Massachusetts Shareholder and Corporation agreement to issue additional stock to a third party to raise capital

Description

How to fill out Shareholder And Corporation Agreement To Issue Additional Stock To A Third Party To Raise Capital?

If you wish to completely download or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you need.

A diverse range of templates for business and personal purposes are categorized by types and states, or keywords.

Step 4. After locating the form you need, click the Purchase now button. Choose the pricing plan you prefer and input your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal to finalize the purchase.

- Use US Legal Forms to find the Massachusetts Shareholder and Corporation agreement to issue additional stock to a third party for capital raising with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Massachusetts Shareholder and Corporation agreement for issuing extra stock to a third party for capital.

- You can access forms you've previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

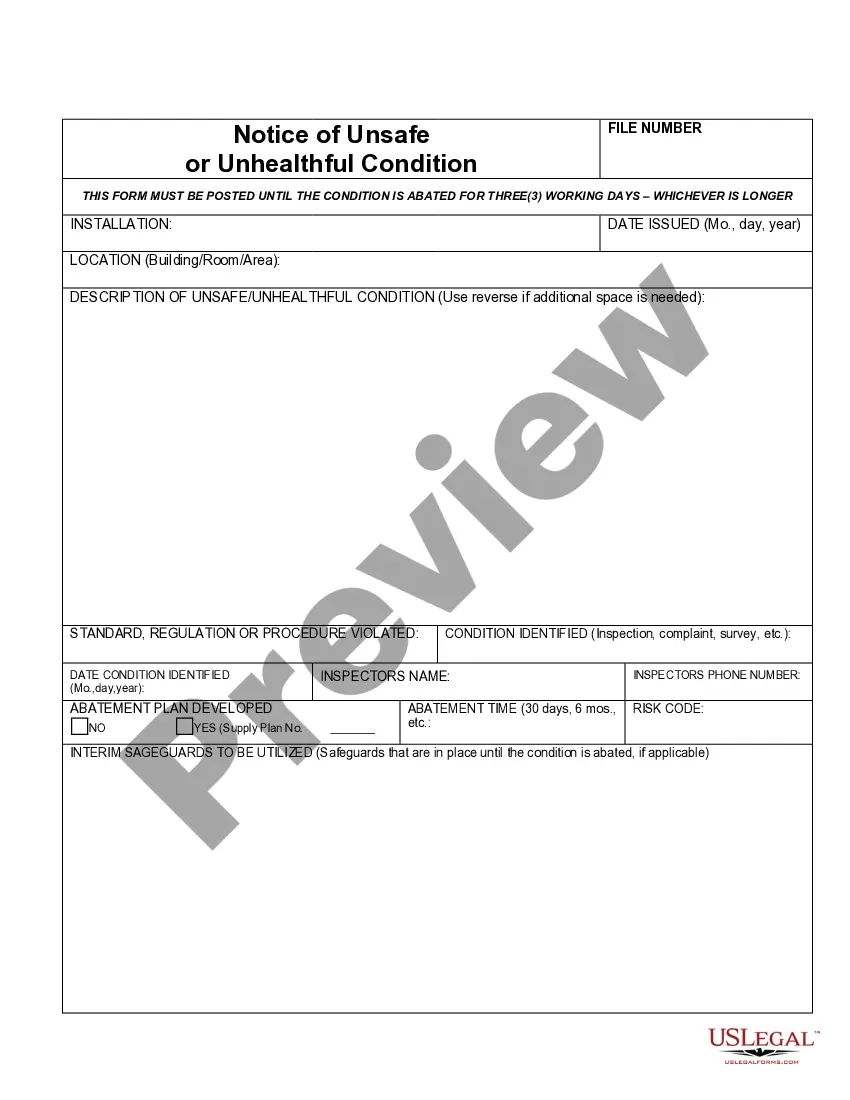

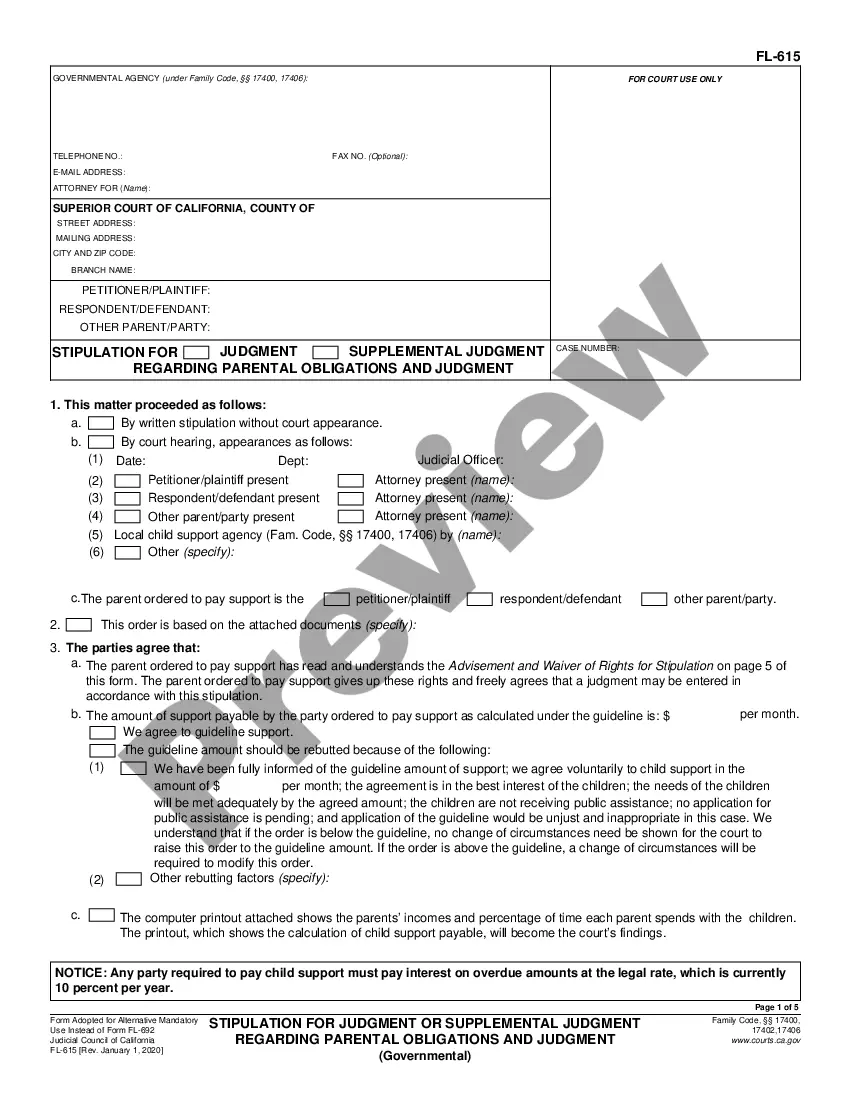

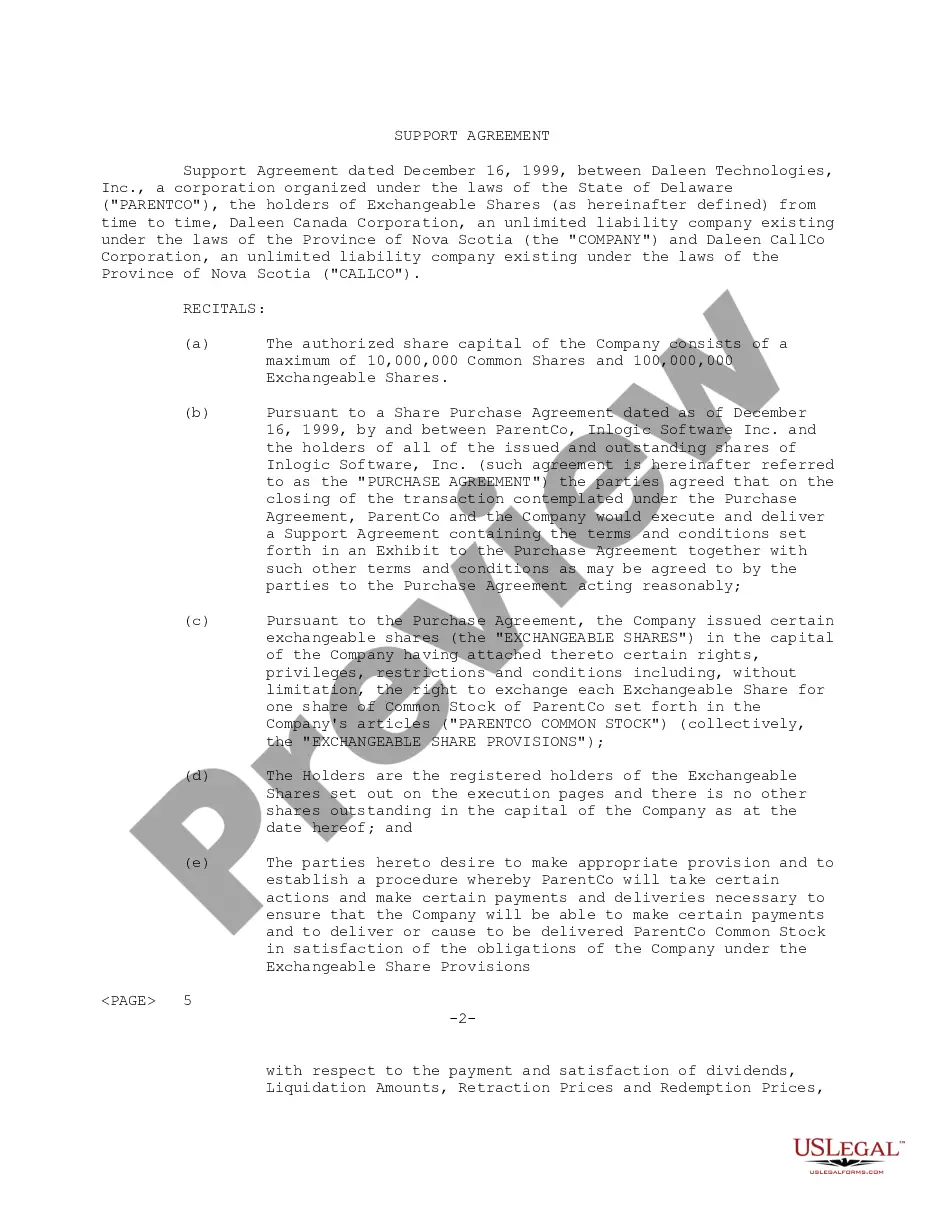

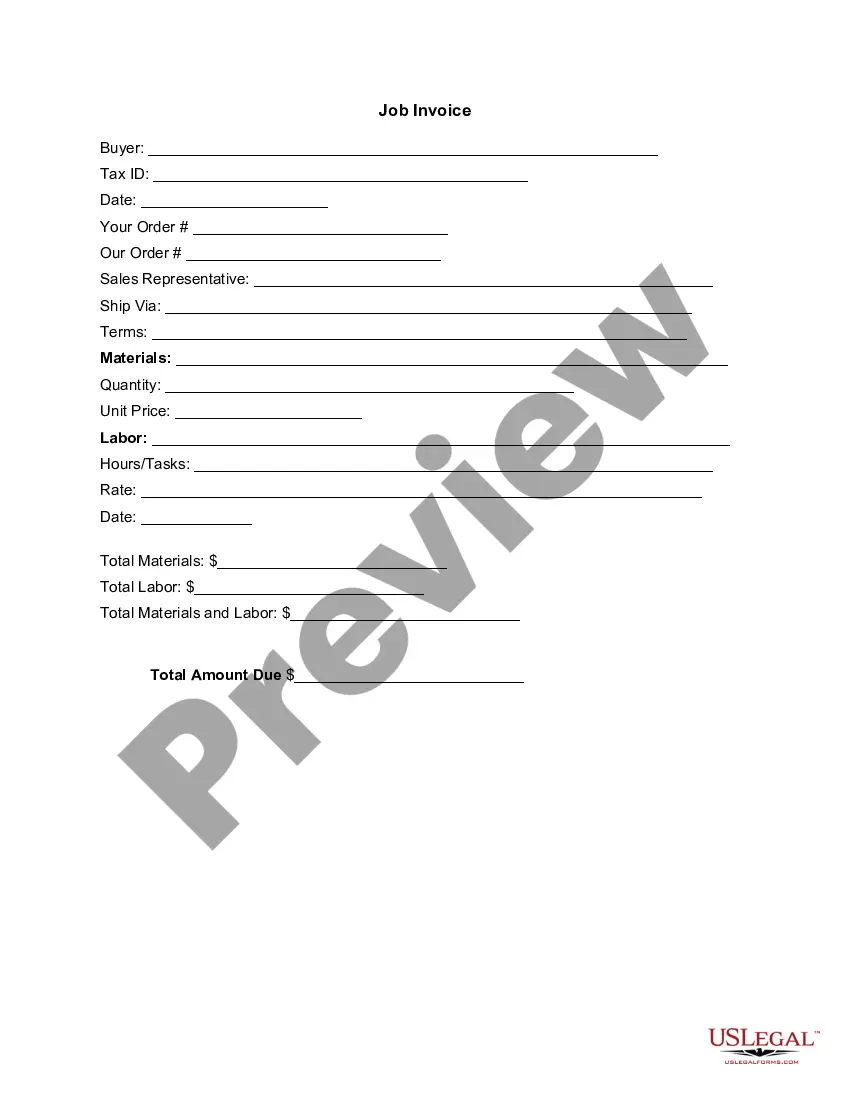

- Step 2. Use the Review option to check the content of the form. Remember to go through the details.

- Step 3. If you are not satisfied with the document, utilize the Search box at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

How many shares do startup founders need to issue? The commonly accepted standard for new companies is 10 million shares. When you build a venture-backed startup designed to scale, you will need to issue shares to an increasing number of employees.

The supposedly-issued shares are void in effect, they do not exist. For the shares to be issued, the Articles (CA) or Certificate (DE) of Incorporation must be amended to increase the authorized number of shares. Then, to be safe, the shares should be re-issued pursuant to an appropriate board resolution.

Drafting a Successful Shareholders' AgreementDrafting a successful shareholders' agreement.Understand your client's business.Don't overcomplicate decision making.Decide how to deal with stalemates.You need an exit.Think through all the possible outcomes for your exit mechanism it needs to work.

Issuing of extra shares will require a resolution to be passed by a general meeting of the company shareholders. The only way of avoiding diluting the company further by issuing shares to new investors is by existing shareholders taking up the extra shares on top of their own.

Authority to allot new shares Directors of companies with more than one class of shares need to obtain express authority to allot from the company's shareholders. This is done by means of an ordinary resolution passed at a general meeting or using the 2006 Act written resolution procedure.

A company that issues all of its authorized stock will have its outstanding shares equal to authorized shares. Outstanding shares can never exceed the authorized number, since the authorized shares total is the maximum number of shares that a company can issue.

Shareholders are added when they purchase stock in the corporation (providing money or services in exchange for shares in the corporation). The stock sale would be approved by the existing shareholders and may depend on your Corporate Bylaws.

When a company issues too many additional shares too quickly, existing shareholders can be hurt. Ownership levels can be diluted and share prices can drop. It can also imply a certain level of risk depending on the reasoning for issuing more shares.

To issue shares in a company is to create new shares, and:All existing members are to agree to the issue of shares via a board meeting.You are to complete a return of allotment of shares via an SH01 form.Create board resolution, meeting minutes, and issue the share certificate(s) to the new shareholder.More items...?

However, a company commonly has the right to increase the amount of stock it's authorized to issue through approval by its board of directors. Also, along with the right to issue more shares for sale, a company has the right to buy back existing shares from stockholders.