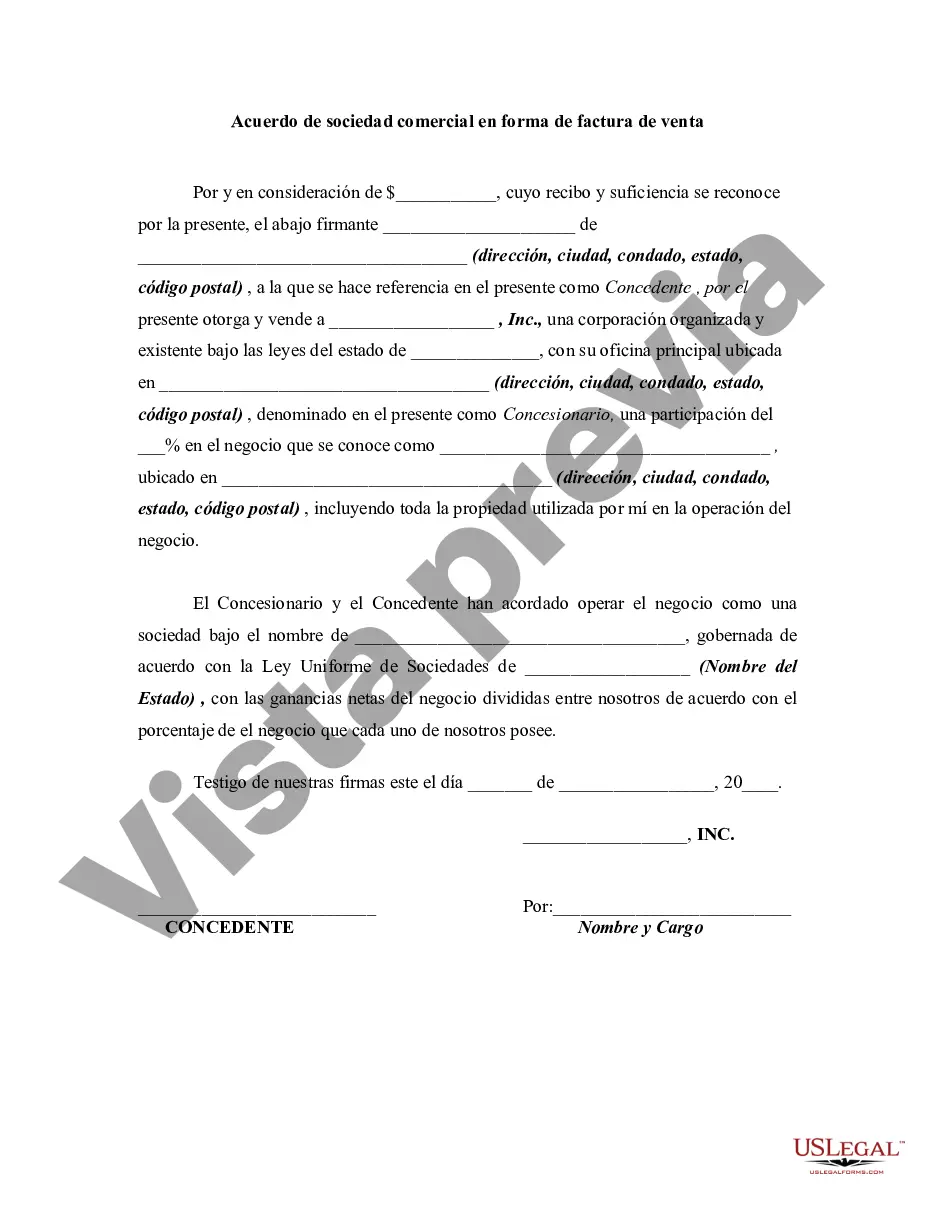

A Massachusetts Commercial Partnership Agreement in the form of a Bill of Sale is a legal document that outlines the terms and conditions of a commercial partnership between two or more entities in the state of Massachusetts. This agreement serves as a binding contract, establishing the rights, responsibilities, and obligations of each partner involved in the partnership. Key terms and clauses included in a Massachusetts Commercial Partnership Agreement in the form of a Bill of Sale may include: 1. Identification of Parties: The agreement will identify the participating partnership entities by their legal names, addresses, and any applicable business identification numbers. 2. Partnership Purpose: This clause outlines the primary objectives and goals of the commercial partnership. It may include details about the shared business activities, industries, or services the partnership is engaged in. 3. Contribution: Each partner's contribution to the partnership is specified in this section. It typically includes details about financial investments, tangible assets, intellectual property, or any other resources contributed by each party. 4. Profit and Loss Distribution: The division of profits and losses among the partners is described in this clause. It outlines the percentage or share of profits or losses each partner will be entitled to receive. 5. Management and Decision-making: This section outlines the decision-making processes within the partnership, including voting rights, management roles, and responsibilities of each partner. 6. Dissolution and Termination: This clause describes the circumstances under which the partnership may be dissolved or terminated. It may include provisions for voluntary dissolution by partners, bankruptcy, or retirement of a partner. There may be different types of Massachusetts Commercial Partnership Agreements based on the nature of the partnership and the specific needs of the parties involved. Some additional types of commercial partnership agreements include: 1. Limited Partnership Agreement: This agreement differentiates between limited partners, who contribute capital but have limited liability, and general partners, who actively manage the partnership and bear unlimited liability. 2. Joint Venture Agreement: This type of agreement is used when two or more entities collaborate on a specific project or enterprise, while retaining their separate legal identities. 3. Limited Liability Partnership Agreement: LLP agreements are commonly used in professional services industries, such as accounting or law firms, where partners have limited liability for the actions of other partners. In conclusion, a Massachusetts Commercial Partnership Agreement in the form of a Bill of Sale is a comprehensive legal document that establishes the terms and conditions of a commercial partnership. It outlines the rights, responsibilities, and obligations of each partner involved. Different types of commercial partnership agreements in Massachusetts include Limited Partnership Agreements, Joint Venture Agreements, and Limited Liability Partnership Agreements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Acuerdo de sociedad comercial en forma de factura de venta - Commercial Partnership Agreement in the Form of a Bill of Sale

Description

How to fill out Massachusetts Acuerdo De Sociedad Comercial En Forma De Factura De Venta?

US Legal Forms - one of the largest libraries of legitimate forms in America - gives a variety of legitimate file web templates you are able to acquire or print out. Using the internet site, you will get a large number of forms for company and personal functions, sorted by types, claims, or keywords and phrases.You can get the most recent versions of forms just like the Massachusetts Commercial Partnership Agreement in the Form of a Bill of Sale in seconds.

If you currently have a subscription, log in and acquire Massachusetts Commercial Partnership Agreement in the Form of a Bill of Sale from the US Legal Forms collection. The Acquire switch will appear on each and every kind you see. You have accessibility to all earlier delivered electronically forms from the My Forms tab of your own bank account.

If you would like use US Legal Forms the first time, allow me to share simple instructions to help you get started off:

- Ensure you have picked out the best kind for your personal town/area. Click the Preview switch to analyze the form`s information. Look at the kind information to ensure that you have chosen the appropriate kind.

- In case the kind doesn`t fit your requirements, take advantage of the Research field at the top of the display screen to obtain the one which does.

- In case you are happy with the form, affirm your decision by simply clicking the Get now switch. Then, select the pricing plan you favor and give your qualifications to sign up for an bank account.

- Approach the purchase. Utilize your credit card or PayPal bank account to finish the purchase.

- Pick the structure and acquire the form in your device.

- Make alterations. Fill out, edit and print out and indication the delivered electronically Massachusetts Commercial Partnership Agreement in the Form of a Bill of Sale.

Each format you included with your money lacks an expiry day and it is your own property eternally. So, if you wish to acquire or print out an additional version, just proceed to the My Forms area and click on in the kind you want.

Gain access to the Massachusetts Commercial Partnership Agreement in the Form of a Bill of Sale with US Legal Forms, the most substantial collection of legitimate file web templates. Use a large number of skilled and express-distinct web templates that fulfill your small business or personal requires and requirements.