Title: Massachusetts Sample Letter for Compromise on a Debt: A Comprehensive Guide Introduction: Compromise on a debt is an arrangement where both the debtor and the creditor agree to settle the debt for a reduced amount. In Massachusetts, individuals struggling with overwhelming debt can benefit from using a sample letter for compromise. This article will provide a detailed description of what a Massachusetts Sample Letter for Compromise on a Debt is, along with its significance and potential benefits. Key Points: 1. Understanding Debt Compromise in Massachusetts: Debt compromise, also known as debt settlement, enables individuals to negotiate a reduced payment with their creditors. This process allows debtors to avoid bankruptcy, reduce financial burden, and establish a realistic payment plan. 2. Importance of a Sample Letter for Compromise: Using a Massachusetts sample letter for compromise on a debt can help debtors effectively communicate their intentions with creditors. It serves as a formal, written request to initiate negotiations and outlines the debtor's financial hardships, proposed settlement amount, and repayment terms. 3. Components of Massachusetts Sample Letter for Compromise on a Debt: • Contact Information: Provide personal details, including name, address, phone number, and email. • Creditor Information: Include the creditor's name, address, phone number, and any relevant account numbers. • Explanation of Financial Hardship: Briefly explain the circumstances leading to financial hardship, such as job loss, medical emergency, or divorce. • Proposed Settlement Amount: Suggest an affordable lump sum or installment plan to resolve the debt. Consider including any assets, if applicable. • Repayment Terms: Outline how you plan to repay the compromised debt, whether through monthly payments, a lump sum within a specific period, or another feasible option. • Formal Closing: Conclude the letter by thanking the creditor for their consideration and providing your signature. 4. Types of Massachusetts Sample Letters for Compromise on a Debt: • Personal Debt: Pertains to individuals facing financial distress in paying off personal loans, credit card debts, medical bills, or other unsecured debts. • Business Debt: Relates to business owners or entrepreneurs struggling with outstanding debts owed to vendors, suppliers, or lenders. 5. Key Benefits of Using a Massachusetts Sample Letter for Compromise on a Debt: • Professional Approach: The sample letter provides a structured format, ensuring a professional and respectful tone throughout the negotiation process. • Enhanced Communication: A written document improves communication between debtors and creditors, ensuring both parties clearly understand the proposed settlement terms. • Increased Negotiating Power: Presenting a well-crafted letter increases the chances of creditors considering the proposed compromise, acknowledging the debtor's efforts to resolve the issue. Conclusion: A Massachusetts Sample Letter for Compromise on a Debt is an invaluable tool for individuals and businesses seeking to negotiate a reduced settlement with creditors. By effectively conveying financial hardship, proposing a reasonable settlement amount, and suggesting repayment terms, using this letter can maximize the chances of obtaining a favorable debt compromise. Remember that seeking professional advice from a debt counselor or attorney is advisable to ensure a smooth negotiation process and protect your rights.

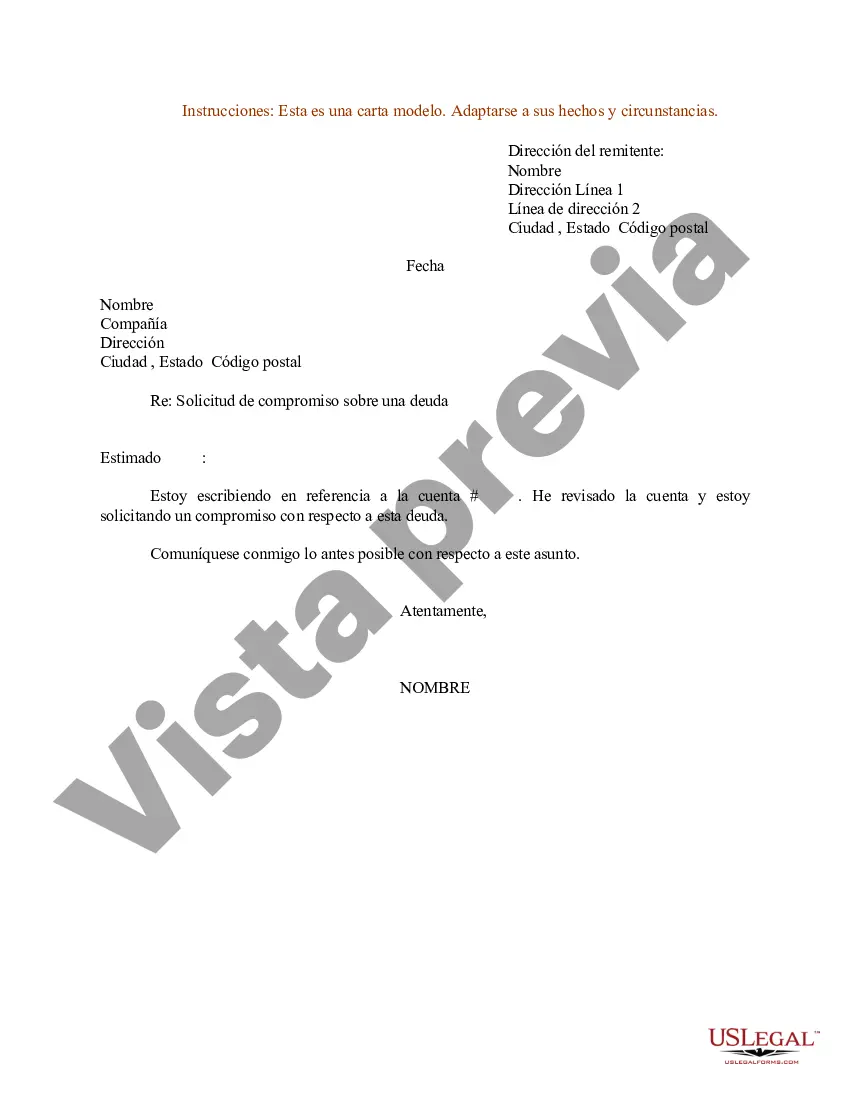

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Ejemplo de carta de compromiso sobre una deuda - Sample Letter for Compromise on a Debt

Description

How to fill out Massachusetts Ejemplo De Carta De Compromiso Sobre Una Deuda?

You may devote several hours on the web looking for the legitimate papers template which fits the federal and state demands you require. US Legal Forms offers a huge number of legitimate kinds which can be reviewed by pros. You can easily obtain or print the Massachusetts Sample Letter for Compromise on a Debt from your assistance.

If you currently have a US Legal Forms profile, you can log in and then click the Acquire option. Following that, you can comprehensive, modify, print, or signal the Massachusetts Sample Letter for Compromise on a Debt. Each and every legitimate papers template you buy is yours eternally. To have one more backup of any obtained kind, visit the My Forms tab and then click the corresponding option.

If you use the US Legal Forms site initially, stick to the straightforward directions under:

- First, make sure that you have chosen the proper papers template to the region/area of your choice. Look at the kind explanation to ensure you have chosen the correct kind. If available, take advantage of the Review option to appear with the papers template also.

- In order to discover one more edition of the kind, take advantage of the Search discipline to find the template that suits you and demands.

- Once you have found the template you want, just click Buy now to move forward.

- Find the rates plan you want, key in your qualifications, and register for a merchant account on US Legal Forms.

- Comprehensive the deal. You can utilize your charge card or PayPal profile to pay for the legitimate kind.

- Find the format of the papers and obtain it to your product.

- Make alterations to your papers if required. You may comprehensive, modify and signal and print Massachusetts Sample Letter for Compromise on a Debt.

Acquire and print a huge number of papers web templates while using US Legal Forms Internet site, that offers the most important assortment of legitimate kinds. Use specialist and state-specific web templates to tackle your organization or person demands.