As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

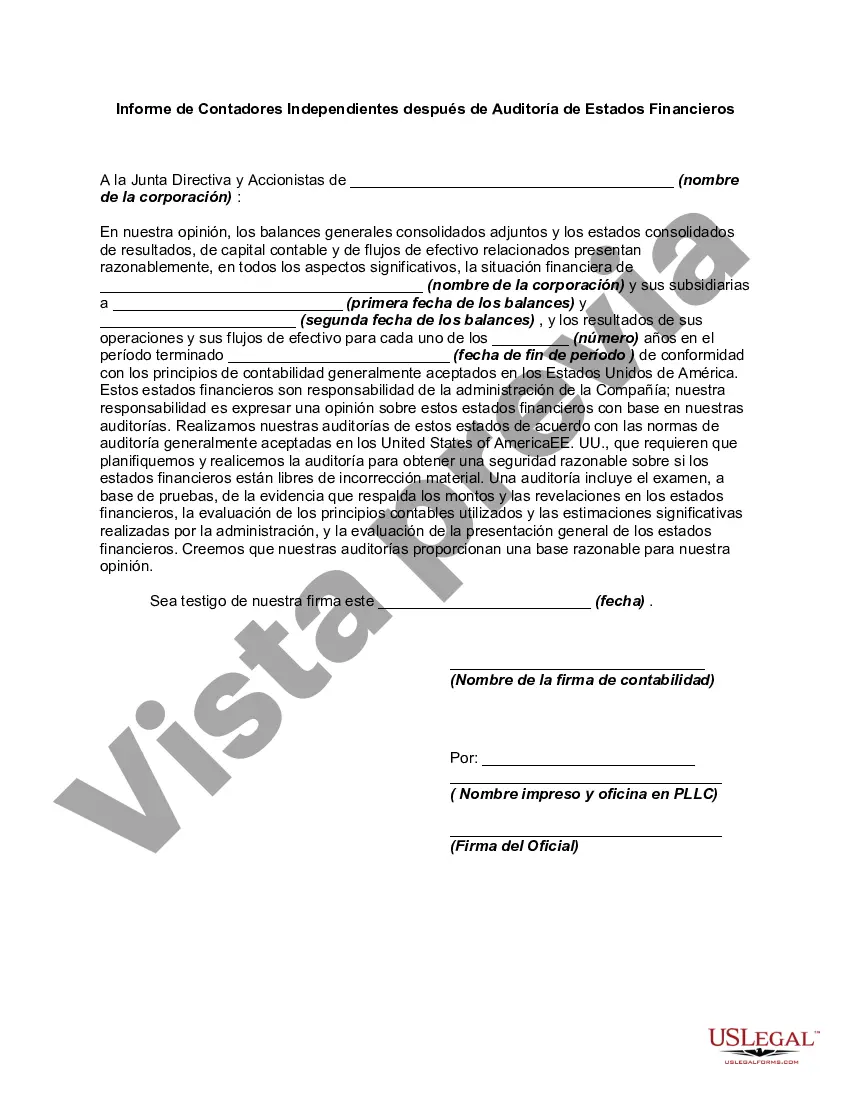

The Massachusetts Report of Independent Accountants after Audit of Financial Statements serves as a comprehensive evaluation of an organization's financial records conducted by an independent accounting firm. This report is crucial for providing transparency, ensuring accuracy, and maintaining the integrity of financial statements. As a vital aspect of financial reporting, the Massachusetts Report of Independent Accountants plays a significant role in regulatory compliance, risk management, and decision-making processes. Keywords: Massachusetts, Report of Independent Accountants, Audit, Financial Statements, evaluation, transparency, accuracy, integrity, financial reporting, regulatory compliance, risk management, decision-making. Different types of Massachusetts Reports of Independent Accountants after Audit of Financial Statements include: 1. Unqualified Opinion: This type of report is issued when the independent accountants conclude that the organization's financial statements are presented fairly, in all material aspects, in accordance with the applicable accounting standards. An unqualified opinion gives the highest level of assurance and demonstrates the organization's financial health. 2. Qualified Opinion: This report is provided when the accountants determine that there is a particular issue affecting the financial statements that require attention. While most of the financial statements are presented fairly, the qualified opinion highlights a specific aspect that may impact the users' understanding of the organization's financial position. 3. Adverse Opinion: An adverse opinion is given when the auditors discover significant discrepancies or material misstatements that greatly impact the financial statements' overall fairness. This type of report suggests that the financial statements do not reflect the organization's true financial position or performance adequately. 4. Disclaimer of Opinion: A disclaimer of opinion is issued when the auditors are unable to obtain sufficient appropriate evidence to express an opinion on the financial statements. This may occur due to constraints imposed by the organization or limitations in the audit process. A disclaimer of opinion does not necessarily imply that the financial statements are inaccurate; rather, it emphasizes that the auditors were unable to provide an opinion. In conclusion, the Massachusetts Report of Independent Accountants after Audit of Financial Statements is a crucial document that ensures the accuracy, transparency, and integrity of an organization's financial records. The report can take various forms, including unqualified opinions, qualified opinions, adverse opinions, or disclaimers of opinions, depending on the auditors' findings and assessment.The Massachusetts Report of Independent Accountants after Audit of Financial Statements serves as a comprehensive evaluation of an organization's financial records conducted by an independent accounting firm. This report is crucial for providing transparency, ensuring accuracy, and maintaining the integrity of financial statements. As a vital aspect of financial reporting, the Massachusetts Report of Independent Accountants plays a significant role in regulatory compliance, risk management, and decision-making processes. Keywords: Massachusetts, Report of Independent Accountants, Audit, Financial Statements, evaluation, transparency, accuracy, integrity, financial reporting, regulatory compliance, risk management, decision-making. Different types of Massachusetts Reports of Independent Accountants after Audit of Financial Statements include: 1. Unqualified Opinion: This type of report is issued when the independent accountants conclude that the organization's financial statements are presented fairly, in all material aspects, in accordance with the applicable accounting standards. An unqualified opinion gives the highest level of assurance and demonstrates the organization's financial health. 2. Qualified Opinion: This report is provided when the accountants determine that there is a particular issue affecting the financial statements that require attention. While most of the financial statements are presented fairly, the qualified opinion highlights a specific aspect that may impact the users' understanding of the organization's financial position. 3. Adverse Opinion: An adverse opinion is given when the auditors discover significant discrepancies or material misstatements that greatly impact the financial statements' overall fairness. This type of report suggests that the financial statements do not reflect the organization's true financial position or performance adequately. 4. Disclaimer of Opinion: A disclaimer of opinion is issued when the auditors are unable to obtain sufficient appropriate evidence to express an opinion on the financial statements. This may occur due to constraints imposed by the organization or limitations in the audit process. A disclaimer of opinion does not necessarily imply that the financial statements are inaccurate; rather, it emphasizes that the auditors were unable to provide an opinion. In conclusion, the Massachusetts Report of Independent Accountants after Audit of Financial Statements is a crucial document that ensures the accuracy, transparency, and integrity of an organization's financial records. The report can take various forms, including unqualified opinions, qualified opinions, adverse opinions, or disclaimers of opinions, depending on the auditors' findings and assessment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.