An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

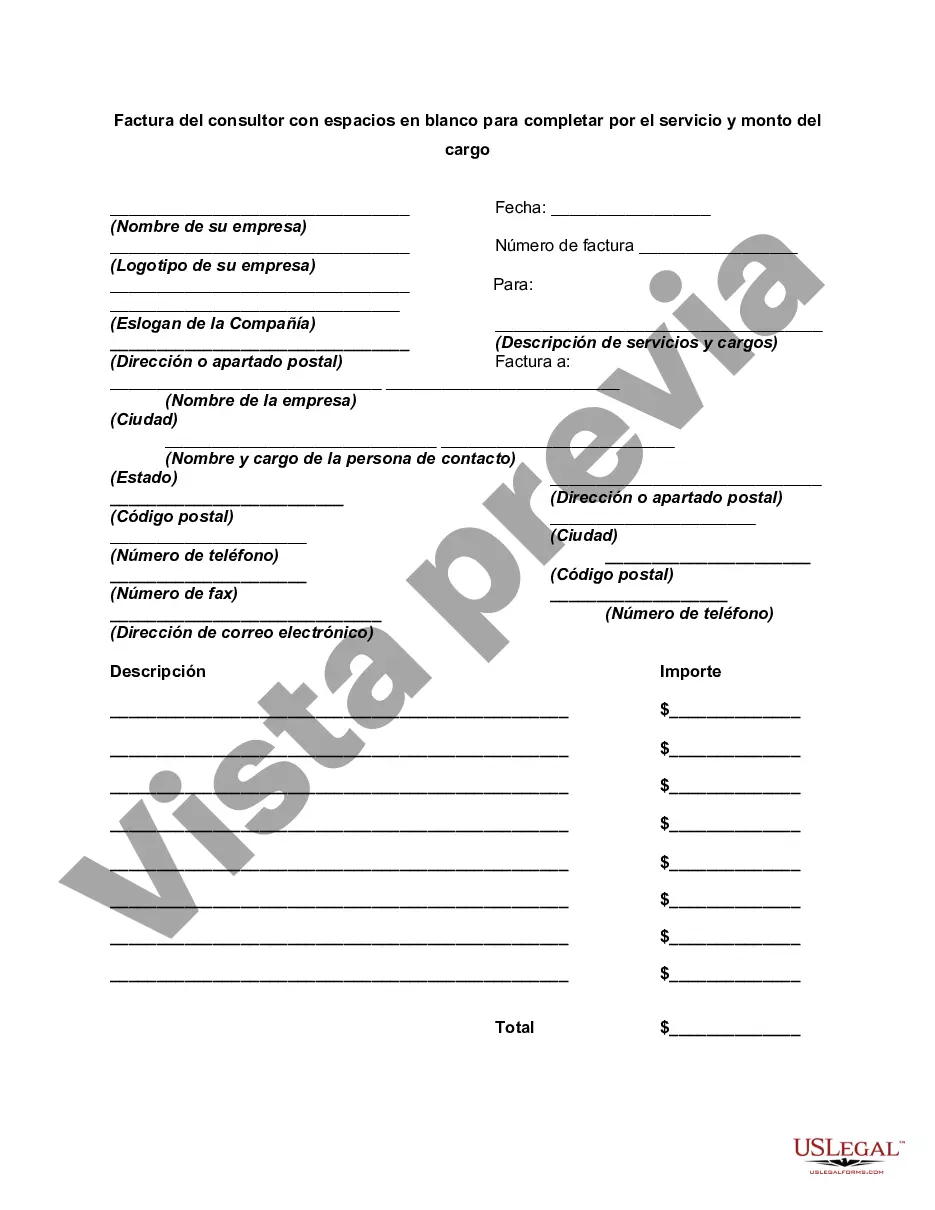

Title: Massachusetts Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge Introduction: The Massachusetts Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge is a legal document used by consultants to bill clients for the services rendered. This detailed description showcases the components of the invoice and its variations, providing key insights into its importance. Key Elements of a Massachusetts Invoice of Consultant: 1. Header Section: Within this section, the invoice should include the consultant's name, address, phone number, email, and the date of issuance. Additionally, it is advisable to mention the client's information, including their name, address, and contact information. 2. Invoice Number and Date: Each invoice should feature a unique invoice number and the corresponding date of issue. These details help in maintaining records and referencing for future correspondence. 3. Description of Services Provided: A section should exist for detailing the services or goods provided by the consultant. The description must be concise, clear, and specific, outlining the nature of the service or itemized goods. 4. Date(s) and Duration of Service: Specify the date(s) on which the services were rendered, along with the duration or number of hours devoted to each task. This information verifies the actual duration of work completed and aids in resolving any discrepancies. 5. Rate, Quantity, and Total Amount: The invoice must provide the rate of the consultant's services per hour, per item, or any other unit of measurement. Multiply the rate by the quantity or the number of hours to calculate the subtotal for each service or item line. Finally, sum up all the service/item subtotals to derive the total amount due. 6. Additional Charges and Expenses: If any additional charges or expenses were incurred during the provision of services, such as travel fees, material costs, or subcontractor fees, these should be listed separately along with their respective amounts. 7. Payment Terms and Methods: Specify the payment terms, including the due date, preferred payment method(s), and any late-payment penalties or discounts for early payments. This ensures both parties are aware of the agreed-upon terms and helps maintain a transparent financial relationship. 8. Tax Information: Include the applicable tax rate/percentage and indicate whether the amount provided is inclusive or exclusive of taxes. This will vary depending on the specific taxation rules in Massachusetts. Types of Massachusetts Invoice of Consultant: 1. Time-Based Invoice: This type of invoice is commonly used when consultants charge an hourly or parodies rate. It involves documenting the number of hours worked or days spent on a project, along with the corresponding charges for each. 2. Project-Based Invoice: For consultants who provide services on a project basis, this invoice type combines a fixed fee for the project with itemized costs if any additional expenses were incurred. 3. Retainer Invoice: In cases where consultants work under a retainer agreement, an invoice can be generated and sent to the client based on the agreed-upon retainer amount. This invoice typically reflects prenegotiated billing terms, such as monthly or quarterly retainers. Conclusion: The Massachusetts Invoice of Consultant with Blanks to be Filled in for Service and Amount of Charge serves as a crucial tool for consultants to bill their clients accurately and professionally. By incorporating the aforementioned sections and adhering to Massachusetts tax regulations, consultants can ensure compliance and maintain a transparent and efficient invoicing process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.