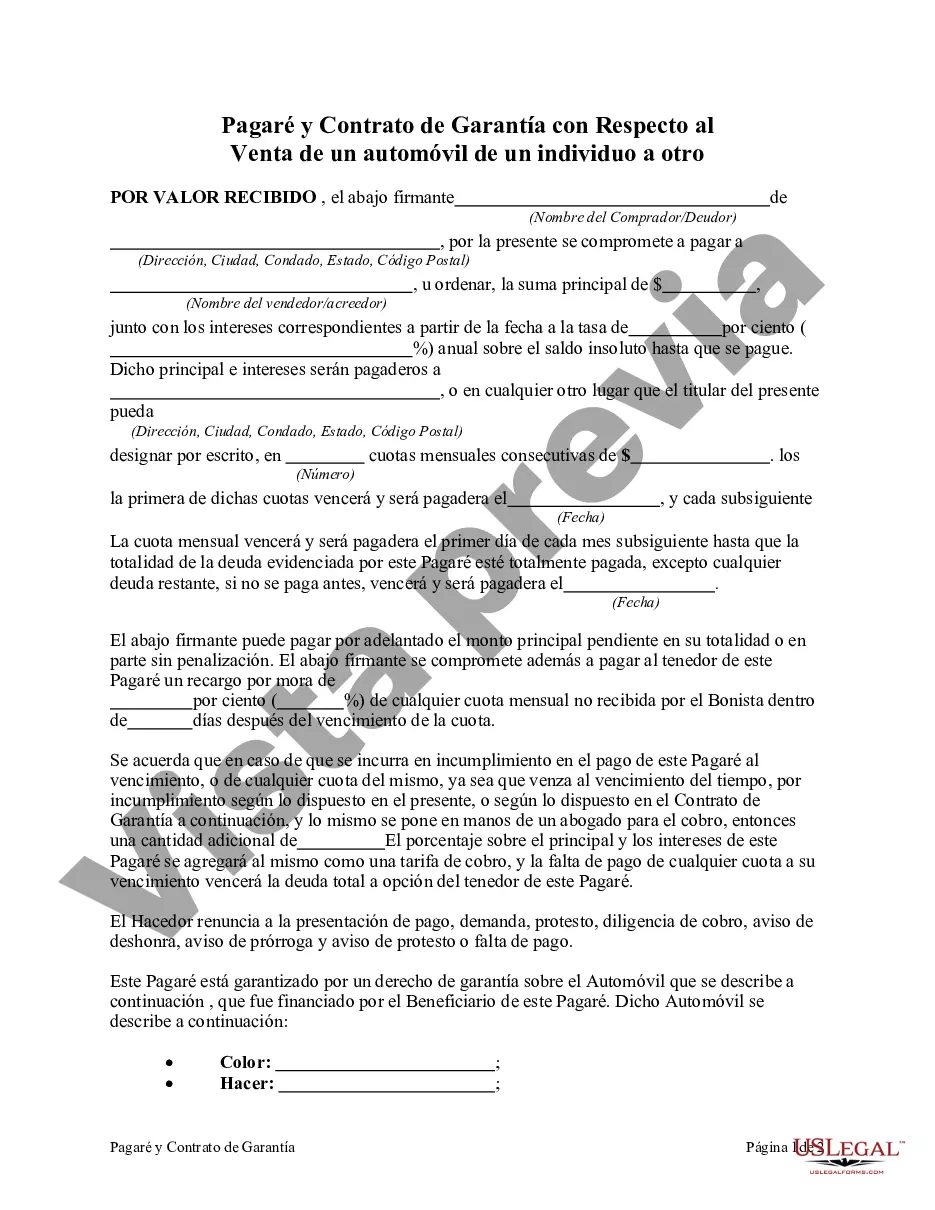

A Louisiana promissory note and security agreement with regard to the sale of an automobile from one individual to another is a legally binding document that outlines the terms and conditions of a sale agreement between two parties. This agreement includes provisions for the payment of the purchase price in installments, as well as the creation of a security interest in the automobile to secure the buyer's performance under the agreement. It is essential to have this document in place to protect both the buyer and the seller's interests in the sale transaction. One type of Louisiana promissory note and security agreement specifically designed for the sale of an automobile is a "Conditional Sales Agreement." In a conditional sales agreement, the seller retains ownership of the vehicle until the buyer fulfills all the terms and conditions outlined in the agreement. This type of agreement is commonly used when a buyer cannot make an upfront payment for the entire purchase price but wishes to finance the vehicle over time. Another type of promissory note and security agreement commonly used for the sale of an automobile in Louisiana is a "Retail Installment Sale Contract." This agreement is used when the buyer makes a down payment and finances the remaining amount over a specific period. The buyer takes immediate possession of the vehicle but has to make regular installment payments until the total purchase price is paid. The Louisiana promissory note and security agreement typically include the following key elements: 1. Identification of the parties involved: The agreement must clearly identify the buyer and the seller, including their legal names, addresses, and contact information. 2. Description of the automobile: The agreement should include specific details about the vehicle being sold, such as make, model, year, VIN number, and any other relevant identifying information. 3. Purchase price and payment terms: The agreement should outline the total purchase price, including any down payment made by the buyer. It should also specify how the remaining balance will be paid, whether in installments or on a specific date, and the frequency of payments. 4. Security interest and collateral: The agreement must establish a security interest in the automobile as collateral for the buyer's obligations under the agreement. It should detail the terms of the security interest, such as the rights of the seller to repossess the vehicle in case of default. 5. Default and remedies: The agreement should outline what constitutes a default by the buyer and what actions the seller can take in case of default, such as repossession, selling the vehicle, or legal action to recover the outstanding balance. 6. Governing law: The agreement should specify that it is governed by Louisiana law, ensuring that the terms and conditions comply with the state's legal requirements. It is crucial for both the buyer and the seller to carefully review and understand the terms of the Louisiana promissory note and security agreement before signing. Seeking legal advice or consulting an attorney specializing in contract law can ensure that both parties' interests are properly protected and that the agreement complies with Louisiana's specific legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Louisiana Pagaré y contrato de garantía con respecto a la venta de un automóvil de un individuo a otro - Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

How to fill out Louisiana Pagaré Y Contrato De Garantía Con Respecto A La Venta De Un Automóvil De Un Individuo A Otro?

You are able to devote several hours on the web attempting to find the lawful file web template that suits the state and federal needs you require. US Legal Forms gives a large number of lawful varieties that happen to be examined by professionals. It is possible to acquire or printing the Louisiana Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another from my service.

If you already have a US Legal Forms profile, you can log in and then click the Download option. After that, you can total, revise, printing, or indication the Louisiana Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another. Each and every lawful file web template you acquire is the one you have permanently. To get another duplicate associated with a acquired develop, proceed to the My Forms tab and then click the corresponding option.

If you use the US Legal Forms internet site the very first time, keep to the basic guidelines below:

- Initially, make sure that you have selected the right file web template to the region/town that you pick. Look at the develop explanation to ensure you have chosen the appropriate develop. If readily available, take advantage of the Preview option to appear through the file web template also.

- In order to locate another model of the develop, take advantage of the Lookup discipline to find the web template that fits your needs and needs.

- Upon having found the web template you want, click Acquire now to move forward.

- Pick the prices program you want, type in your qualifications, and register for your account on US Legal Forms.

- Comprehensive the purchase. You should use your Visa or Mastercard or PayPal profile to purchase the lawful develop.

- Pick the formatting of the file and acquire it to your gadget.

- Make changes to your file if necessary. You are able to total, revise and indication and printing Louisiana Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another.

Download and printing a large number of file themes utilizing the US Legal Forms site, that provides the largest selection of lawful varieties. Use professional and state-particular themes to take on your organization or person requires.