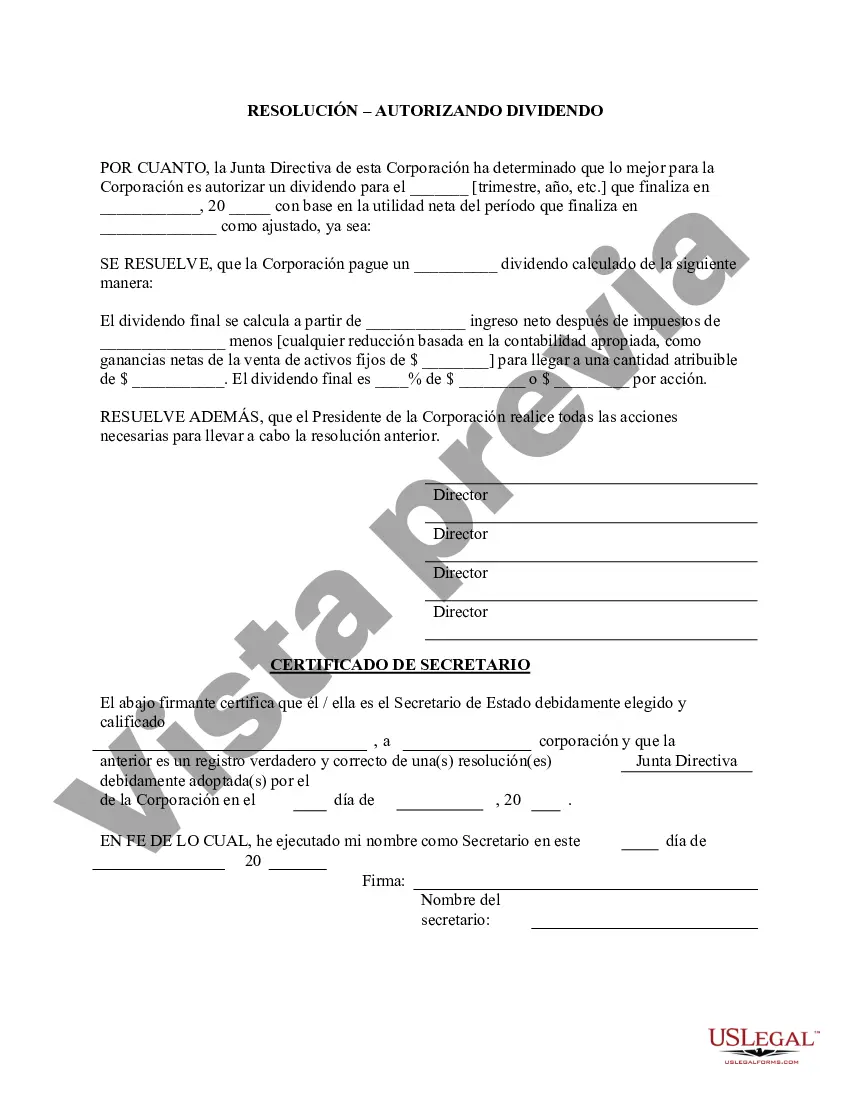

The Massachusetts Stock Dividend — Resolution For— - Corporate Resolutions is a legal document that encompasses the necessary steps for a corporation to declare and distribute stock dividends to its shareholders. This form outlines the resolution that needs to be passed by the corporation's board of directors, authorizing the distribution of stock dividends. It is an essential tool for corporations operating in Massachusetts to ensure compliance with state laws and regulations. Keywords: Massachusetts, stock dividend, resolution form, corporate resolutions, shareholders, board of directors, distribution, compliance, state laws, regulations. Different types of Massachusetts Stock Dividend — Resolution For— - Corporate Resolutions may include: 1. Cash Dividend Resolution Form: This type of resolution form pertains to the distribution of cash dividends instead of stock dividends. It outlines the board's decision to distribute a certain amount of cash per share to the shareholders. 2. Stock Split Resolution Form: Sometimes, instead of issuing stock dividends, corporations may decide to split their existing shares to increase the number of outstanding shares. This resolution form documents the board's decision and outlines the details of the stock split. 3. Stock Dividend Reinvestment Plan (DRIP) Resolution Form: Some corporations offer a dividend reinvestment plan to their shareholders, allowing them to reinvest their dividends back into purchasing additional shares of the company's stock. This resolution form authorizes the establishment and operation of such a plan. 4. Preferred Stock Dividend Resolution Form: In cases where a corporation has different classes of stock, such as common stock and preferred stock, a specific resolution form may be required to declare and distribute dividends on the preferred stock. This form outlines the details of the preferred stock dividends to be paid out. 5. Dividend Declaration Resolution Form: This type of resolution form is used to document the board's decision to declare dividends in general, regardless of whether they are stock or cash dividends. It establishes the dates, amounts, and other necessary details regarding the dividend declaration. It is important for corporations in Massachusetts to use the appropriate resolution form relevant to their specific situation when declaring and distributing stock dividends. These forms ensure compliance with state laws and provide a clear record of the board's decisions regarding dividends.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Dividendo en Acciones - Formulario de Resoluciones - Resoluciones Corporativas - Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Massachusetts Dividendo En Acciones - Formulario De Resoluciones - Resoluciones Corporativas?

Finding the right authorized record design could be a have difficulties. Needless to say, there are tons of themes available on the net, but how do you obtain the authorized develop you want? Use the US Legal Forms website. The support gives 1000s of themes, including the Massachusetts Stock Dividend - Resolution Form - Corporate Resolutions, which you can use for company and personal requirements. Every one of the forms are examined by experts and meet state and federal specifications.

When you are already signed up, log in to your profile and click the Obtain option to find the Massachusetts Stock Dividend - Resolution Form - Corporate Resolutions. Make use of profile to look through the authorized forms you might have acquired formerly. Go to the My Forms tab of the profile and get yet another copy of the record you want.

When you are a new end user of US Legal Forms, allow me to share basic recommendations for you to follow:

- Very first, make certain you have selected the proper develop to your metropolis/county. It is possible to examine the shape using the Preview option and look at the shape outline to make certain this is basically the right one for you.

- In the event the develop will not meet your preferences, utilize the Seach industry to discover the proper develop.

- Once you are certain that the shape is acceptable, select the Purchase now option to find the develop.

- Choose the costs strategy you would like and enter in the essential details. Build your profile and pay money for your order utilizing your PayPal profile or credit card.

- Select the document structure and download the authorized record design to your gadget.

- Comprehensive, revise and produce and indication the acquired Massachusetts Stock Dividend - Resolution Form - Corporate Resolutions.

US Legal Forms is definitely the most significant library of authorized forms where you will find numerous record themes. Use the company to download appropriately-manufactured papers that follow express specifications.