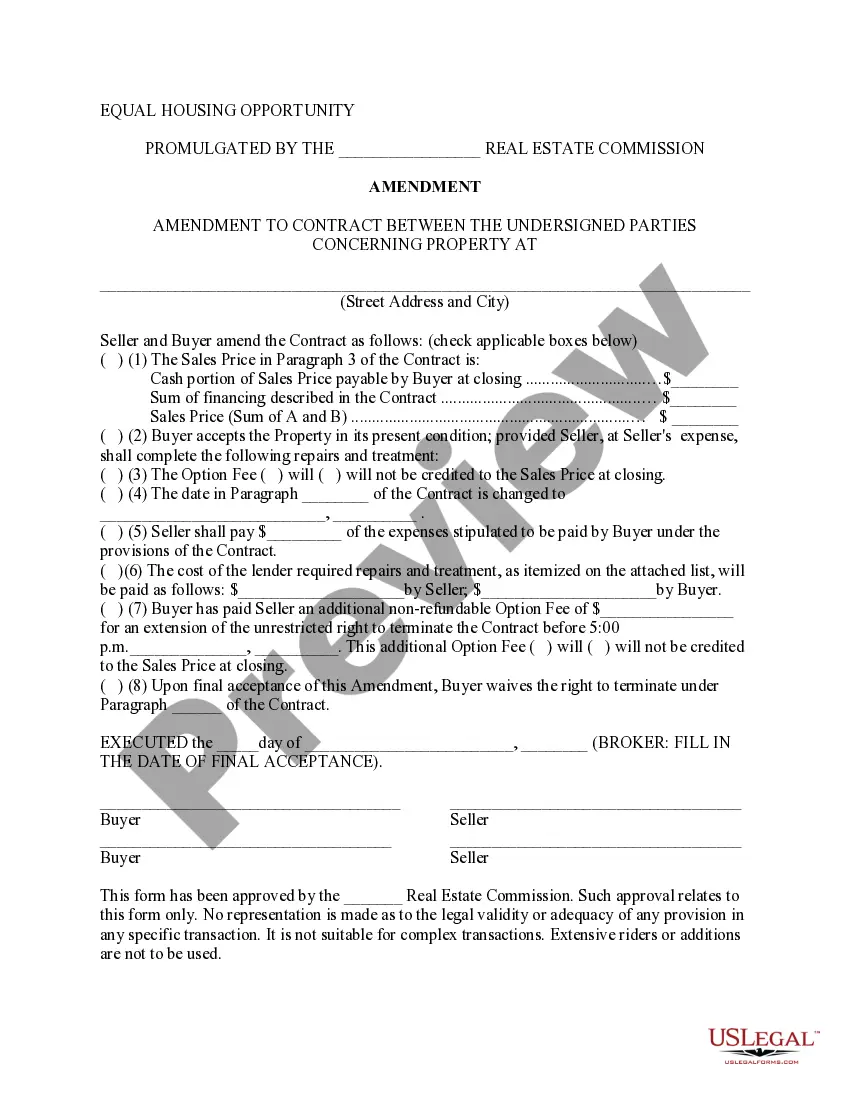

Louisiana General Disclosures Required By The Federal Truth In Lending Act (TILL) — Retail InstallmenContractac— - Closed End Disclosures are a set of mandatory requirements designed to protect consumers and ensure transparency in lending practices. These disclosures need to be provided by lenders to borrowers who enter into retail installment contracts for closed-end credit transactions in Louisiana. The Federal Truth In Lending Act is a federal law enforced by the Consumer Financial Protection Bureau (CFPB) that promotes the informed use of consumer credit and protects consumers against predatory lending practices. It requires lenders to disclose important information about the loan terms, such as interest rates, finance charges, repayment schedules, and any other fees or costs associated with the loan. Some key Louisiana General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures include: 1. Annual Percentage Rate (APR): Lenders must disclose the annual percentage rate, which represents the true cost of credit on an annual basis and includes both the interest rate and certain fees or costs associated with the loan. 2. Finance Charge: This is the total cost of credit, including any interest charges and other finance-related fees imposed by the lender. 3. Amount Financed: This is the principal amount borrowed, minus any prepaid finance charges or upfront fees that the borrower pays. 4. Total Loan Amount: The total amount that the borrower will have to repay over the life of the loan, including the principal amount borrowed and the finance charges. 5. Payment Schedule: Lenders must provide a detailed breakdown of the repayment schedule, including the number of installments, due dates, and the amount due at each payment. 6. Late Payment Fees: If applicable, lenders must disclose the amount or percentage of any late payment fees that may be charged in the event of a late payment. 7. Prepayment Penalties: If there are any penalties for early repayment of the loan, these must be clearly disclosed to the borrower. 8. Security Interest: If the loan requires the borrower to provide collateral, such as a car or property, the lender must disclose the nature and value of the collateral. It is important to note that the specific Louisiana General Disclosures Required By The Federal Truth In Lending Act — Retail InstallmenContractac— - Closed End Disclosures may vary depending on the specific loan product and lender. However, these disclosures generally aim to provide borrowers with clear and accurate information about the loan terms, enabling them to make informed decisions about their borrowing needs. Compliance with these disclosures is essential for lenders, as failure to provide accurate and complete disclosures can result in legal consequences and potential financial penalties. Therefore, both lenders and borrowers should familiarize themselves with these requirements to ensure a fair and transparent lending process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.