The Louisiana Waiver of Qualified Joint and Survivor Annuity (JSA) is a legal provision that allows individuals to waive their rights to receive a joint and survivor annuity upon retirement. This waiver option provides retirees with flexibility in choosing how their pension benefits will be distributed after their retirement. Under the Louisiana Waiver of JSA, individuals who are nearing retirement age have the ability to elect an alternative form of pension payment other than the standard joint and survivor annuity. This can be useful for individuals who may not have a spouse or dependent, or who prefer to maximize their retirement income in another way. One type of Louisiana Waiver of JSA is known as the Single Life Annuity. With this option, the retiree receives the full pension benefit for their lifetime. However, if the retiree passes away, the pension payments stop and no further benefits are provided to any beneficiaries. Another type is the Term-Certain Annuity, which allows the retiree to receive pension payments for a specified period of time, typically a set number of years. If the retiree passes away before this term is complete, the remaining payments can be passed on to a designated beneficiary. The Louisiana Waiver of JSA can also encompass variations of these options, such as the Ten Year Certain and Life Annuity, where the retiree receives pension payments for a minimum of ten years or their lifetime, whichever is longer. If the retiree passes away before ten years, the remaining payments are given to a beneficiary. It's important to note that selecting a waiver of JSA option requires careful consideration and consultation with financial advisors, as it may have long-term financial implications. Retirees should thoroughly evaluate their personal circumstances, financial goals, and future plans before making a decision to waive the standard joint and survivor annuity. In conclusion, the Louisiana Waiver of Qualified Joint and Survivor Annuity (JSA) provides retirees with the flexibility to choose an alternative pension payment option that best suits their individual needs. The types of waivers within this provision, such as the Single Life Annuity, Term-Certain Annuity, and Ten Year Certain and Life Annuity, offer different benefits and considerations. Proper financial planning is crucial when deciding to waive the standard JSA, ensuring retirees make informed choices aligned with their retirement goals.

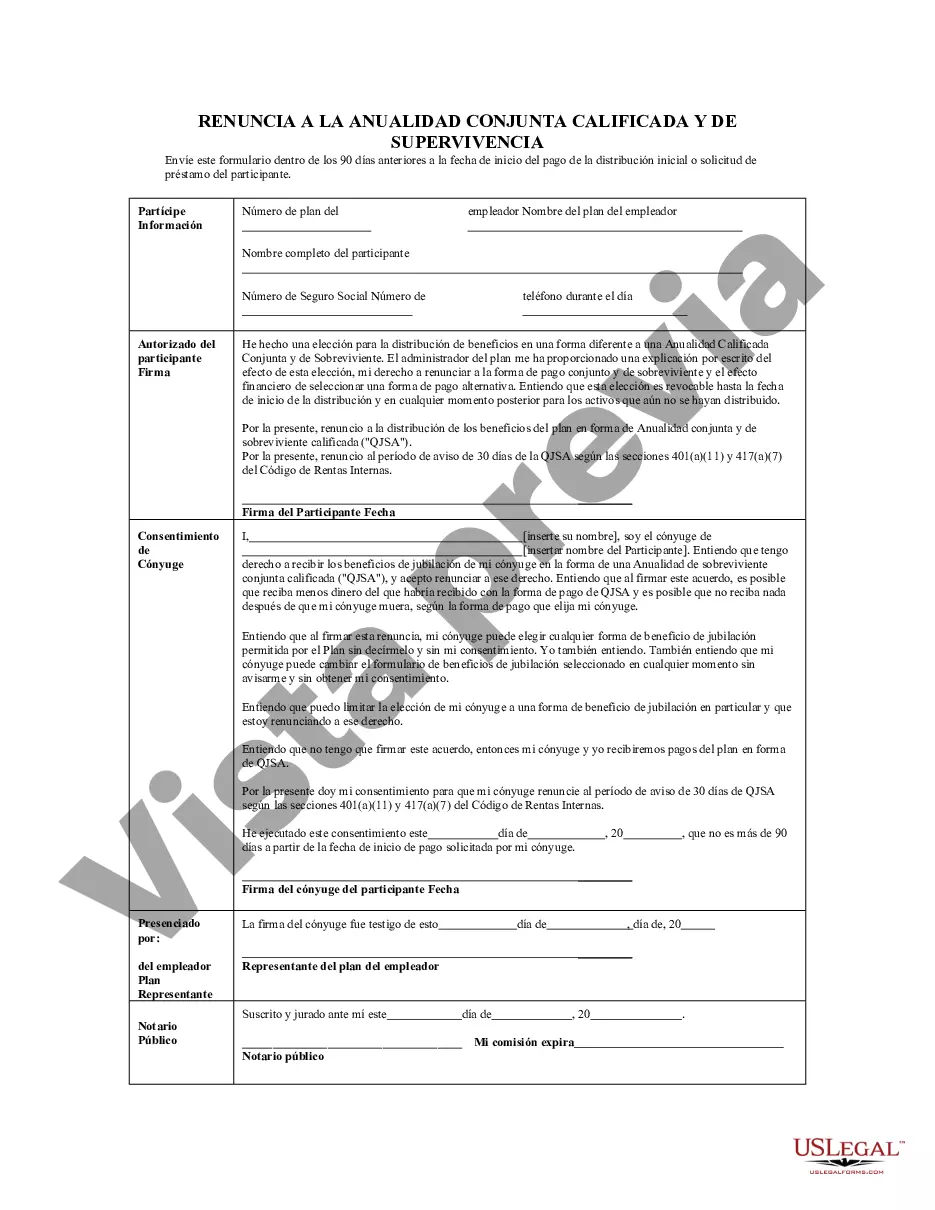

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Louisiana Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Louisiana Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

US Legal Forms - among the largest libraries of legitimate kinds in the United States - delivers a wide array of legitimate papers web templates you may download or print out. While using web site, you can find a large number of kinds for company and personal reasons, sorted by types, claims, or keywords and phrases.You will discover the newest types of kinds just like the Louisiana Waiver of Qualified Joint and Survivor Annuity - QJSA in seconds.

If you have a subscription, log in and download Louisiana Waiver of Qualified Joint and Survivor Annuity - QJSA through the US Legal Forms collection. The Obtain switch will appear on every single develop you view. You gain access to all earlier saved kinds from the My Forms tab of your account.

In order to use US Legal Forms initially, listed below are easy guidelines to help you started:

- Be sure to have picked out the correct develop to your metropolis/area. Click on the Review switch to examine the form`s articles. See the develop information to ensure that you have chosen the right develop.

- If the develop does not match your demands, make use of the Look for area towards the top of the display screen to obtain the one that does.

- If you are content with the shape, affirm your choice by visiting the Acquire now switch. Then, choose the prices prepare you favor and supply your accreditations to sign up for an account.

- Process the deal. Utilize your credit card or PayPal account to accomplish the deal.

- Choose the file format and download the shape in your product.

- Make modifications. Fill out, edit and print out and indicator the saved Louisiana Waiver of Qualified Joint and Survivor Annuity - QJSA.

Each design you included with your bank account lacks an expiry day and is also your own property for a long time. So, if you would like download or print out yet another duplicate, just visit the My Forms segment and then click on the develop you need.

Gain access to the Louisiana Waiver of Qualified Joint and Survivor Annuity - QJSA with US Legal Forms, probably the most comprehensive collection of legitimate papers web templates. Use a large number of professional and status-particular web templates that meet your organization or personal demands and demands.