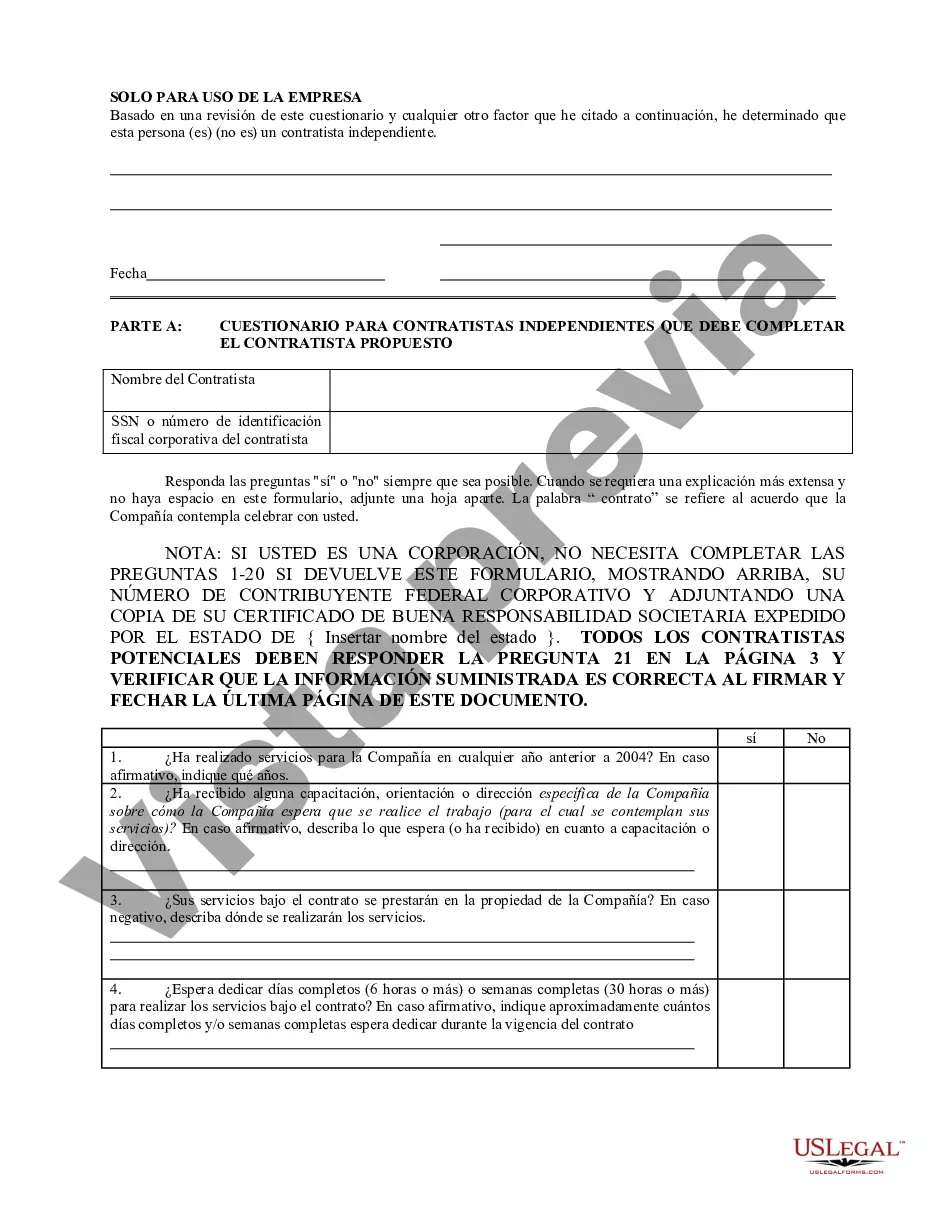

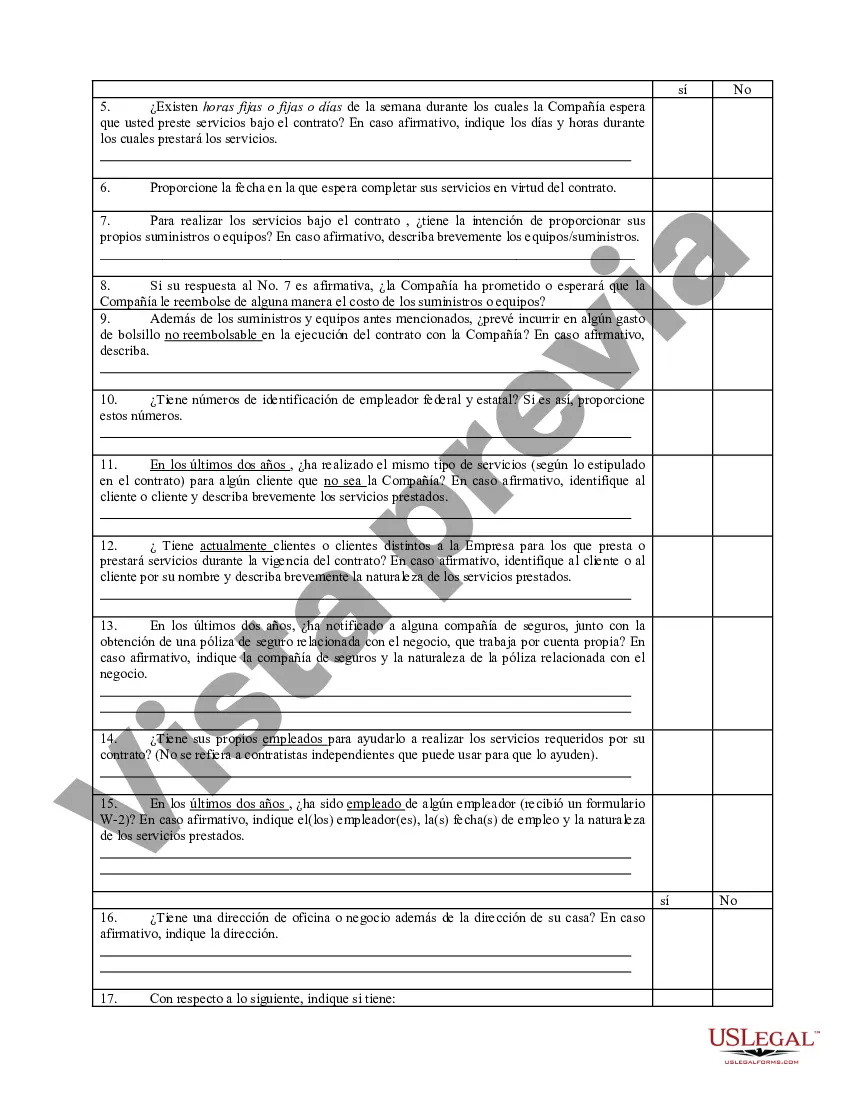

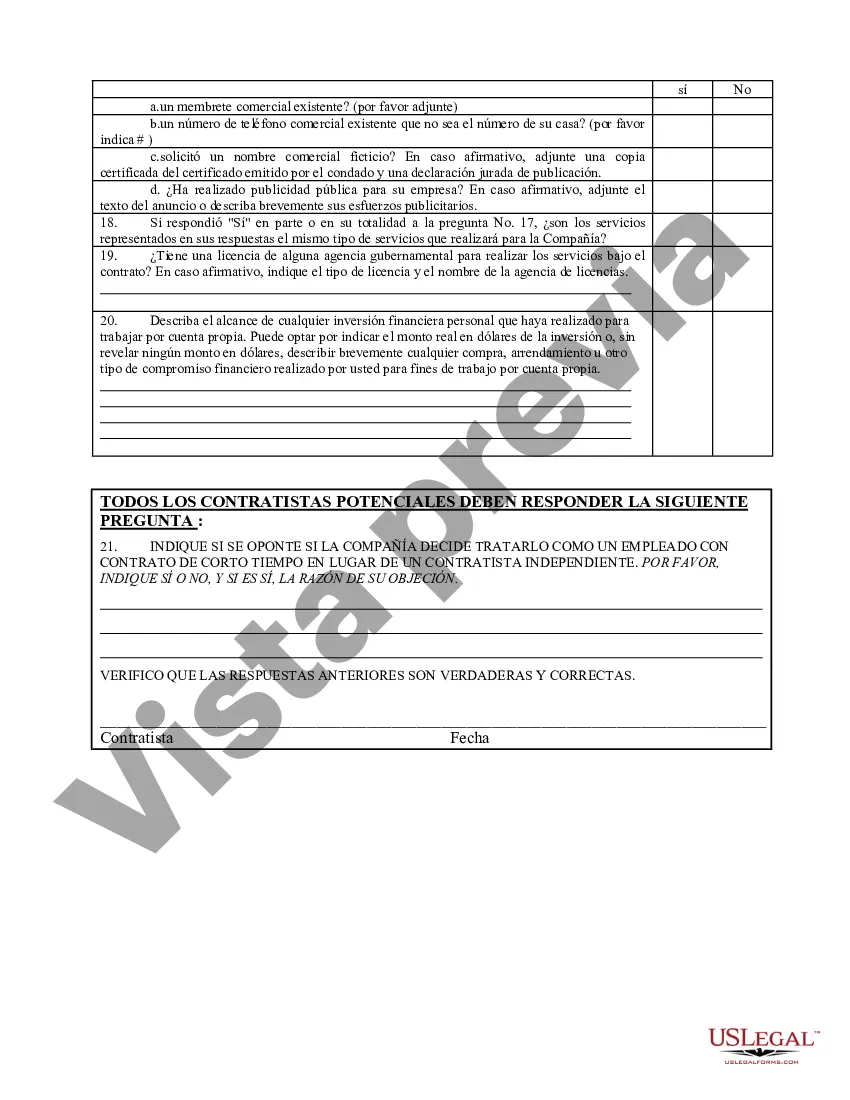

The Louisiana Self-Employed Independent Contractor Questionnaire is a document specifically designed for individuals who work as independent contractors or self-employed individuals in the state of Louisiana. This questionnaire serves as a comprehensive tool to gather relevant information pertaining to the contractor's business activities, tax obligations, and compliance with state regulations. This questionnaire is an essential component of the tax filing and compliance process for self-employed individuals and independent contractors in Louisiana. It ensures that contractors accurately report their income, deductions, and expenses, and helps the state government determine if the contractor meets the criteria for independent contractor status under state law. Some key areas covered in the Louisiana Self-Employed Independent Contractor Questionnaire include: 1. Personal Information: Contractors are required to provide their full legal name, address, contact details, and social security number or taxpayer identification number. 2. Business Information: Contractors need to provide detailed information about their business activities, such as the type of services or products offered, years in operation, and the number of employees, if applicable. 3. Classification Status: Contractors have to determine their employment classification status (i.e., independent contractor or employee) based on specific criteria outlined by the Louisiana Workforce Commission. This information helps to determine their tax obligations and benefits eligibility. 4. Federal Identification Numbers: Contractors are required to provide their federal Employer Identification Number (EIN) if applicable. 5. Income Reporting: Contractors must accurately report their income earned during the tax year, including income from all sources, such as client payments, royalties, and rental income. 6. Expense Deductions: Contractors are required to document and deduct legitimate business expenses incurred in the course of their self-employment. This may include expenses related to supplies, equipment, travel, and professional services. 7. Estimated Tax Payments: Contractors need to report their estimated tax payments made during the tax year to avoid underpayment penalties. Different types or versions of the Louisiana Self-Employed Independent Contractor Questionnaire might exist based on specific industry or profession requirements. For example, there may be specific questionnaires tailored for construction contractors, healthcare professionals, or real estate agents. These specific questionnaires focus on gathering additional industry-specific information relevant to the respective professions. In conclusion, the Louisiana Self-Employed Independent Contractor Questionnaire is a crucial tool for self-employed individuals and independent contractors working in Louisiana, ensuring accurate reporting of income, deductions, and compliance with state regulations. It ensures that contractors meet their tax obligations and helps the state government enforce tax laws effectively.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Louisiana Cuestionario para contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Questionnaire

Description

How to fill out Louisiana Cuestionario Para Contratistas Independientes Que Trabajan Por Cuenta Propia?

US Legal Forms - one of many largest libraries of legitimate forms in the USA - provides a variety of legitimate record layouts it is possible to acquire or print. While using website, you can find thousands of forms for enterprise and individual reasons, sorted by categories, says, or key phrases.You will find the latest models of forms such as the Louisiana Self-Employed Independent Contractor Questionnaire in seconds.

If you already have a subscription, log in and acquire Louisiana Self-Employed Independent Contractor Questionnaire from the US Legal Forms catalogue. The Down load button will appear on each develop you perspective. You have accessibility to all earlier delivered electronically forms from the My Forms tab of your own account.

If you want to use US Legal Forms the first time, here are simple recommendations to help you started out:

- Be sure to have picked out the proper develop for your area/area. Select the Review button to check the form`s information. Browse the develop outline to actually have chosen the correct develop.

- In the event the develop does not match your specifications, make use of the Lookup discipline towards the top of the monitor to discover the one that does.

- Should you be happy with the shape, verify your selection by simply clicking the Acquire now button. Then, opt for the costs strategy you like and provide your credentials to register on an account.

- Method the purchase. Make use of bank card or PayPal account to finish the purchase.

- Pick the file format and acquire the shape on your own system.

- Make alterations. Load, modify and print and indication the delivered electronically Louisiana Self-Employed Independent Contractor Questionnaire.

Each format you included with your money does not have an expiration day and is also yours permanently. So, if you wish to acquire or print another backup, just proceed to the My Forms area and click in the develop you need.

Gain access to the Louisiana Self-Employed Independent Contractor Questionnaire with US Legal Forms, the most comprehensive catalogue of legitimate record layouts. Use thousands of skilled and express-specific layouts that meet up with your business or individual requirements and specifications.

Form popularity

FAQ

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Independent Contractor Interview Questions:Why did you choose to become an independent contractor?Can you tell me about the project that you are proudest of?Have you ever had difficulty meeting deadlines?How do you track your performance?What would you do if you encountered unexpected difficulties on a project?

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

If you choose to pay yourself as a contractor, you need to file IRS Form W-9 with the LLC and the LLC will file an IRS Form 1099-MISC at the end of the year. You will be responsible for paying self-employment taxes on the amount earned.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

In this article, we discuss five questions that you should ask yourself before deciding to become an independent contractor.What are the Advantages of Being an IC?What Do I Lose by Becoming an IC?Do I Have the Requisite Expertise?Can I Self-Motivate to Find Business and Complete Projects?More items...

How Do You Become Self-Employed?Think of a Name for Your Self-Employed Business. Consider what services you will offer, and then pick a name that describes what you do.Choose a Self-Employed Business Structure and Get a Proper License.Open a Business Bank Account.Advertise Your Independent Contractor Services.7 Sept 2021