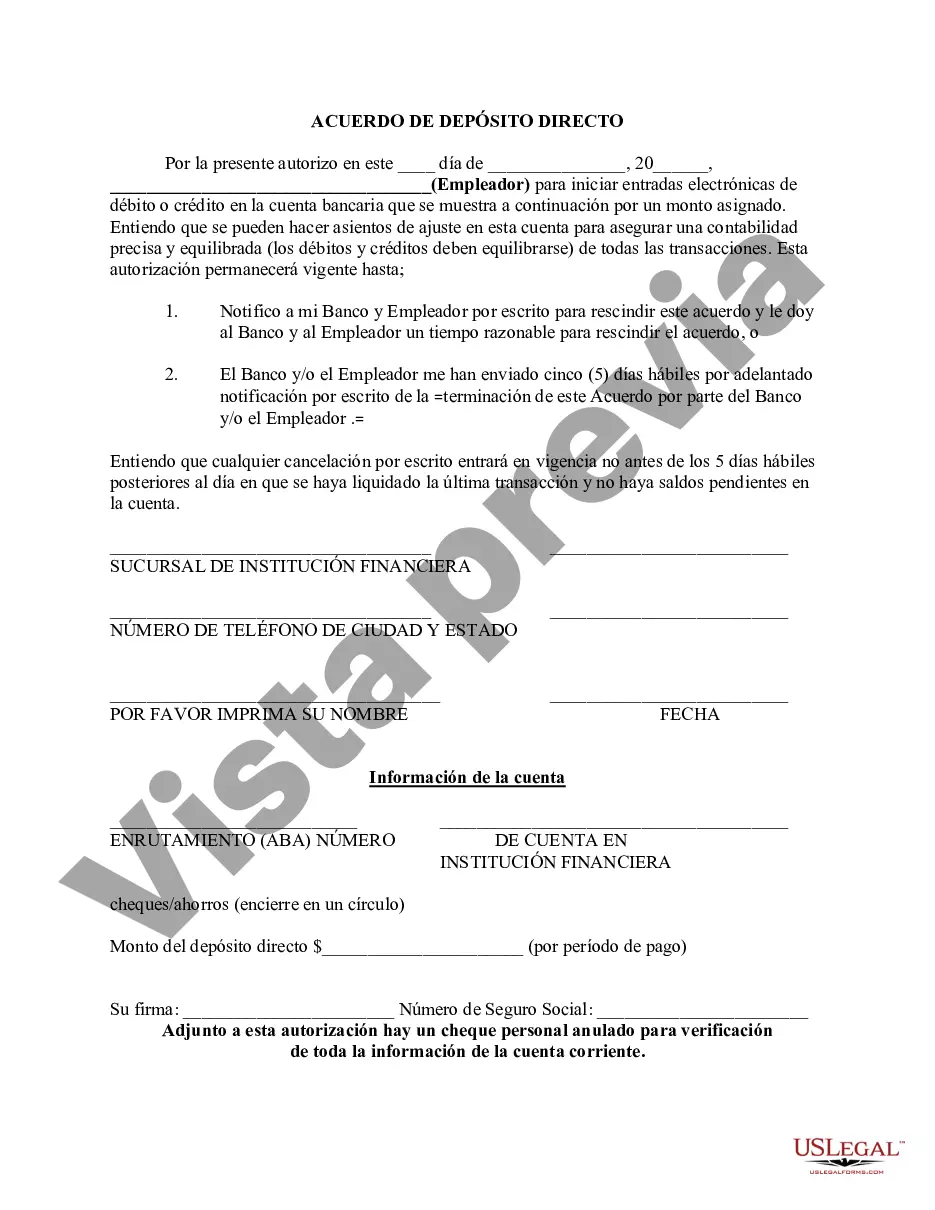

The Massachusetts Direct Deposit Form for IRS is a document that allows Massachusetts taxpayers to authorize the Internal Revenue Service (IRS) to electronically deposit their tax refunds directly into their bank accounts. This form eliminates the need for a physical check and offers a more convenient and secure method of receiving tax refunds. The Massachusetts Direct Deposit Form is specifically designed for taxpayers residing in Massachusetts and is used in conjunction with their federal tax return. By providing their bank account information on this form, taxpayers can ensure that their tax refund is directly deposited into their desired account. The form requires various information to be filled out accurately, including the taxpayer's name, social security number, and banking details such as the routing number and account number. It is crucial to double-check all the provided fields to avoid any errors that may result in delays or failed direct deposits. Different types of Massachusetts Direct Deposit Form for IRS may include variations for individuals, joint filers (married couples filing jointly), and businesses. However, regardless of the specific form type, they all serve the same purpose of establishing a direct deposit arrangement for tax refunds. It is advisable to seek assistance from a professional tax advisor or use the official Massachusetts Department of Revenue website to obtain the most up-to-date versions of the Massachusetts Direct Deposit Form for IRS. Additionally, individuals may need to refer to the specific instructions accompanying the form for any additional requirements or guidelines. Utilizing direct deposit for tax refunds not only offers convenience but also reduces the risk of lost or stolen checks. By opting for electronic deposit, taxpayers can receive their refunds faster and securely transfer the funds to their desired accounts for immediate use or savings purposes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Formulario de depósito directo para el IRS - Direct Deposit Form for IRS

Description

How to fill out Massachusetts Formulario De Depósito Directo Para El IRS?

US Legal Forms - one of many most significant libraries of legitimate types in the United States - offers an array of legitimate papers web templates you may download or produce. While using website, you may get a large number of types for business and individual purposes, sorted by classes, suggests, or keywords.You will find the latest variations of types such as the Massachusetts Direct Deposit Form for IRS in seconds.

If you already possess a registration, log in and download Massachusetts Direct Deposit Form for IRS through the US Legal Forms collection. The Obtain button can look on each and every type you view. You have access to all previously acquired types in the My Forms tab of your respective bank account.

If you would like use US Legal Forms the first time, listed here are straightforward recommendations to help you began:

- Be sure to have picked out the right type for your metropolis/county. Select the Preview button to analyze the form`s content. Browse the type outline to actually have selected the right type.

- When the type does not suit your specifications, take advantage of the Search discipline on top of the display to obtain the one which does.

- Should you be content with the shape, verify your option by clicking the Purchase now button. Then, select the costs plan you prefer and offer your references to sign up for the bank account.

- Procedure the deal. Make use of credit card or PayPal bank account to perform the deal.

- Choose the file format and download the shape on your own system.

- Make changes. Fill up, revise and produce and indicator the acquired Massachusetts Direct Deposit Form for IRS.

Each template you included in your account lacks an expiry particular date and it is yours eternally. So, in order to download or produce another copy, just proceed to the My Forms portion and click around the type you will need.

Obtain access to the Massachusetts Direct Deposit Form for IRS with US Legal Forms, by far the most extensive collection of legitimate papers web templates. Use a large number of professional and state-certain web templates that satisfy your organization or individual requires and specifications.