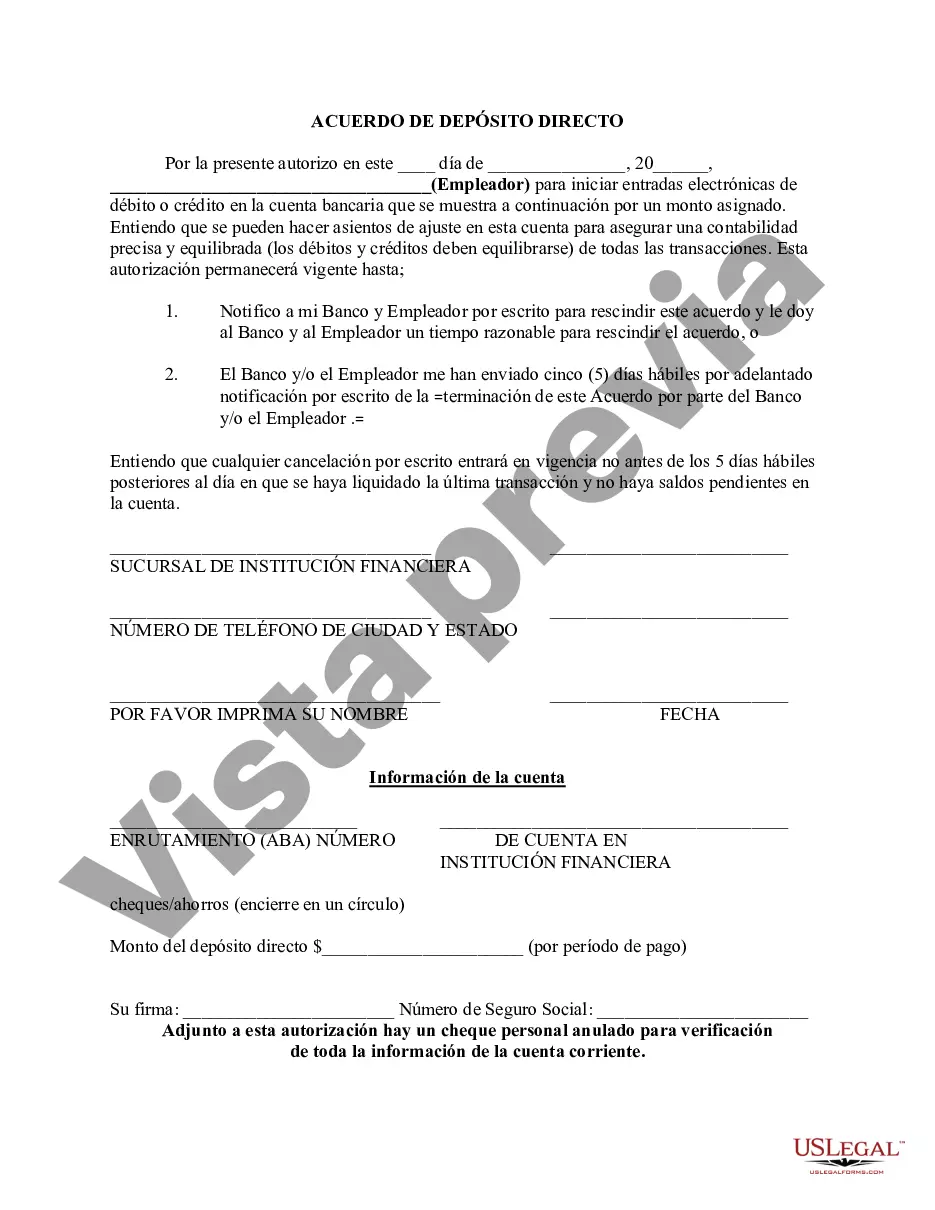

The Massachusetts Direct Deposit Form for Employees is a document that enables workers to sign up for direct deposit services provided by their employer. Direct deposit is a convenient and efficient method of salary payment, where the employee's wages are electronically transferred directly into their designated bank account. This eliminates the need for physical paper checks and enables employees to access their funds faster and more conveniently. The Massachusetts Direct Deposit Form for Employees typically requires essential information such as the employee's name, address, social security number, employee identification number, and contact details. Additionally, the form will require the employee to provide their banking details. This includes the name and address of their bank, bank's routing number, and the employee's bank account number. It is worth noting that while the Massachusetts Direct Deposit Form for Employees is used as a template for most workplaces in the state, there may be variations depending on the employer or industry. Some companies may have customized forms tailored to their specific payroll systems. However, the core information required remains consistent, focusing on essential personal and banking details. Different types or variations of the Massachusetts Direct Deposit Form for Employees may exist to cater to diverse work environments or specific employer preferences. For example, there can be modified forms for hourly employees, salaried employees, or independent contractors. These modifications may account for differing wage structures, such as hourly rates, fixed salaries, or commission-based income. It is essential for employees to accurately complete the Massachusetts Direct Deposit Form, ensuring that all information is correct and up-to-date. Any errors or discrepancies in the provided details may lead to payment delays or complications in receiving funds. Employees must carefully review the completed form before submitting it to their employer's human resources or payroll department. The Massachusetts Direct Deposit Form for Employees serves as a crucial administrative tool in streamlining payroll processes for businesses, reducing paper waste, and increasing efficiency in salary disbursement. It is an integral part of ensuring accurate and timely payments to employees, contributing to improved financial management for both businesses and workers alike.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Formulario de depósito directo para empleados - Direct Deposit Form for Employees

Description

How to fill out Massachusetts Formulario De Depósito Directo Para Empleados?

Choosing the best lawful document design can be quite a battle. Of course, there are a lot of web templates available online, but how can you find the lawful kind you will need? Utilize the US Legal Forms website. The services offers a large number of web templates, like the Massachusetts Direct Deposit Form for Employees, which can be used for business and private needs. Every one of the forms are inspected by specialists and meet up with federal and state needs.

When you are currently authorized, log in to your profile and then click the Download option to have the Massachusetts Direct Deposit Form for Employees. Make use of your profile to search throughout the lawful forms you have ordered in the past. Visit the My Forms tab of your profile and have one more version of the document you will need.

When you are a brand new consumer of US Legal Forms, listed below are simple instructions for you to stick to:

- First, make sure you have chosen the appropriate kind to your city/region. You can look over the form utilizing the Preview option and study the form information to make certain it is the right one for you.

- In the event the kind fails to meet up with your expectations, utilize the Seach area to discover the appropriate kind.

- When you are sure that the form would work, select the Buy now option to have the kind.

- Opt for the prices program you need and enter in the required information and facts. Design your profile and pay for your order with your PayPal profile or Visa or Mastercard.

- Choose the data file file format and acquire the lawful document design to your product.

- Full, change and produce and signal the received Massachusetts Direct Deposit Form for Employees.

US Legal Forms is the largest local library of lawful forms for which you can find different document web templates. Utilize the service to acquire skillfully-made documents that stick to condition needs.