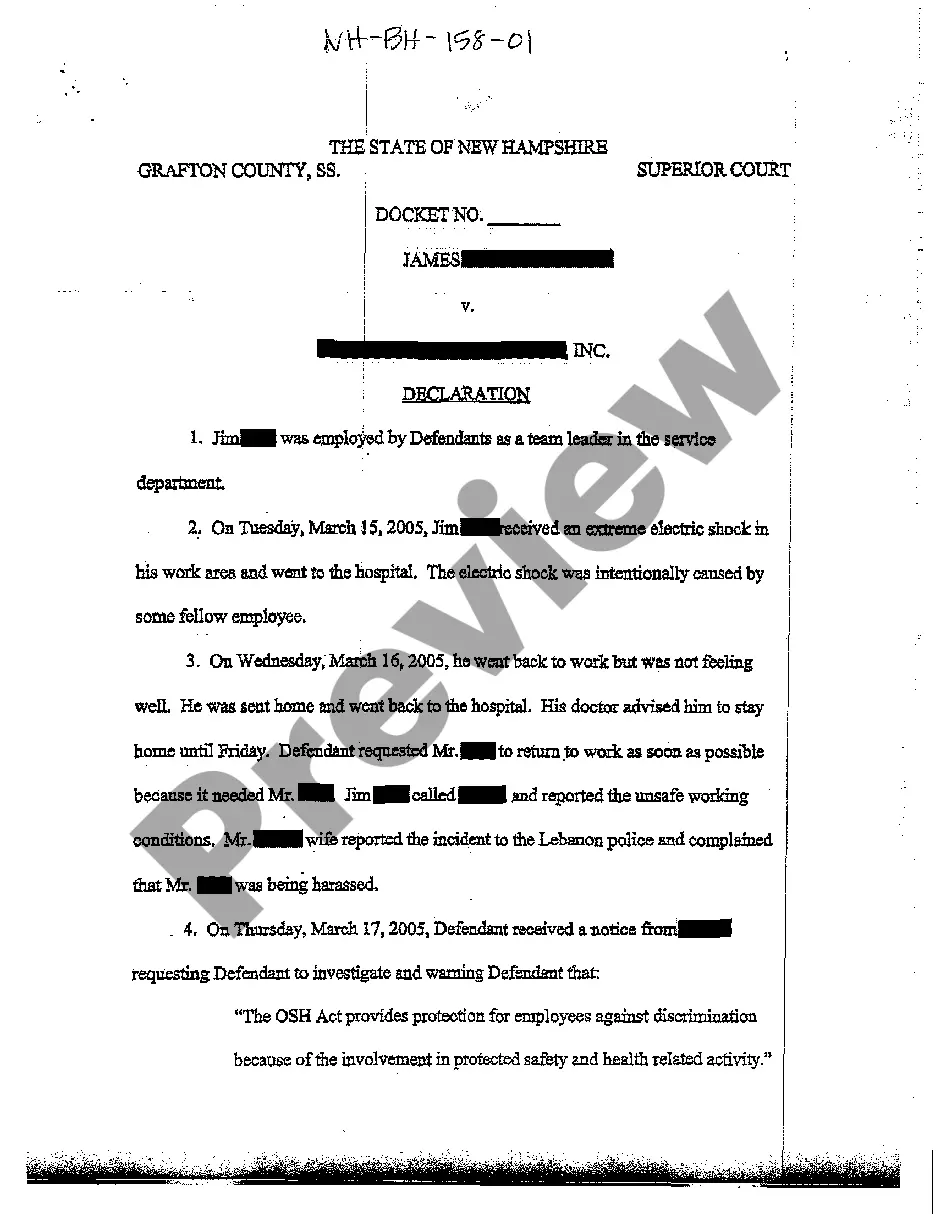

A Massachusetts Notice of Default-Third Party is a legal document issued by a lender to a borrower when they are in default of a loan agreement. This document is used to inform the borrower that the lender is taking legal action against them, and that they have a certain period of time to cure the default or face foreclosure. There are two types of Massachusetts Notice of Default-Third Party: standard and accelerated. The standard Notice of Default-Third Party gives the borrower 30 days to cure the default, while the accelerated Notice of Default-Third Party gives the borrower only 21 days to cure the default. Both notices include details about the loan, the default, the right of the borrower to cure the default, and the potential consequences of failing to cure the default.

Massachusetts Notice of Default-Third Party

Description

How to fill out Massachusetts Notice Of Default-Third Party?

Handling official paperwork requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Massachusetts Notice of Default-Third Party template from our library, you can be sure it complies with federal and state regulations.

Dealing with our service is straightforward and fast. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to get your Massachusetts Notice of Default-Third Party within minutes:

- Remember to carefully check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Massachusetts Notice of Default-Third Party in the format you need. If it’s your first experience with our website, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the Massachusetts Notice of Default-Third Party you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

(a) Entering a Default. When a party against whom a judgment for affirmative relief is sought has failed to plead or otherwise defend, and that failure is shown by affidavit or otherwise, the clerk must enter the party's default.

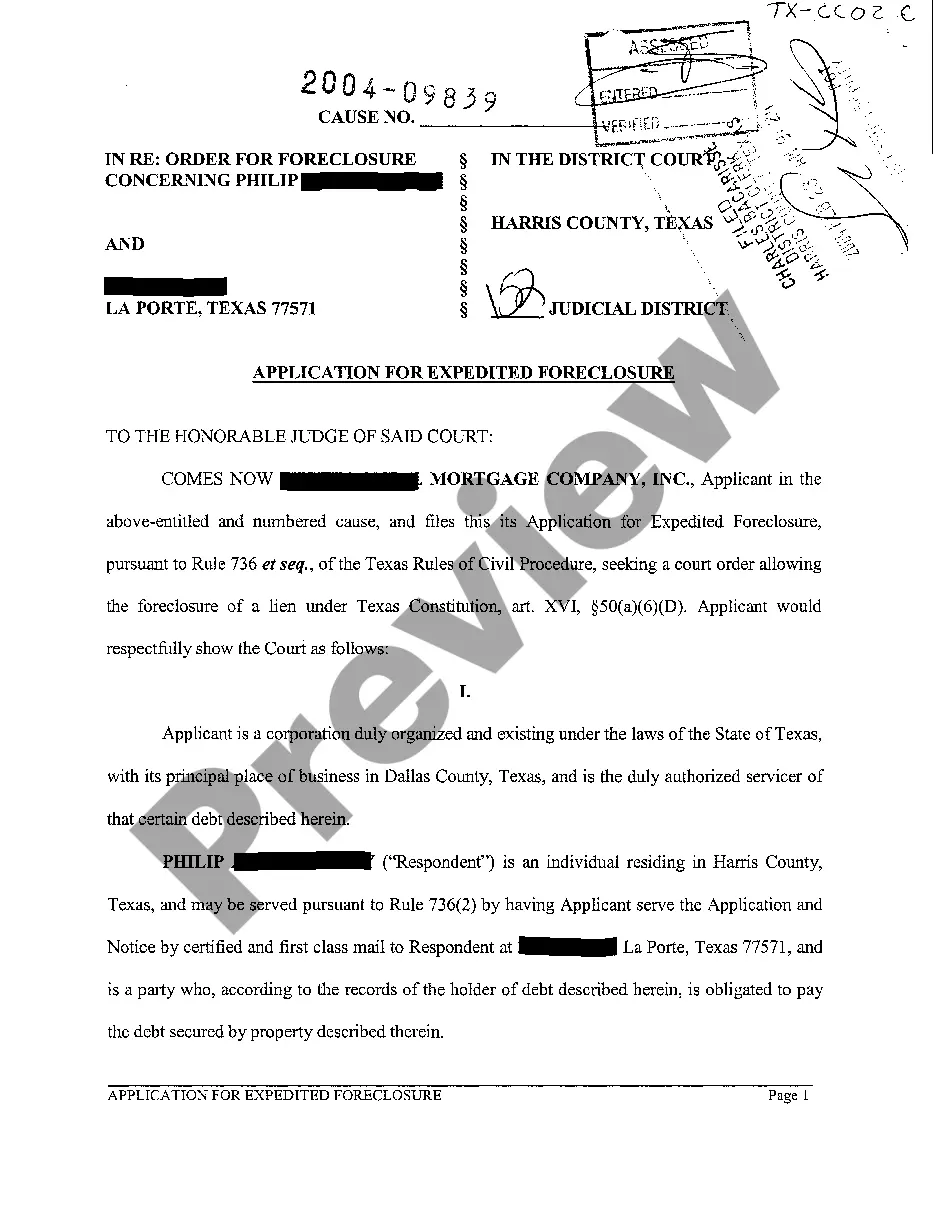

A notice of default is a public notice that gets filed with a court. The notice of default declares the mortgage borrower is in default on their loan. The lender files a notice of default when the mortgage payments get behind by the borrower. A notice of default is typically the first step towards foreclosure.

Under the amendment of the initial sentences of the subdivision, a defendant as a third-party plaintiff may freely and without leave of court bring in a third-party defendant if he files the third-party complaint not later than 10 days after he serves his original answer.

Rule 41(b)(2) provides for involuntary dismissal upon motion of the defendant on one of two grounds: (1) failure to comply with the rules or any order of the court; or (2) in an action tried without a jury, if, upon the facts and the law, the plaintiff has shown no right to relief.

Massachusetts Rules of Civil Procedure (the Rules) allow a party to move to vacate a judgment if certain parameters are met. Specifically, a judgment may be vacated due to excusable neglect, mistake or inadvertence, or because of newly discovered evidence.

What is Third Party Defendant? A party who is sued by the original defendant and brought into the case on a theory of being responsible to the defendant for all or part of the claim made by the plaintiff.

Under Rule 55(b)(1) the plaintiff must request the clerk to enter the judgment by default and submit affidavits establishing the amount due and stating that the defendant is not an infant or an adjudged incompetent person.