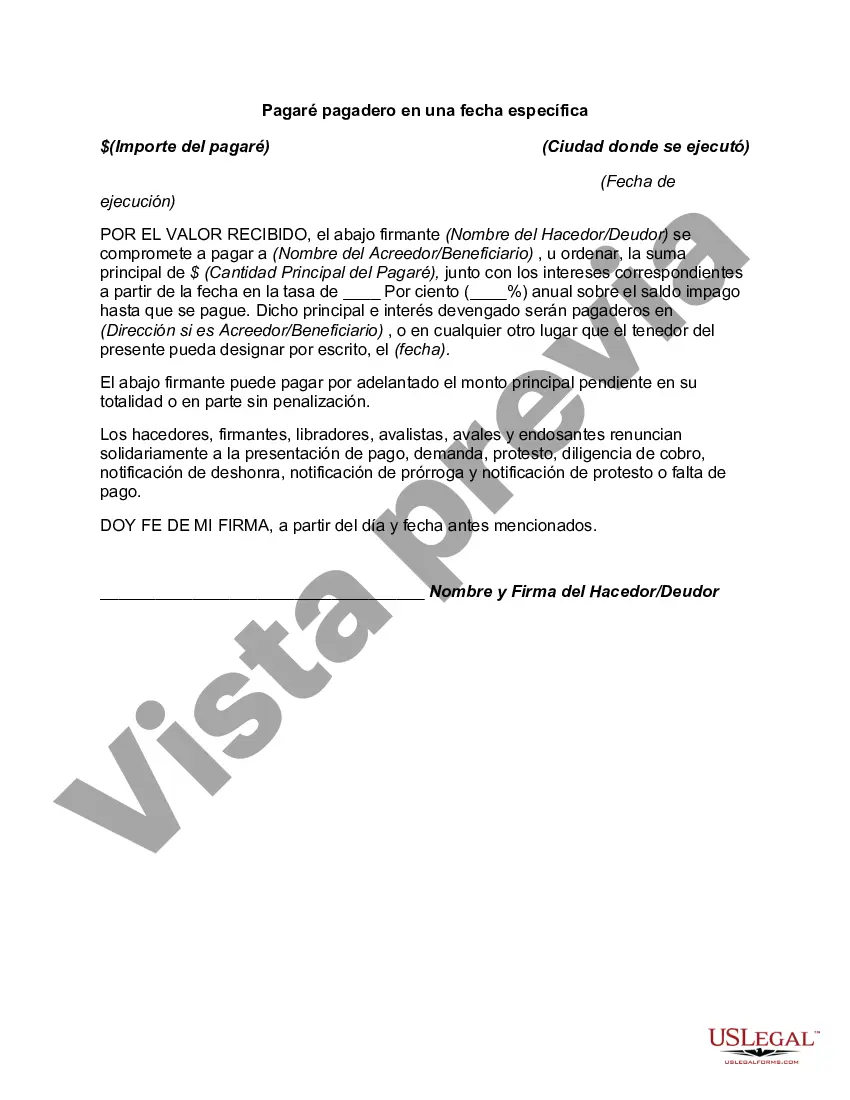

A Louisiana Promissory Note Payable on a Specific Date is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Louisiana. This type of promissory note specifies a predetermined date by which the borrower must repay the loan amount in full, along with any accrued interest. The Louisiana Promissory Note Payable on a Specific Date serves to provide security to the lender and establishes the borrower's commitment to repay the borrowed funds within a defined time frame. It includes essential information such as the loan amount, interest rate, payment schedule, and any additional terms and conditions agreed upon by both parties. In Louisiana, there are various types of Promissory Notes Payable on a Specific Date that are commonly used, depending on the nature of the loan. Some common types include: 1. Personal Loan Promissory Note: This type of promissory note is used for lending money between individuals, such as friends or family members. It outlines the terms of a personal loan and includes details about repayment schedule and interest rate, if applicable. 2. Business Loan Promissory Note: Businesses often use this type of promissory note to formalize loan agreements with financial institutions or private lenders. It includes terms specific to the business loan, such as repayment structure based on cash flow or collateral. 3. Student Loan Promissory Note: Educational institutions or private lenders use this type of promissory note to establish repayment terms and conditions for student loans. It typically includes information about deferment options, grace periods, and repayment plans specific to student loans. 4. Mortgage Promissory Note: When obtaining a mortgage to purchase real estate, the lender requires the borrower to sign a promissory note that outlines the repayment terms, interest rate, and consequences of defaulting on the mortgage loan. Ultimately, a Louisiana Promissory Note Payable on a Specific Date serves as a legally binding contract that protects both the lender and borrower. It ensures that the borrower understands the terms of the loan and the consequences of failing to repay the amount within the specified time frame. It is important for both parties to carefully review and understand the terms outlined in the Promissory Note before signing to avoid any future disputes or legal issues.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Louisiana Pagaré pagadero en una fecha específica - Promissory Note Payable on a Specific Date

Description

How to fill out Louisiana Pagaré Pagadero En Una Fecha Específica?

If you wish to full, down load, or print out authorized record layouts, use US Legal Forms, the biggest assortment of authorized varieties, which can be found on the web. Take advantage of the site`s easy and practical lookup to find the documents you need. Numerous layouts for organization and specific reasons are sorted by groups and states, or search phrases. Use US Legal Forms to find the Louisiana Promissory Note Payable on a Specific Date in a number of clicks.

Should you be already a US Legal Forms buyer, log in to your bank account and click the Download option to get the Louisiana Promissory Note Payable on a Specific Date. You may also accessibility varieties you formerly acquired in the My Forms tab of your bank account.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for that appropriate city/country.

- Step 2. Take advantage of the Preview choice to examine the form`s information. Don`t forget to learn the explanation.

- Step 3. Should you be not satisfied with the form, utilize the Look for area on top of the screen to find other models of the authorized form design.

- Step 4. Upon having found the form you need, select the Acquire now option. Pick the prices program you like and include your qualifications to register for the bank account.

- Step 5. Procedure the transaction. You can use your Мisa or Ьastercard or PayPal bank account to accomplish the transaction.

- Step 6. Select the formatting of the authorized form and down load it on your own device.

- Step 7. Full, edit and print out or indicator the Louisiana Promissory Note Payable on a Specific Date.

Every authorized record design you acquire is your own forever. You may have acces to every form you acquired in your acccount. Click the My Forms segment and select a form to print out or down load once more.

Be competitive and down load, and print out the Louisiana Promissory Note Payable on a Specific Date with US Legal Forms. There are thousands of specialist and condition-certain varieties you can use to your organization or specific demands.