Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement

Description

How to fill out Sample Letter For Policy On Vehicle Expense Reimbursement?

Are you situated in a location where you frequently require documents for either business or personal purposes? There are numerous legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of form templates, such as the Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement, designed to meet state and federal requirements.

If you are already acquainted with the US Legal Forms website and possess an account, simply Log In. Afterwards, you can download the Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement template.

Select a convenient document format and download your version.

Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement anytime, if necessary. Just select the required form to download or print the document template. Utilize US Legal Forms, one of the largest collections of legal forms, to save time and avoid mistakes. The platform offers expertly crafted legal document templates suitable for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

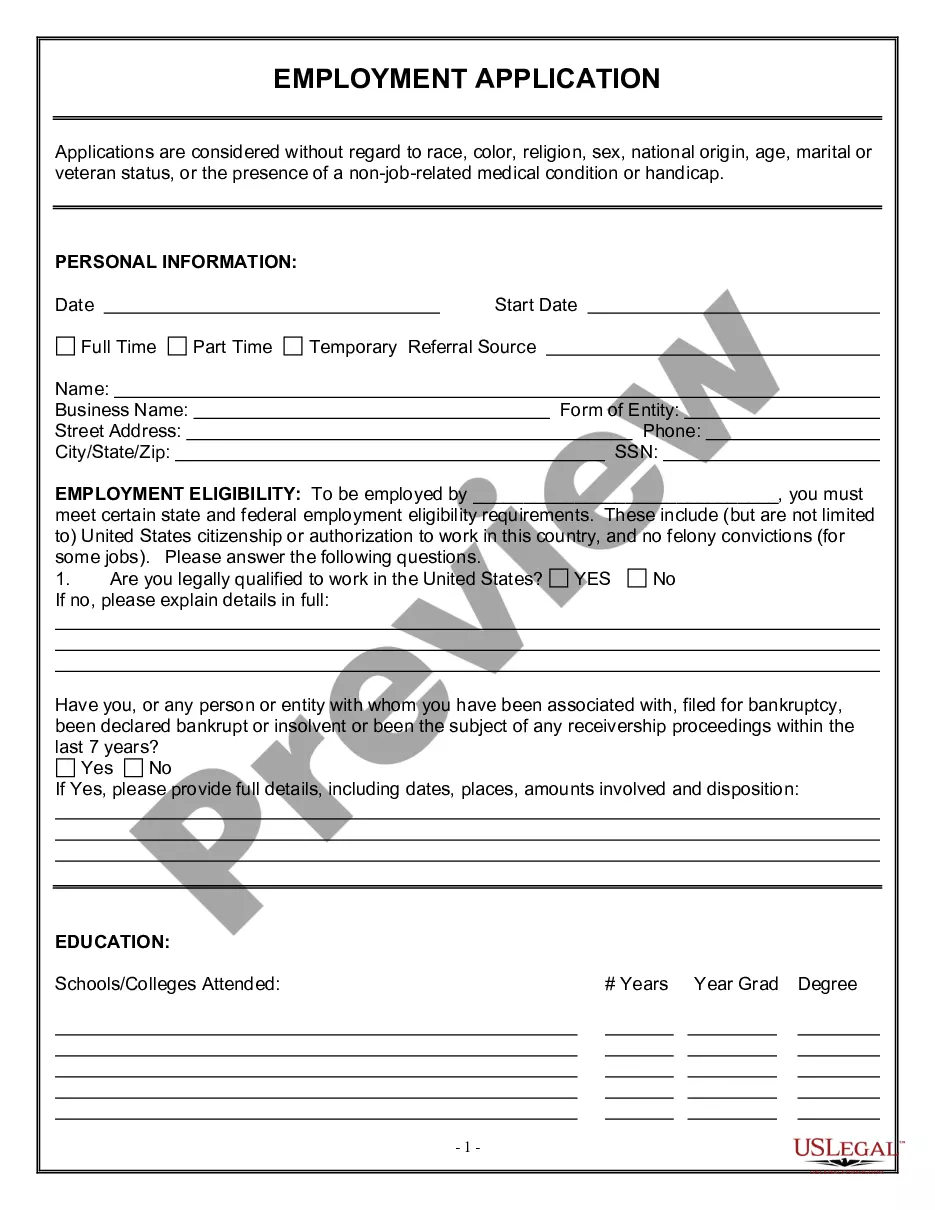

- Use the Review button to examine the document.

- Read the description to confirm you have selected the right form.

- If the document is not what you are looking for, utilize the Search field to find the form that fits your requirements.

- Once you find the correct form, click on Get now.

- Choose the pricing plan you prefer, fill out the necessary information to create your account, and purchase your order using PayPal or a credit card.

Form popularity

FAQ

To write a reimbursement request, start by clearly stating the purpose of your letter. Include essential details such as the date of the expense, the amount, and the reason for your vehicle use related to work. Make sure to refer to a Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement to guide your format and structure. This approach ensures that your request is straightforward and fully aligned with your company's policies.

An example of expense reimbursement is when an employee submits a claim for travel expenses incurred while using their personal vehicle for work-related tasks. This claim typically includes fuel receipts, tolls, and parking charges. The employee would then receive a reimbursement according to the company's expense policy. If you need a comprehensive guide, a Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement can serve as a helpful template.

When filling in an expense form, begin with clearly stating your name and the dates for which you are claiming reimbursements. Then, provide a detailed breakdown of each expense, including the type of expense, date, and amount spent. It’s important to include any required documentation as attachments. Utilizing a Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement can help you organize your information properly.

To fill out a reimbursement claim form, start by gathering all necessary receipts and documentation related to your vehicle expenses. Next, accurately record the date, amount, and purpose of each expense in the designated sections of the form. Finally, review your entries for accuracy and attach your supporting documents. For a standardized approach, you might consider using a Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement to ensure all necessary details are included.

When asking for reimbursement of travel expenses, clearly outline the costs incurred during your trip. Include specific details such as dates, locations, and itemized expenses. The 'Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement' can serve as a helpful reference for structuring your request. Don’t forget to attach all relevant receipts to support your claim.

Filling out an expense reimbursement form requires careful attention to detail. Begin by entering your personal information accurately, followed by detailing each expense with the corresponding amounts. Refer to guidelines provided, such as those in the 'Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement,' which can provide clarity on required entries. Double-check for any supporting documents needed.

To politely ask for reimbursement, frame your request respectfully. Start with a friendly greeting, clearly explain the context of the expense, and request reimbursement directly but courteously. Incorporating elements from the 'Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement' can enhance your request's formality. A polite closing can also foster goodwill.

Writing a formal letter for reimbursement involves a few steps. Address the letter to the appropriate person, include a formal greeting, and state your purpose immediately. Use the 'Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement' as a template for clarity. Additionally, maintain a professional tone throughout, and ensure you provide all relevant information.

Begin your refund letter by clearly stating your request for a refund. Provide details about the original transaction, and include any relevant dates and amounts. For guidance, refer to the 'Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement' to ensure your letter meets formal standards. Remember to express gratitude for their attention to your matter.

To write a mail for reimbursement of expenses, start with a clear subject line. In the body, state your request concisely, mentioning the specific expenses you're seeking reimbursement for. It may help to reference the 'Louisiana Sample Letter for Policy on Vehicle Expense Reimbursement' for structure. Always include the necessary details and attach supporting documents.