The Louisiana Partnership Agreement for Investment Club is a legally binding document that outlines the terms and conditions of a partnership formed to engage in investment activities. This agreement governs the relationship between the partners involved in the investment club, providing clarity and protection for all parties. Keywords: Louisiana, partnership agreement, investment club, terms and conditions, partnership, investment activities, relationship, clarity, protection, parties. There are several types of Louisiana Partnership Agreements for Investment Clubs, including: 1. General Partnership Agreement: This type of agreement establishes a partnership where all partners have equal rights, responsibilities, and liabilities. All partners are actively involved in making investment decisions and sharing profits and losses. 2. Limited Partnership Agreement: In a limited partnership agreement, there are two types of partners: general partners and limited partners. General partners manage the investment club and have unlimited liability, while limited partners have limited liability and primarily contribute capital to the partnership. 3. Limited Liability Partnership Agreement: This type of partnership agreement combines elements of a general partnership and a limited liability company (LLC). Partners have limited liability, protecting their personal assets from the partnership's debts and obligations. 4. Master Limited Partnership Agreement: This agreement is commonly used for investment clubs focused on energy resources or real estate. It allows the partnership to be publicly traded, providing investors with liquidity and tax advantages while still maintaining partnership characteristics. Regardless of the type, a Louisiana Partnership Agreement for Investment Club typically includes: — Identification of the partners involved, their roles, and initial contributions. — Terms regarding profit sharing, loss allocation, and withdrawal of funds. — Outline of investment strategies, objectives, and decision-making processes. — Provisions for adding or removing partners. — Dispute resolution procedures and methods for dissolving the partnership. — Compliance with relevant laws and regulations, including securities laws and tax obligations. It is important for any investment club in Louisiana to carefully draft a partnership agreement, tailored to their specific needs and goals, to ensure transparent operations and protect the interests of all partners involved.

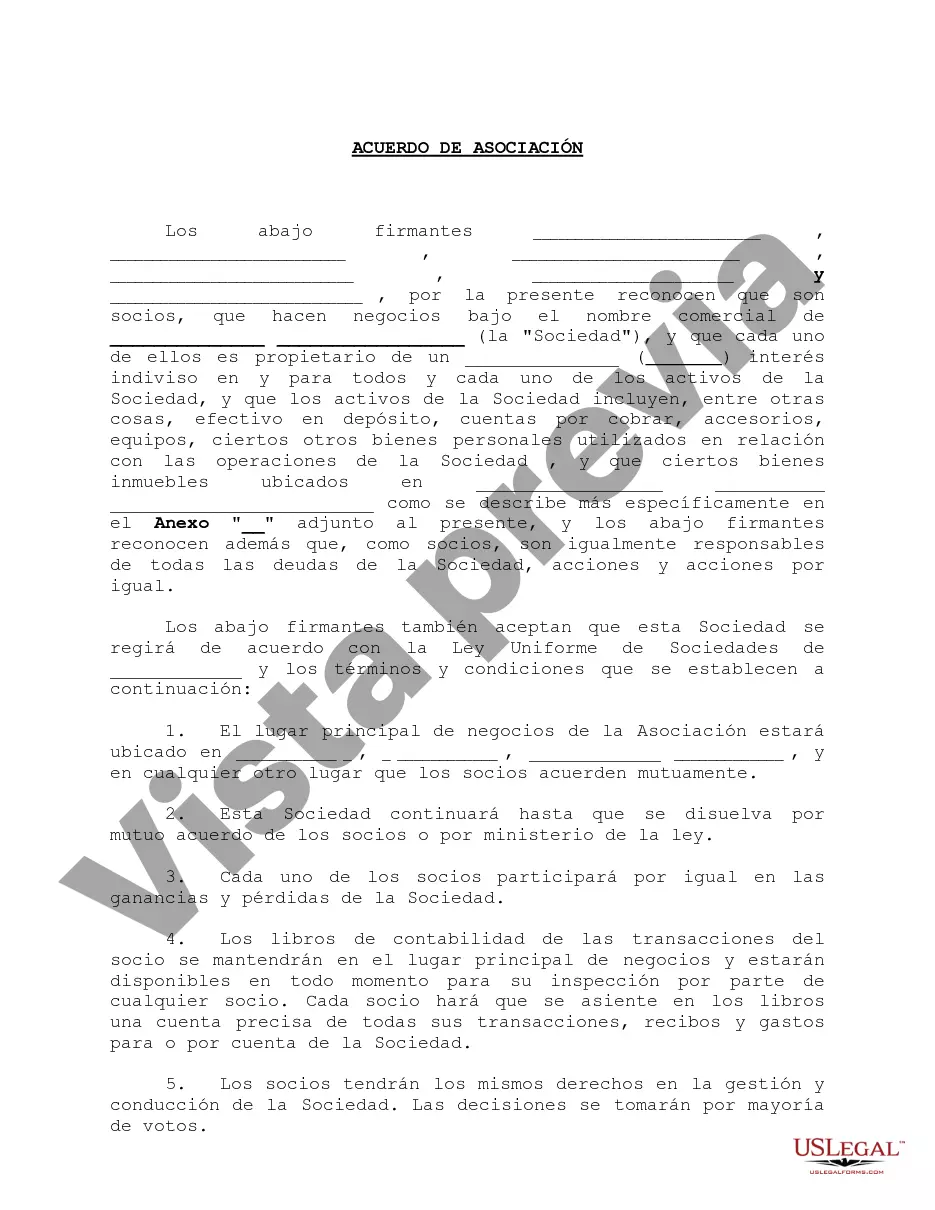

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Louisiana Acuerdo de Asociación para el Club de Inversión - Partnership Agreement for Investment Club

Description

How to fill out Louisiana Acuerdo De Asociación Para El Club De Inversión?

Discovering the right lawful papers format could be a struggle. Naturally, there are tons of templates available on the Internet, but how would you discover the lawful type you want? Take advantage of the US Legal Forms web site. The support gives a large number of templates, including the Louisiana Partnership Agreement for Investment Club, which you can use for organization and private demands. Each of the kinds are checked out by experts and meet up with state and federal requirements.

Should you be currently listed, log in to your profile and click the Down load key to get the Louisiana Partnership Agreement for Investment Club. Utilize your profile to check with the lawful kinds you may have acquired previously. Check out the My Forms tab of your own profile and acquire an additional duplicate of your papers you want.

Should you be a brand new customer of US Legal Forms, allow me to share easy directions so that you can follow:

- Initially, ensure you have chosen the correct type for your city/county. You are able to look over the shape using the Review key and study the shape information to make sure this is basically the right one for you.

- In the event the type fails to meet up with your expectations, make use of the Seach industry to get the proper type.

- When you are certain that the shape would work, click on the Purchase now key to get the type.

- Opt for the rates strategy you need and type in the needed information and facts. Design your profile and purchase an order using your PayPal profile or charge card.

- Opt for the submit structure and download the lawful papers format to your device.

- Total, revise and print out and sign the acquired Louisiana Partnership Agreement for Investment Club.

US Legal Forms may be the largest catalogue of lawful kinds for which you will find a variety of papers templates. Take advantage of the service to download skillfully-made documents that follow status requirements.