A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law. A conditional guaranty contemplates, as a condition to liability on the part of the guarantor, the happening of some contingent event. A guaranty of the payment of a debt is distinguished from a guaranty of the collection of the debt, the former being absolute and the latter conditional.

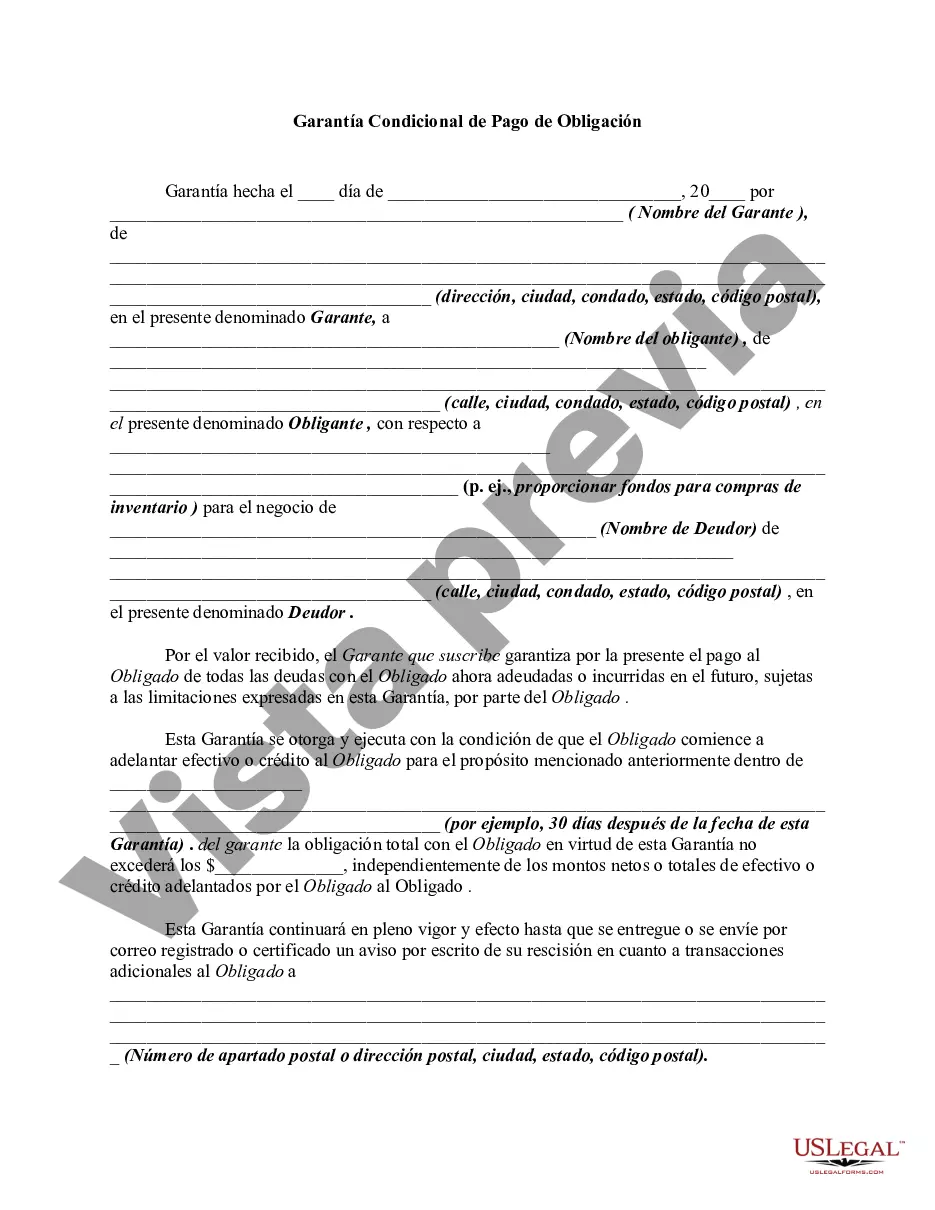

The Massachusetts Conditional Guaranty of Payment of Obligation is a legal document typically used for securing a debt or financial obligation. This guaranty is designed to provide additional assurance to lenders, creditors, or landlords that a third party (known as the guarantor) will be responsible for fulfilling the payment obligations of the principal debtor in case of default. One of the key characteristics of the Massachusetts Conditional Guaranty of Payment of Obligation is that it is contingent upon certain conditions. These conditions may include specific events, actions, or non-actions, which trigger the guarantor's liability. If the debtor fails to meet their payment obligations or breaches the terms of the agreement, the guarantor becomes legally obligated to make payments on behalf of the debtor. Massachusetts recognizes several types of conditional guaranties of payment. Firstly, there is the "Payment Guaranty," which ensures the guarantor's liability for the entire payment obligation of the debtor. This type of guaranty is commonly used in commercial transactions, such as loans, lease agreements, or the purchase of goods and services. Another type is the "Performance Guaranty," where the guarantor guarantees the debtor's performance of specific obligations. This type of guaranty is often utilized in construction contracts when a contractor or subcontractor requires assurance that a supplier or contractor will fulfill their obligations punctually. Additionally, Massachusetts allows for "Payment Guaranty of Collection," where the guarantor guarantees the collection of a debt rather than the actual payment. In this case, if the creditor is unable to collect the debt from the debtor, the guarantor becomes responsible for making the payment. It is important to note that the terms, conditions, and provisions of the Massachusetts Conditional Guaranty of Payment of Obligation may differ depending on the specific agreement and the parties involved. As with any legal document, it is crucial to seek professional advice when dealing with such guaranties to ensure compliance with Massachusetts state law and to protect the rights and interests of all parties involved.The Massachusetts Conditional Guaranty of Payment of Obligation is a legal document typically used for securing a debt or financial obligation. This guaranty is designed to provide additional assurance to lenders, creditors, or landlords that a third party (known as the guarantor) will be responsible for fulfilling the payment obligations of the principal debtor in case of default. One of the key characteristics of the Massachusetts Conditional Guaranty of Payment of Obligation is that it is contingent upon certain conditions. These conditions may include specific events, actions, or non-actions, which trigger the guarantor's liability. If the debtor fails to meet their payment obligations or breaches the terms of the agreement, the guarantor becomes legally obligated to make payments on behalf of the debtor. Massachusetts recognizes several types of conditional guaranties of payment. Firstly, there is the "Payment Guaranty," which ensures the guarantor's liability for the entire payment obligation of the debtor. This type of guaranty is commonly used in commercial transactions, such as loans, lease agreements, or the purchase of goods and services. Another type is the "Performance Guaranty," where the guarantor guarantees the debtor's performance of specific obligations. This type of guaranty is often utilized in construction contracts when a contractor or subcontractor requires assurance that a supplier or contractor will fulfill their obligations punctually. Additionally, Massachusetts allows for "Payment Guaranty of Collection," where the guarantor guarantees the collection of a debt rather than the actual payment. In this case, if the creditor is unable to collect the debt from the debtor, the guarantor becomes responsible for making the payment. It is important to note that the terms, conditions, and provisions of the Massachusetts Conditional Guaranty of Payment of Obligation may differ depending on the specific agreement and the parties involved. As with any legal document, it is crucial to seek professional advice when dealing with such guaranties to ensure compliance with Massachusetts state law and to protect the rights and interests of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.