The Louisiana Self-Assessment Worksheet is a comprehensive tool designed to help individuals evaluate their tax liability and determine if they qualify for any tax credits or deductions specific to the state of Louisiana. This worksheet allows taxpayers to carefully assess their income, expenses, and personal circumstances, ensuring accurate reporting and minimizing the risk of errors on their tax returns. The Louisiana Department of Revenue provides different types of self-assessment worksheets to cater to various tax situations. Here are some key types: 1. Louisiana Individual Income Tax Self-Assessment Worksheet: This worksheet is primarily used by individuals to assess their income tax liability. It includes sections for reporting different types of income, such as wages, self-employment income, rental income, and investment income. Additionally, it provides space to claim eligible deductions, exemptions, and tax credits specific to Louisiana. 2. Louisiana Business Tax Self-Assessment Worksheet: This worksheet is designed for businesses operating in Louisiana. It assists business owners in accurately determining their tax obligations, including income, sales, and use taxes. It also allows them to claim applicable tax credits and deductions related to their business activities. 3. Louisiana Property Tax Self-Assessment Worksheet: Property owners in Louisiana can utilize this worksheet to evaluate their property tax liability and claim any exemptions or credits they may be eligible for. It incorporates sections to report property details, assess fair market value, and calculate the corresponding tax amount. 4. Louisiana Education Expense Self-Assessment Worksheet: This worksheet caters specifically to taxpayers who have education-related expenses that qualify for deductions or credits. It assists individuals in determining the extent to which their educational costs can be claimed on their Louisiana tax return. By utilizing the appropriate Louisiana self-assessment worksheet, taxpayers can ensure accurate reporting and potentially reduce their tax liability. It is essential to carefully review the instructions provided with each worksheet to understand how to complete it correctly and make the most of any available tax benefits.

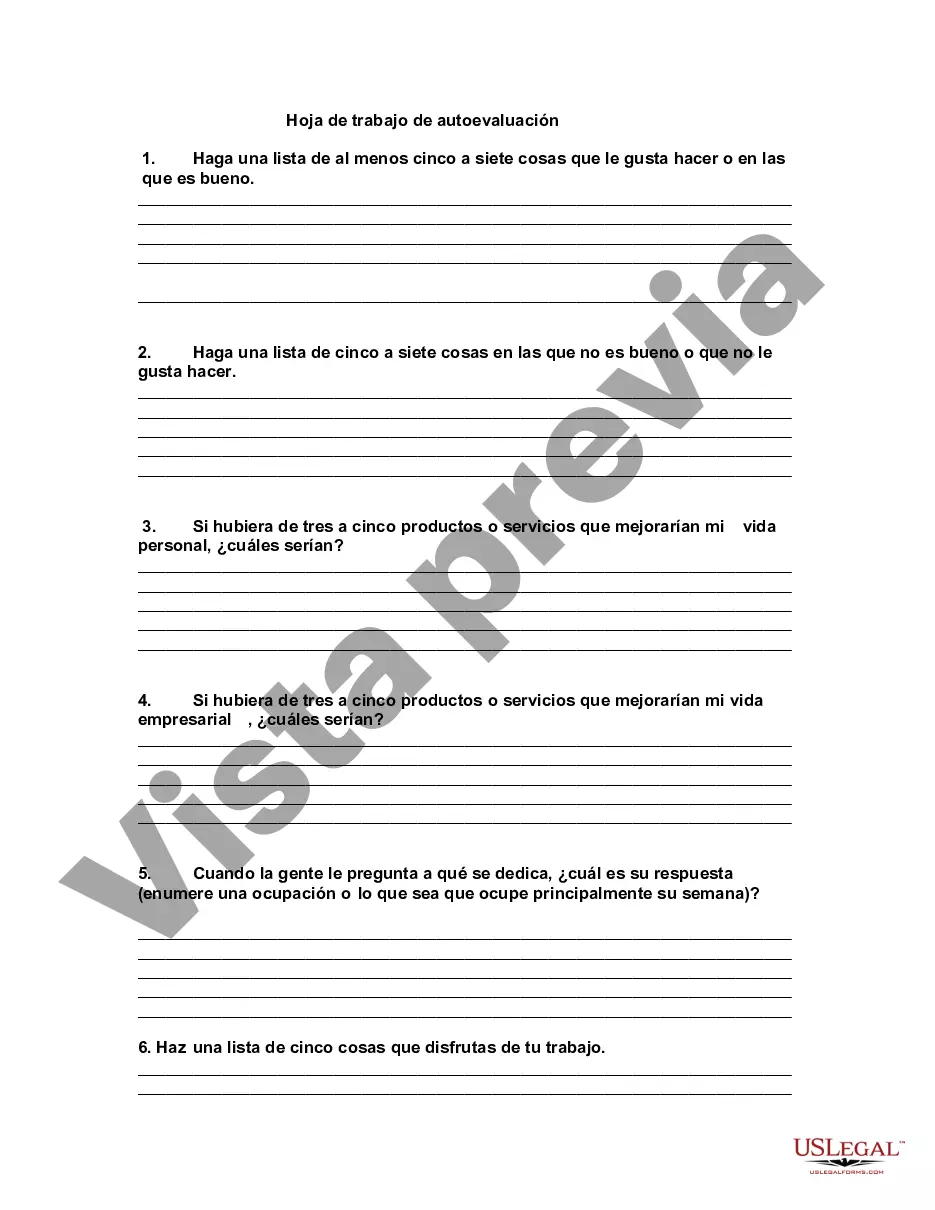

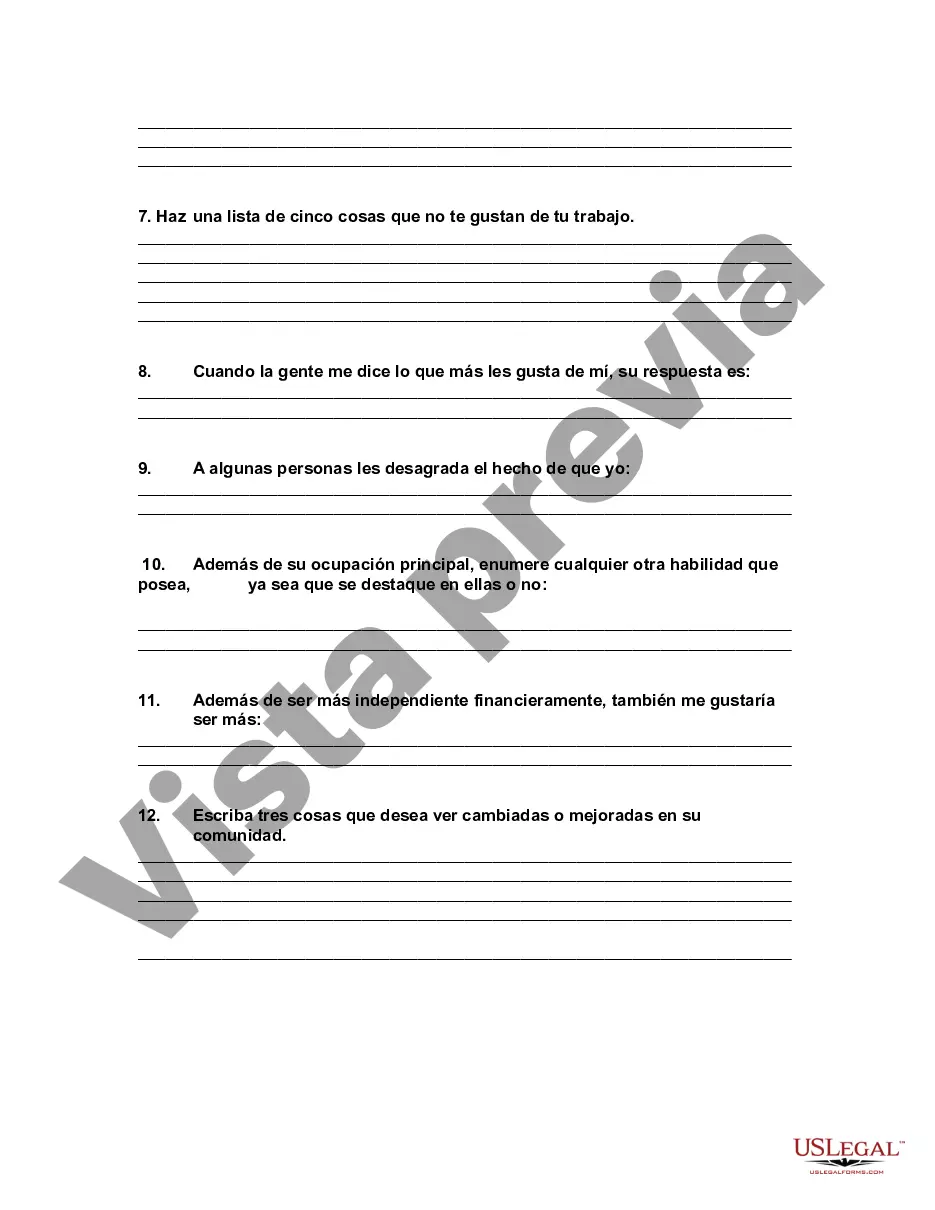

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Louisiana Hoja de trabajo de autoevaluación - Self-Assessment Worksheet

Description

How to fill out Louisiana Hoja De Trabajo De Autoevaluación?

Are you currently in the place where you need to have papers for sometimes organization or person purposes virtually every day time? There are a variety of legitimate file themes available on the Internet, but locating ones you can rely isn`t effortless. US Legal Forms delivers thousands of type themes, such as the Louisiana Self-Assessment Worksheet, which are written in order to meet federal and state requirements.

In case you are currently knowledgeable about US Legal Forms site and have a merchant account, basically log in. After that, you may down load the Louisiana Self-Assessment Worksheet web template.

If you do not provide an profile and wish to start using US Legal Forms, abide by these steps:

- Find the type you require and make sure it is to the proper metropolis/county.

- Make use of the Preview option to check the form.

- Browse the information to actually have chosen the right type.

- If the type isn`t what you are searching for, use the Research discipline to get the type that suits you and requirements.

- If you obtain the proper type, just click Purchase now.

- Select the prices prepare you would like, fill in the required info to create your money, and purchase the transaction utilizing your PayPal or charge card.

- Decide on a hassle-free data file formatting and down load your duplicate.

Discover all the file themes you have bought in the My Forms menu. You can get a extra duplicate of Louisiana Self-Assessment Worksheet at any time, if needed. Just select the necessary type to down load or printing the file web template.

Use US Legal Forms, probably the most considerable selection of legitimate kinds, to save lots of some time and steer clear of mistakes. The support delivers appropriately created legitimate file themes that can be used for a selection of purposes. Generate a merchant account on US Legal Forms and commence making your daily life easier.