In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

The Massachusetts Report from Review of Financial Statements and Compilation by an Accounting Firm is an essential document used in the financial auditing and reporting process. It provides a detailed analysis and assessment of a company's financial statements, ensuring accuracy, compliance, and transparent accounting practices. This report serves as a tool for stakeholders, including investors, creditors, and regulatory agencies, to evaluate the financial health and performance of an organization. There are several types of Massachusetts Reports from Review of Financial Statements and Compilation by an Accounting Firm, namely: 1. Compilation Report: This report is generated after a compilation engagement, where the accounting firm assists the company in preparing financial statements without providing any assurance or verification of the accuracy of the information presented. It states that the financial statements have been compiled in accordance with the applicable accounting frameworks. 2. Review Report: Following a review engagement, the accounting firm provides limited assurance on the financial statements, expressing their opinion whether any material modifications are required for the financial statements to be presented fairly in accordance with the applicable accounting standards. This report is less extensive than an audit report but still provides users with a level of confidence in the financial information. 3. Audit Report: The most comprehensive type of report, the audit report is generated after an external audit is conducted. It provides reasonable assurance on the fair presentation of financial statements and confirms whether they comply with the relevant accounting framework (e.g., Generally Accepted Accounting Principles — GAAP). The audit report also includes comments on internal controls, risk management, and other relevant financial processes. The Massachusetts Report from Review of Financial Statements and Compilation by an Accounting Firm follows the guidelines set by the Massachusetts Board of Accountancy. This regulatory body ensures that accounting firms operating in the state adhere to professional standards and provide accurate, reliable financial information to the stakeholders. It is crucial for businesses in Massachusetts to obtain such reports to maintain credibility, facilitate decision-making processes, and address compliance requirements. By engaging accounting firms to conduct reviews, compilations, or audits and obtaining the corresponding Massachusetts Report from Review of Financial Statements and Compilation, companies can demonstrate a commitment to financial transparency and accountability while meeting legal requirements. This report serves as a significant tool for organizations to assess their financial standing, identify areas for improvement, and build trust with their stakeholders.The Massachusetts Report from Review of Financial Statements and Compilation by an Accounting Firm is an essential document used in the financial auditing and reporting process. It provides a detailed analysis and assessment of a company's financial statements, ensuring accuracy, compliance, and transparent accounting practices. This report serves as a tool for stakeholders, including investors, creditors, and regulatory agencies, to evaluate the financial health and performance of an organization. There are several types of Massachusetts Reports from Review of Financial Statements and Compilation by an Accounting Firm, namely: 1. Compilation Report: This report is generated after a compilation engagement, where the accounting firm assists the company in preparing financial statements without providing any assurance or verification of the accuracy of the information presented. It states that the financial statements have been compiled in accordance with the applicable accounting frameworks. 2. Review Report: Following a review engagement, the accounting firm provides limited assurance on the financial statements, expressing their opinion whether any material modifications are required for the financial statements to be presented fairly in accordance with the applicable accounting standards. This report is less extensive than an audit report but still provides users with a level of confidence in the financial information. 3. Audit Report: The most comprehensive type of report, the audit report is generated after an external audit is conducted. It provides reasonable assurance on the fair presentation of financial statements and confirms whether they comply with the relevant accounting framework (e.g., Generally Accepted Accounting Principles — GAAP). The audit report also includes comments on internal controls, risk management, and other relevant financial processes. The Massachusetts Report from Review of Financial Statements and Compilation by an Accounting Firm follows the guidelines set by the Massachusetts Board of Accountancy. This regulatory body ensures that accounting firms operating in the state adhere to professional standards and provide accurate, reliable financial information to the stakeholders. It is crucial for businesses in Massachusetts to obtain such reports to maintain credibility, facilitate decision-making processes, and address compliance requirements. By engaging accounting firms to conduct reviews, compilations, or audits and obtaining the corresponding Massachusetts Report from Review of Financial Statements and Compilation, companies can demonstrate a commitment to financial transparency and accountability while meeting legal requirements. This report serves as a significant tool for organizations to assess their financial standing, identify areas for improvement, and build trust with their stakeholders.

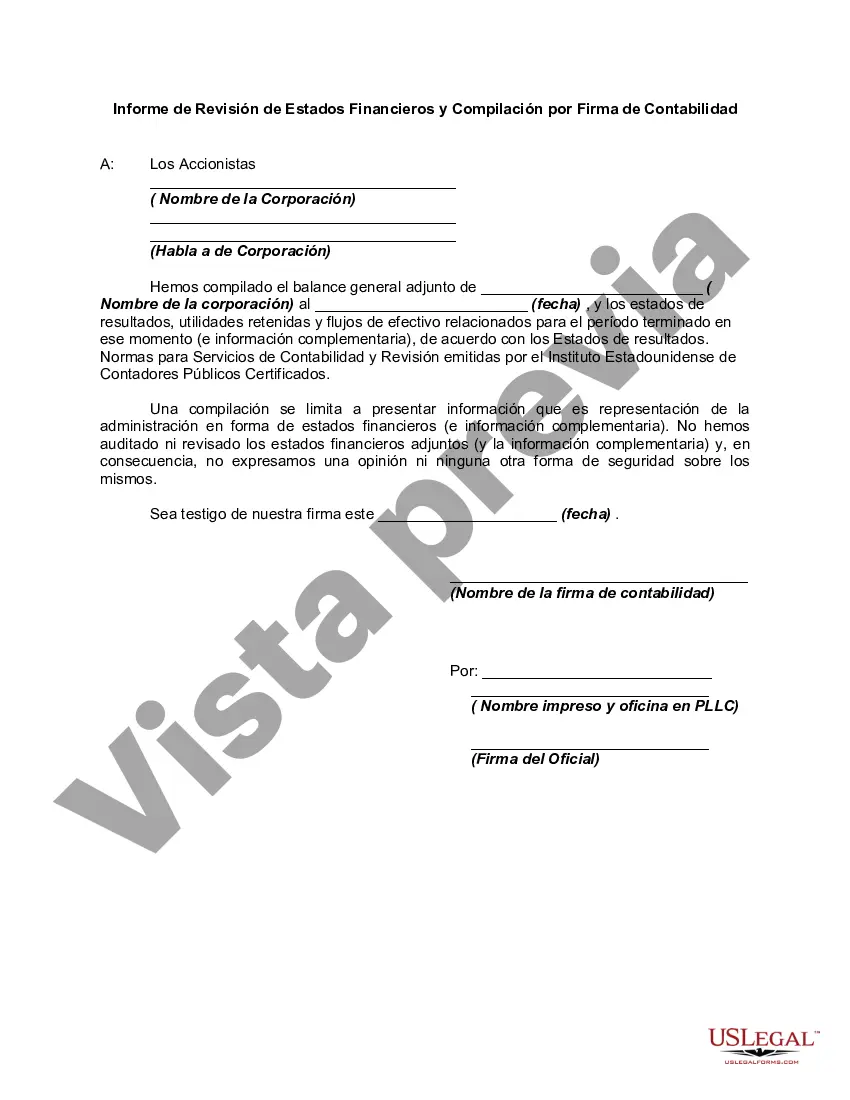

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.