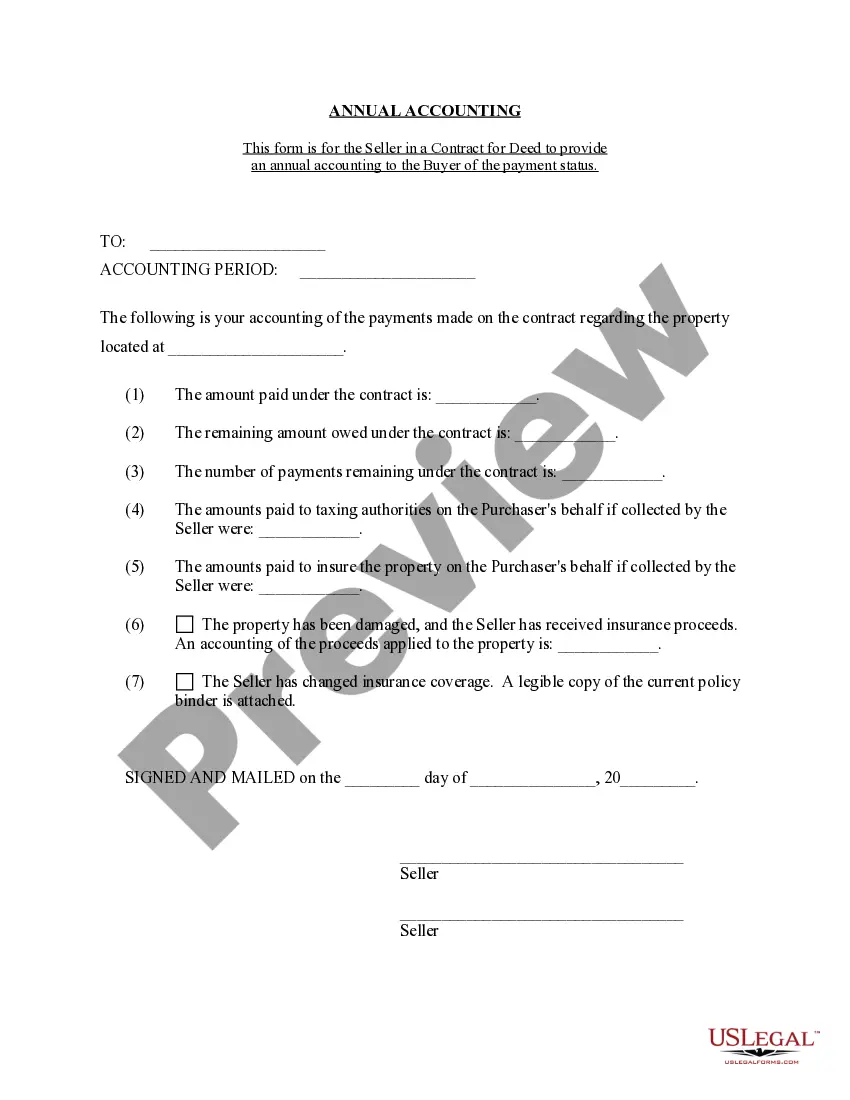

A disclaimer is a denial or renunciation of something. A disclaimer may be the act of a party by which be refuses to accept of an estate which has been conveyed to him. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Massachusetts Disclaimer by Beneficiary of all Rights in Trust

Description

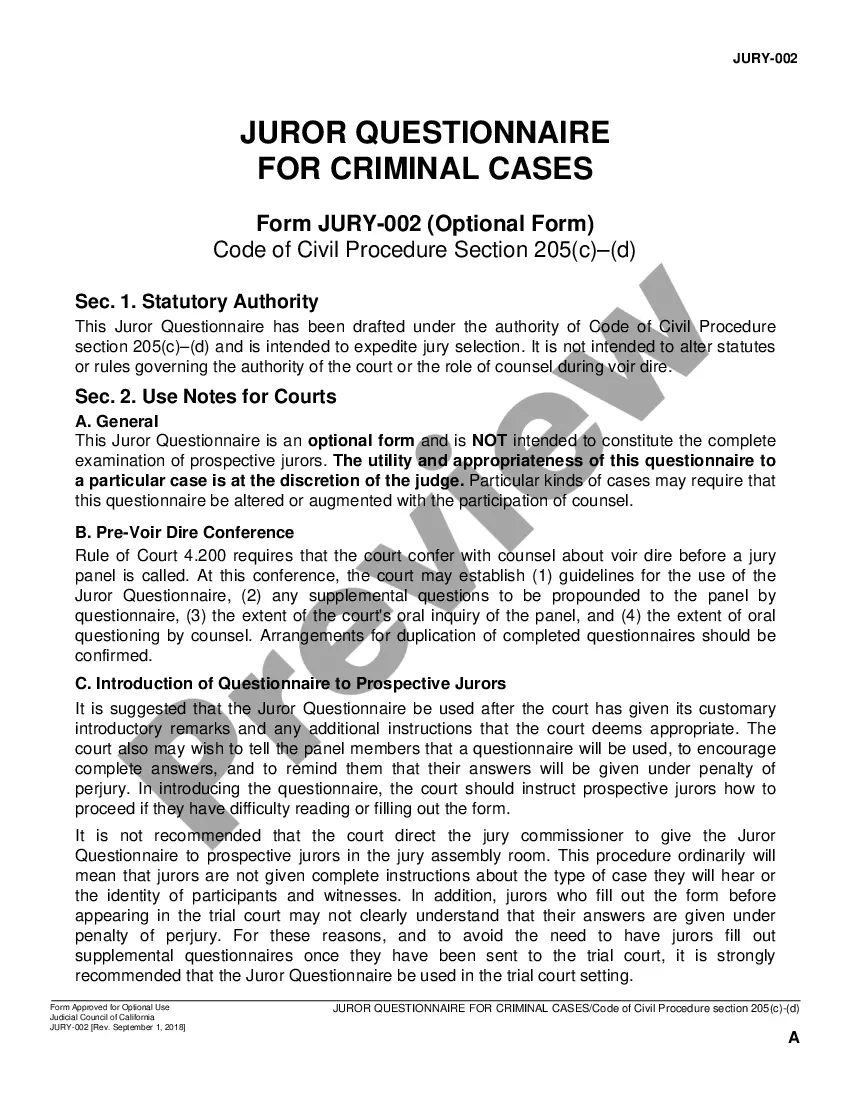

How to fill out Disclaimer By Beneficiary Of All Rights In Trust?

Have you found yourself in a scenario where documentation for both business or personal motives is required almost constantly.

There are numerous legal document samples available online, yet finding ones you can depend on is challenging.

US Legal Forms offers thousands of form templates, including the Massachusetts Disclaimer by Beneficiary of all Rights in Trust, which can be tailored to meet state and federal requirements.

Once you find the correct form, click Buy now.

Choose the payment plan you want, enter the necessary details for payment, and finalize your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts Disclaimer by Beneficiary of all Rights in Trust template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/region.

- Use the Preview button to review the form.

- Examine the details to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search field to find the form that suits you and your specifications.

Form popularity

FAQ

If a trustee breaches their duties, beneficiaries have several rights to seek remediation. They can demand an accounting, request removal of the trustee, or even pursue damages in court. Such actions help ensure that trustees fulfill their responsibilities and act fairly towards beneficiaries. Understanding concepts like the Massachusetts Disclaimer by Beneficiary of all Rights in Trust can help beneficiaries navigate these processes more effectively.

The power dynamics between a trustee and a beneficiary can vary depending on the specific circumstances of the trust. Generally, the trustee holds more authority in managing the trust assets, but beneficiaries have significant rights and can challenge the trustee's decisions if necessary. Understanding your position can empower you to take action when needed. Knowledge of the Massachusetts Disclaimer by Beneficiary of all Rights in Trust can further strengthen a beneficiary's stance.

A beneficiary holds important rights over a trustee, including the right to receive information about the trust and access to its financial records. Beneficiaries also have the right to ensure that trustees act in the best interests of the trust. If the trustee fails in their duties, beneficiaries can seek remedies under the law. Familiarity with your rights, including the Massachusetts Disclaimer by Beneficiary of all Rights in Trust, is crucial for effective advocacy.

When a trustee violates the trust, it can lead to serious consequences. Beneficiaries may pursue legal action to hold the trustee accountable for their actions. Such violations may include mismanagement of assets or failure to distribute funds as outlined in the trust. In these situations, understanding the Massachusetts Disclaimer by Beneficiary of all Rights in Trust is essential for protecting your interests.

Yes, beneficiaries in Massachusetts have the right to see the trust documents. This access allows them to understand their rights and the terms governing the trust. Transparency is essential for beneficiaries to make informed decisions about their entitlements and potential disclaimers. Familiarizing oneself with the Massachusetts Disclaimer by Beneficiary of all Rights in Trust can facilitate this process and ensure compliance with legal standards.

A Disclaimer trust may present several disadvantages worth considering. Beneficiaries may lose tax benefits associated with the property, or they may inadvertently create family tension by refusing an inheritance. Additionally, once a disclaimer is executed, making changes can be difficult. Therefore, understanding the implications of a Massachusetts Disclaimer by Beneficiary of all Rights in Trust is crucial before making any decisions.

A Disclaimer by beneficiary of trust is a legal document that allows beneficiaries to refuse assets designated to them. This declaration must meet certain legal standards to be valid under Massachusetts law, clearly stating the intent to disclaim particular assets. This action can help in preventing tax liabilities or family disputes. The Massachusetts Disclaimer by Beneficiary of all Rights in Trust serves as a guide for those considering this important decision.

A disclaimer by a beneficiary of a trust is a formal refusal to accept all or part of the trust property. This process is executed to relinquish rights without affecting future inheritances or tax obligations. Understanding the Massachusetts Disclaimer by Beneficiary of all Rights in Trust helps beneficiaries assess when this option is appropriate and how to proceed correctly. Consulting with legal resources can assist in making informed decisions.

In Massachusetts, a trustee is required to notify beneficiaries within a reasonable time frame after the trust becomes irrevocable. This timeframe typically falls around 30 days, allowing beneficiaries to understand their rights and responsibilities. Timely notifications are crucial for beneficiaries to make informed decisions about disclaiming property or taking other actions. Utilizing resources about the Massachusetts Disclaimer by Beneficiary of all Rights in Trust can clarify these expectations.

A beneficiary may choose to disclaim property for several reasons. They might want to avoid tax implications or protect their eligibility for government benefits. Additionally, disallowing a specific inheritance can simplify financial matters and help maintain family harmony. Understanding the Massachusetts Disclaimer by Beneficiary of all Rights in Trust is essential to navigate this process effectively.