A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Louisiana Check Disbursements Journal

Description

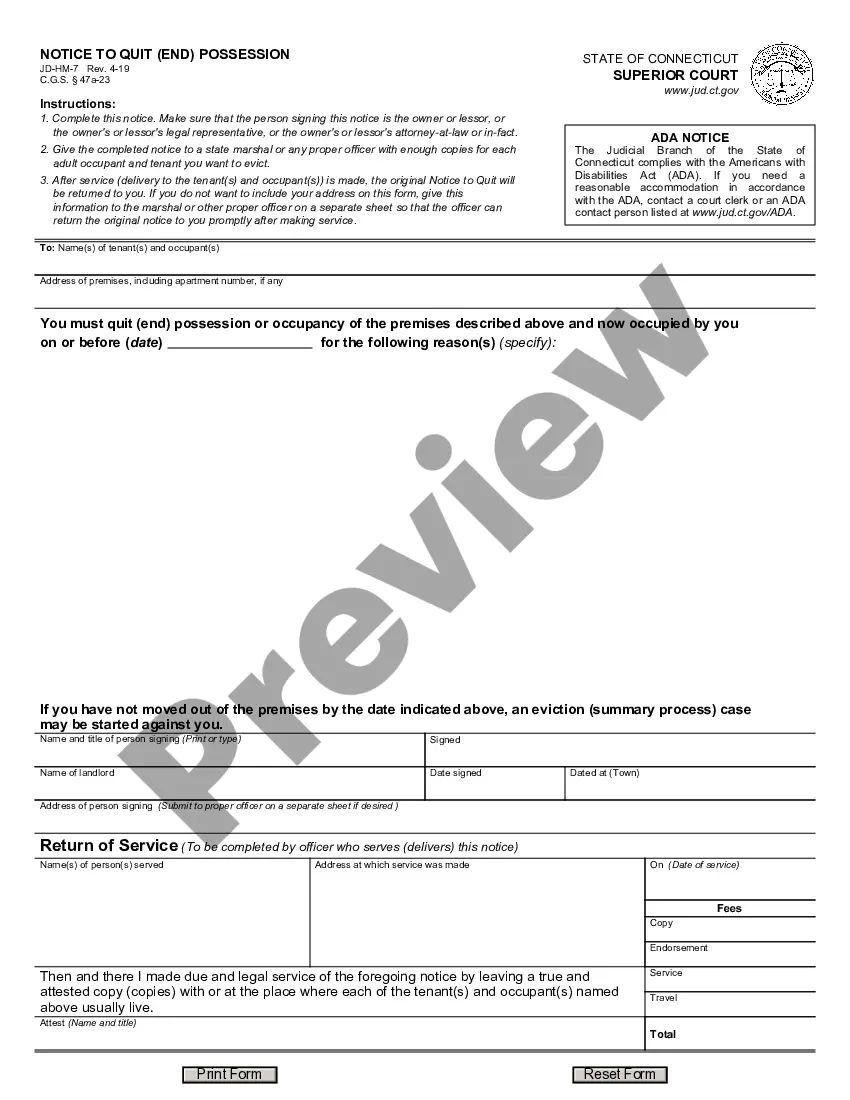

How to fill out Check Disbursements Journal?

US Legal Forms - among the most important repositories of official documents in the United States - offers a variety of legal form templates that you can obtain or create.

By utilizing the website, you can access thousands of forms for commercial and personal use, organized by categories, states, or keywords.

You can find the latest versions of forms like the Louisiana Check Disbursements Journal in seconds.

Read the form description to confirm you have chosen the appropriate form.

If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- If you are a current subscriber, Log In to retrieve the Louisiana Check Disbursements Journal from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- If this is your first time using US Legal Forms, here are simple steps to help you get started.

- Ensure you have selected the correct form for your area/region.

- Click the Review button to check the form's content.

Form popularity

FAQ

You can check your Louisiana state tax liabilities by visiting the Louisiana Department of Revenue's official site. The Louisiana Check Disbursements Journal feature will allow you to see a detailed account of your tax returns and any amounts owed. It's an efficient way to manage and review your state tax information.

To check your Louisiana state refund status, you should visit the Louisiana Department of Revenue's refund status page. Enter the required information to access the Louisiana Check Disbursements Journal, which provides real-time updates on where your refund stands in the process. This can ease any concerns you may have about your refund timeline.

Looking up what you owe in taxes is simple with the Louisiana Department of Revenue's resources. Visit their website and utilize the Louisiana Check Disbursements Journal feature, where you can input your information to see your tax balance and payment history. This will help you manage your tax obligations effectively.

To determine how much you still owe in taxes, access the Louisiana Department of Revenue website. By navigating to the Louisiana Check Disbursements Journal, you can view your current outstanding amounts along with payment history. Regular check-ins can help you stay on top of your financial responsibilities.

You can find out how much you owe in Louisiana state taxes by logging into the Louisiana Department of Revenue's online portal. This is where the Louisiana Check Disbursements Journal becomes particularly useful, offering a detailed view of your tax liabilities and any payments made. It’s a straightforward way to keep track of your financial obligations.

LaTAP, which stands for Louisiana Tax Account Portal, is an online service provided by the Louisiana Department of Revenue. Through this portal, you can view your tax account details, including your payment history and balance due. Utilizing the Louisiana Check Disbursements Journal feature can help streamline your access to important financial records.

To find out what you owe to the state of Louisiana, you can visit the Louisiana Department of Revenue's website. There, you can access your account information through the Louisiana Check Disbursements Journal link. This resource provides up-to-date information about your payments or outstanding balances.

You use a disbursement journal to track and document all outgoing payments made by your business or personal accounts. By keeping accurate records in a Louisiana Check Disbursements Journal, you can easily analyze spending patterns and prepare for audits. Regularly referencing this journal helps promote transparency and accountability in financial management.

To fill out a disbursement journal effectively, record each payment with the date, check number, recipient name, amount, and a brief description of the purpose. Consistently updating your journal helps maintain accurate financial records and simplifies the reconciliation process. A well-maintained Louisiana Check Disbursements Journal will provide clarity and streamline financial management.

The entry of a disbursement account includes a record of every financial transaction related to outgoing checks. Each entry typically comprises the date, vendor name, amount, and purpose of the disbursement. Organizing these entries in a Louisiana Check Disbursements Journal simplifies tracking and provides a clear view of your financial responsibilities.