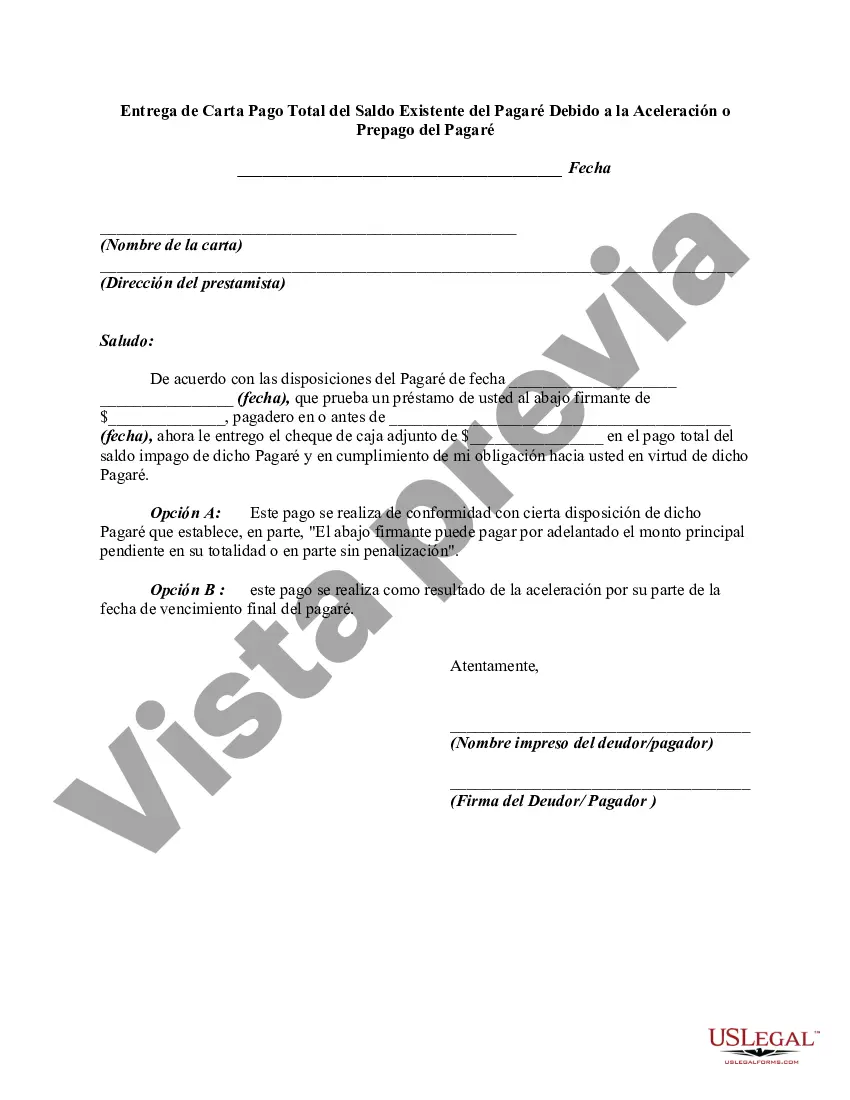

A sample of an acceleration clause in a promissory note would be: "the failure to pay any installment when due shall mature the entire indebtedness at the option of the holder of this Note." A sample of a prepayment clause in a promissory note would be: "the undersigned may prepay the principal amount outstanding in whole or in part without penalty."

Title: Massachusetts Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note Introduction: In Massachusetts, when a borrower wishes to fully repay the outstanding balance of a promissory note before its original maturity date or due to acceleration, it is recommended to send a carefully crafted letter to the lender. This letter serves as official notice of the borrower's intention to tender full payment. Below is a detailed description explaining the necessary contents of such a letter, along with relevant keywords for better understanding. Keywords: Massachusetts, letter, tendering, full payment, existing balance, promissory note, acceleration, prepayment. 1. Proper Heading and Contact Information: The letter should follow a formal business format, including the sender's name, address, phone number, and email address at the top, followed by the recipient's information. 2. Date: Include the current date when writing the letter to establish a timeline. 3. Addressee: Clearly state the full name, title, and address of the lender or loan service. 4. Salutation: Start with an appropriate salutation, such as "Dear Mr./Ms./Dr. [Lender's Last Name]". 5. Reference Details: Mention the specific promissory note being referenced, including the date it was signed, the original loan amount, and the outstanding balance. 6. Declaration of Intent: Clearly state the purpose of the letter and the borrower's intention to tender the full payment. Keywords to include: tendering full payment, repaying the existing balance, early repayment, full settlement, accelerated payment, prepayment. 7. Request for Payoff Amount: Ask the lender to provide the exact amount required for full repayment, considering any additional fees or interest due until the designated date of payment. This demonstrates the borrower's readiness to fulfill their obligations. 8. Payment Method and Date: Specify the preferred method of payment (e.g., certified check, wire transfer) and propose a mutually agreed-upon date for the final payment. Offer flexibility, if possible, to accommodate both parties' schedules. 9. Request for Confirmation: Ask the lender to send a written acknowledgment of the payoff request, including an itemized payoff statement that reflects the updated balance upon receipt of the tendered funds. This confirmation ensures a complete record of the satisfying transaction. 10. Contact Information: Reiterate the borrower's contact details, encouraging the lender to reach out if any further information or clarification is needed. 11. Gratitude: Express appreciation to the lender for their cooperation and the opportunity to fulfill the financial obligation ahead of schedule. 12. Closing: End the letter with a professional closing phrase such as "Sincerely" or "Best regards," followed by the borrower's signature. Consider attaching a copy of the original promissory note and any supporting documents when sending the letter. Types of Massachusetts Letters Tendering Full Payment: 1. Massachusetts Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration: This type of letter is used when the borrower has been notified of a lender's intention to accelerate the promissory note due to missed payments or other contractual breaches. 2. Massachusetts Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Prepayment: This type of letter is used when the borrower voluntarily decides to prepay the outstanding balance of the promissory note before its scheduled maturity date, without any acceleration. Note: It is advisable to consult an attorney or legal professional to ensure compliance with Massachusetts laws and regulations while drafting and sending such letters.Title: Massachusetts Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration or Prepayment of Note Introduction: In Massachusetts, when a borrower wishes to fully repay the outstanding balance of a promissory note before its original maturity date or due to acceleration, it is recommended to send a carefully crafted letter to the lender. This letter serves as official notice of the borrower's intention to tender full payment. Below is a detailed description explaining the necessary contents of such a letter, along with relevant keywords for better understanding. Keywords: Massachusetts, letter, tendering, full payment, existing balance, promissory note, acceleration, prepayment. 1. Proper Heading and Contact Information: The letter should follow a formal business format, including the sender's name, address, phone number, and email address at the top, followed by the recipient's information. 2. Date: Include the current date when writing the letter to establish a timeline. 3. Addressee: Clearly state the full name, title, and address of the lender or loan service. 4. Salutation: Start with an appropriate salutation, such as "Dear Mr./Ms./Dr. [Lender's Last Name]". 5. Reference Details: Mention the specific promissory note being referenced, including the date it was signed, the original loan amount, and the outstanding balance. 6. Declaration of Intent: Clearly state the purpose of the letter and the borrower's intention to tender the full payment. Keywords to include: tendering full payment, repaying the existing balance, early repayment, full settlement, accelerated payment, prepayment. 7. Request for Payoff Amount: Ask the lender to provide the exact amount required for full repayment, considering any additional fees or interest due until the designated date of payment. This demonstrates the borrower's readiness to fulfill their obligations. 8. Payment Method and Date: Specify the preferred method of payment (e.g., certified check, wire transfer) and propose a mutually agreed-upon date for the final payment. Offer flexibility, if possible, to accommodate both parties' schedules. 9. Request for Confirmation: Ask the lender to send a written acknowledgment of the payoff request, including an itemized payoff statement that reflects the updated balance upon receipt of the tendered funds. This confirmation ensures a complete record of the satisfying transaction. 10. Contact Information: Reiterate the borrower's contact details, encouraging the lender to reach out if any further information or clarification is needed. 11. Gratitude: Express appreciation to the lender for their cooperation and the opportunity to fulfill the financial obligation ahead of schedule. 12. Closing: End the letter with a professional closing phrase such as "Sincerely" or "Best regards," followed by the borrower's signature. Consider attaching a copy of the original promissory note and any supporting documents when sending the letter. Types of Massachusetts Letters Tendering Full Payment: 1. Massachusetts Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Acceleration: This type of letter is used when the borrower has been notified of a lender's intention to accelerate the promissory note due to missed payments or other contractual breaches. 2. Massachusetts Letter Tendering Full Payment of Existing Balance of Promissory Note Due to Prepayment: This type of letter is used when the borrower voluntarily decides to prepay the outstanding balance of the promissory note before its scheduled maturity date, without any acceleration. Note: It is advisable to consult an attorney or legal professional to ensure compliance with Massachusetts laws and regulations while drafting and sending such letters.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.