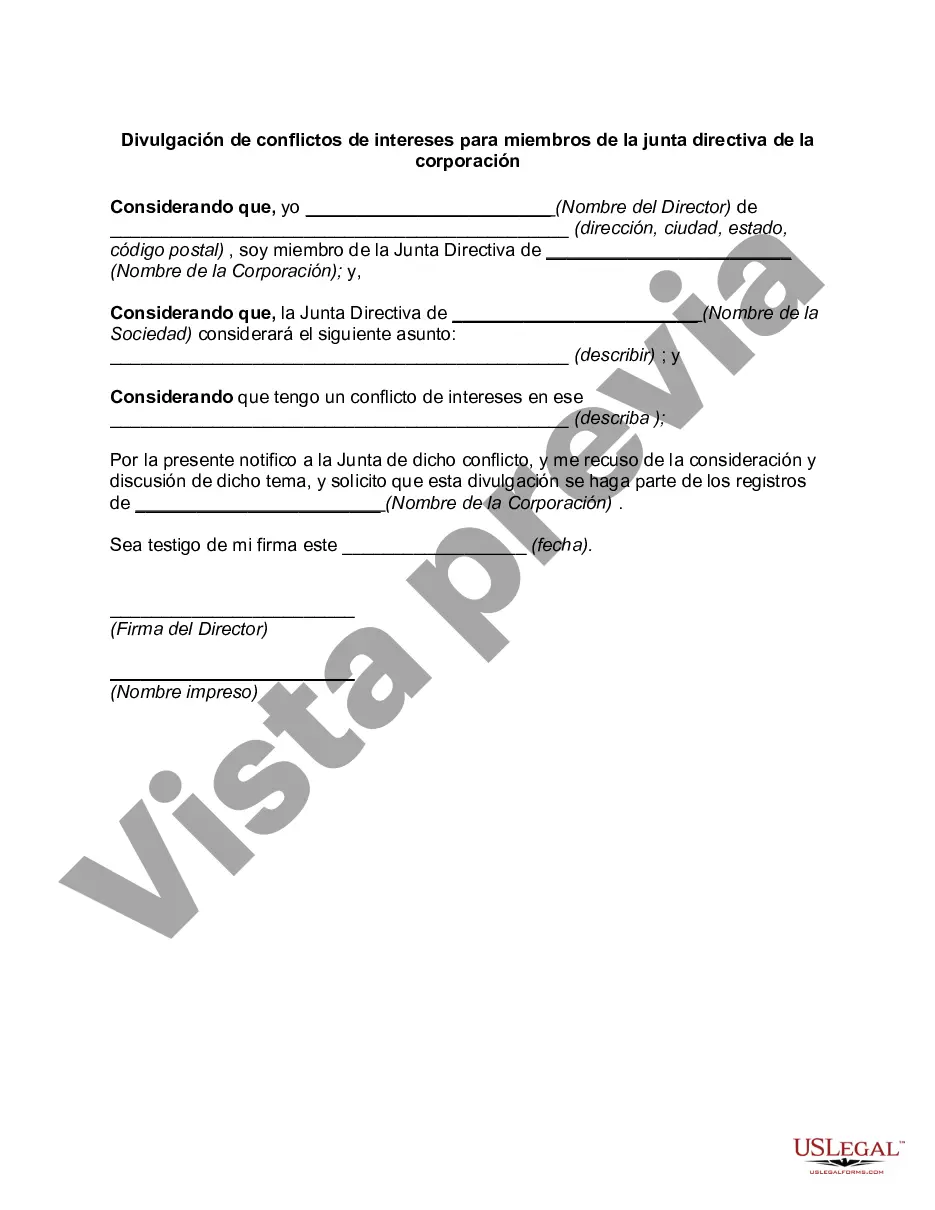

Louisiana Conflict of Interest Disclosure for Members of Board of Directors of Corporation is a crucial aspect of corporate governance that helps maintain transparency and integrity within organizations. This disclosure requirement aims to avoid any potential conflicts of interest that may arise among board members and ensures they act in the best interest of the corporation. Let's explore the details of this disclosure in Louisiana. The Louisiana Conflict of Interest Disclosure for Members of Board of Directors of Corporation is governed by specific laws and regulations that outline the necessary steps to fulfill this obligation. One such regulation is the Louisiana Revised Statutes, Title 12, Section 13, which focuses on defining and addressing conflicts of interest. Keywords: Louisiana, conflict of interest, disclosure, board of directors, corporation, corporate governance, transparency, integrity, regulations, Louisiana Revised Statutes, Title 12, Section 13. Regarding the types of Louisiana Conflict of Interest Disclosures, there are a few key categories to consider: 1. Financial Interests Disclosure: Board members are required to disclose any financial interests they have that might conflict with the corporation's objectives and decision-making processes. This includes ownership or interest in businesses that could compete with or benefit from the corporation's operations. 2. Family or Personal Relationships Disclosure: Board members must disclose any personal or familial relationships that could influence their impartiality when making decisions on behalf of the corporation. This ensures that the board acts in the best interest of the company rather than personal interests. 3. Gifts and Benefits Disclosure: Louisiana Conflict of Interest Disclosure also encompasses the reporting of any gifts, benefits, or favors received by board members that could compromise their objectivity and decision-making process. This helps prevent undue influence on their role as a director. 4. Indirect Interests Disclosure: Board members are required to disclose any indirect financial interests, such as investments in companies that have business dealings with the corporation. This includes transactions with suppliers, customers, or competitors in which the board member may have a financial stake. 5. Timing and Frequency of Disclosure: It is crucial for board members to disclose any conflicts of interest promptly upon identification. Additionally, regular periodic updates may be required to ensure ongoing compliance with disclosure regulations. It is essential for corporations to establish clear policies and procedures to facilitate the proper disclosure and management of conflicts of interest among board members. Failure to comply with the disclosure requirements can result in legal consequences and damage an organization's reputation. In conclusion, the Louisiana Conflict of Interest Disclosure for Board Members of Corporations plays a vital role in maintaining the integrity, transparency, and impartiality of corporate governance. By necessitating the disclosure of financial interests, personal relationships, gifts, and indirect interests, this disclosure requirement ensures that board members act in the best interest of the corporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Louisiana Divulgación de conflictos de intereses para miembros de la junta directiva de la corporación - Conflict of Interest Disclosure for Member of Board of Directors of Corporation

Description

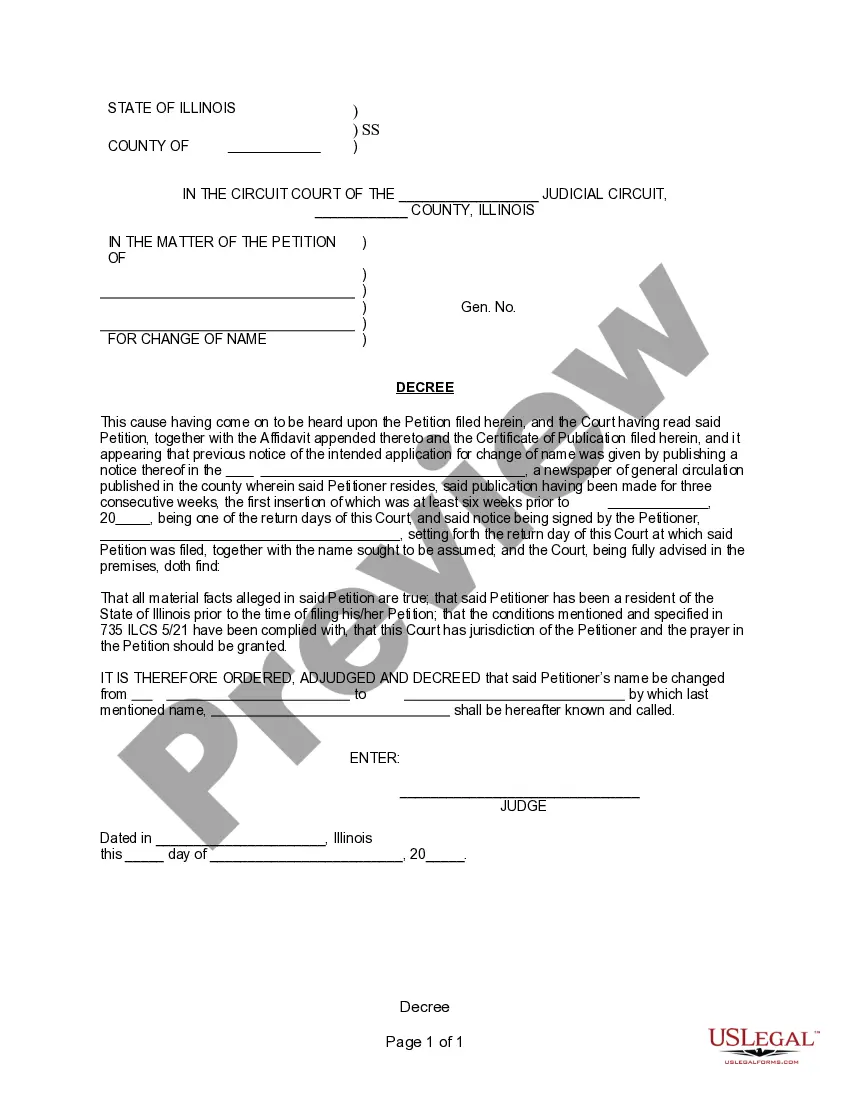

How to fill out Louisiana Divulgación De Conflictos De Intereses Para Miembros De La Junta Directiva De La Corporación?

You may invest hours on the web searching for the lawful document template which fits the federal and state demands you need. US Legal Forms supplies 1000s of lawful varieties that are analyzed by professionals. You can easily obtain or print out the Louisiana Conflict of Interest Disclosure for Member of Board of Directors of Corporation from our service.

If you already have a US Legal Forms accounts, you can log in and click on the Acquire key. Following that, you can total, revise, print out, or sign the Louisiana Conflict of Interest Disclosure for Member of Board of Directors of Corporation. Each lawful document template you purchase is yours forever. To get an additional copy for any obtained kind, go to the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms site for the first time, stick to the straightforward instructions below:

- Very first, be sure that you have selected the proper document template for that region/area of your choosing. Browse the kind outline to ensure you have chosen the correct kind. If offered, take advantage of the Review key to check throughout the document template too.

- If you want to get an additional version from the kind, take advantage of the Lookup field to obtain the template that suits you and demands.

- When you have identified the template you would like, click Purchase now to continue.

- Choose the pricing program you would like, key in your credentials, and register for an account on US Legal Forms.

- Total the purchase. You can utilize your bank card or PayPal accounts to pay for the lawful kind.

- Choose the formatting from the document and obtain it to your gadget.

- Make adjustments to your document if needed. You may total, revise and sign and print out Louisiana Conflict of Interest Disclosure for Member of Board of Directors of Corporation.

Acquire and print out 1000s of document web templates using the US Legal Forms web site, which offers the greatest variety of lawful varieties. Use skilled and express-distinct web templates to tackle your company or individual demands.