A financial hardship resulting in a need for such an affidavit such as this form can be defined as a material change in the financial situation of a person that is or will affect their ability to pay their debts. Many things can cause a hardship such as a payment Increase on your mortgage note, loss of your job, business failure, damage to property, death of a spouse or other family member, severe illness, divorce, medical bills, or just accruing too much debt.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

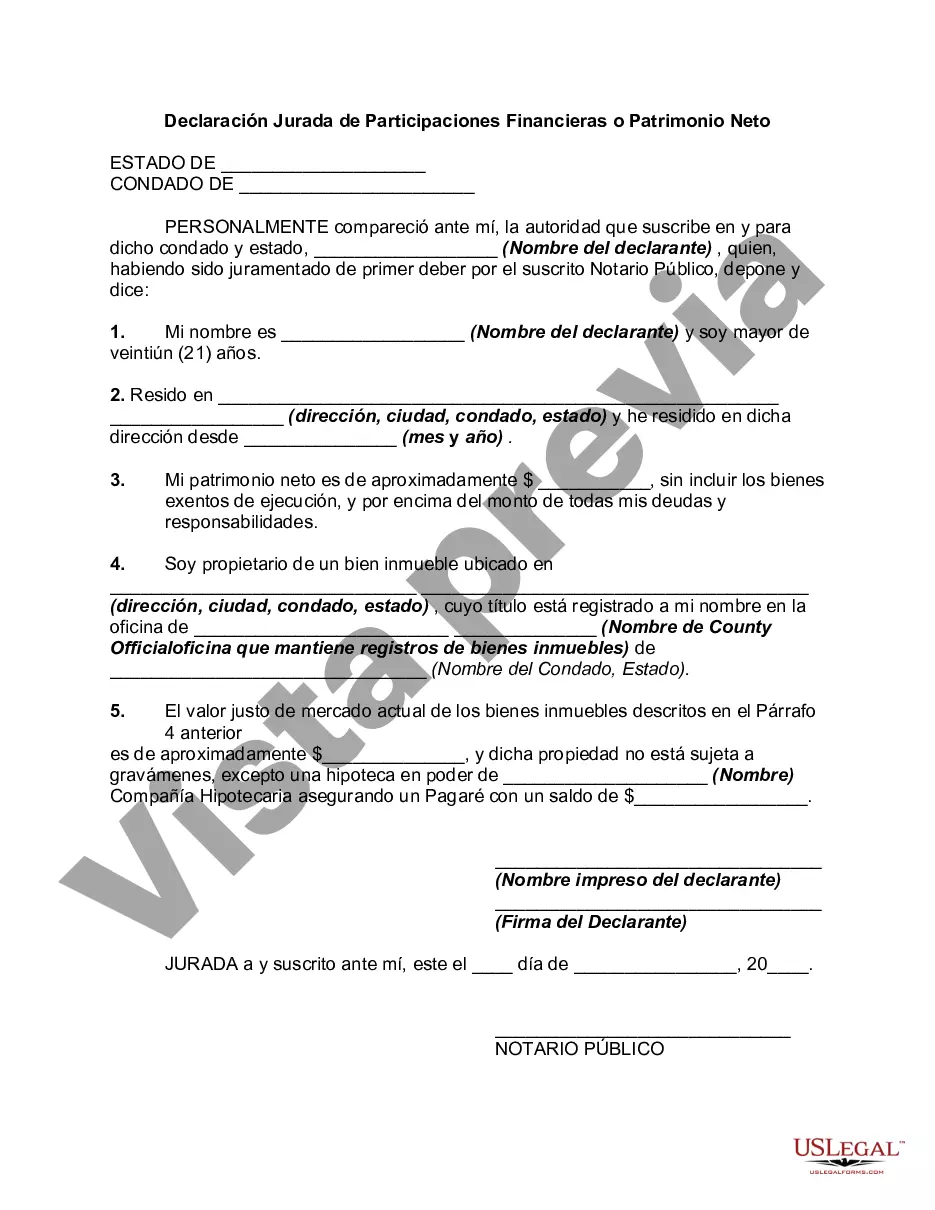

The Massachusetts Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a legal document used to disclose an individual's financial standing and verify their net worth. This affidavit is commonly required in various legal proceedings, such as divorce cases, child custody battles, or when applying for certain licenses or permits. Keywords associated with this document include Massachusetts, affidavit, financial holdings, net worth, assets, liabilities, and legal disclosures. The Massachusetts Affidavit of Financial Holdings or Net Worth — Assets and Liabilities consists of several sections that gather comprehensive information about an individual's financial situation. These sections include: 1. Personal Information: This section collects basic personal details, such as the individual's full name, address, phone number, and social security number, to ensure accurate identification. 2. Income: Here, the individual is required to list all sources of income, including salaries, wages, bonuses, rental income, investments, and any other income-generating activities. 3. Assets: This section aims to collect information about the individual's assets, both tangible and intangible. It includes details about real estate properties, vehicles, investments (stocks, bonds, mutual funds), bank accounts, retirement savings (IRA, 401(k)), valuable possessions (jewelry, artwork), and any other significant assets. 4. Liabilities: In this section, the individual must disclose any outstanding debts or financial obligations. This includes mortgages, car loans, student loans, credit card debt, taxes owed, alimony or child support payments, and any other liabilities. 5. Monthly Expenses: Here, the individual provides an overview of monthly expenses, such as rent or mortgage payments, utility bills, insurance premiums, groceries, transportation costs, education expenses, and any other regular monthly expenditures. 6. Contingent Liabilities: This section addresses any potential liabilities that may arise in the future, such as pending lawsuits, anticipated inheritances, or financial guarantees given to others. It is important to note that different types of Massachusetts Affidavits of Financial Holdings or Net Worth — Assets and Liabilities may exist, often tailored to specific legal requirements or purposes. For example, in divorce cases, there may be separate affidavits for each spouse, allowing for a comprehensive understanding of both parties' financial positions. Additionally, certain licenses or permits may require a specialized affidavit focusing on specific financial information relevant to that particular application. In summary, the Massachusetts Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a crucial legal document utilized in various circumstances to assess an individual's financial status. It requires complete disclosure of assets, liabilities, income, and expenses, aiding in fair decision-making during legal proceedings.The Massachusetts Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a legal document used to disclose an individual's financial standing and verify their net worth. This affidavit is commonly required in various legal proceedings, such as divorce cases, child custody battles, or when applying for certain licenses or permits. Keywords associated with this document include Massachusetts, affidavit, financial holdings, net worth, assets, liabilities, and legal disclosures. The Massachusetts Affidavit of Financial Holdings or Net Worth — Assets and Liabilities consists of several sections that gather comprehensive information about an individual's financial situation. These sections include: 1. Personal Information: This section collects basic personal details, such as the individual's full name, address, phone number, and social security number, to ensure accurate identification. 2. Income: Here, the individual is required to list all sources of income, including salaries, wages, bonuses, rental income, investments, and any other income-generating activities. 3. Assets: This section aims to collect information about the individual's assets, both tangible and intangible. It includes details about real estate properties, vehicles, investments (stocks, bonds, mutual funds), bank accounts, retirement savings (IRA, 401(k)), valuable possessions (jewelry, artwork), and any other significant assets. 4. Liabilities: In this section, the individual must disclose any outstanding debts or financial obligations. This includes mortgages, car loans, student loans, credit card debt, taxes owed, alimony or child support payments, and any other liabilities. 5. Monthly Expenses: Here, the individual provides an overview of monthly expenses, such as rent or mortgage payments, utility bills, insurance premiums, groceries, transportation costs, education expenses, and any other regular monthly expenditures. 6. Contingent Liabilities: This section addresses any potential liabilities that may arise in the future, such as pending lawsuits, anticipated inheritances, or financial guarantees given to others. It is important to note that different types of Massachusetts Affidavits of Financial Holdings or Net Worth — Assets and Liabilities may exist, often tailored to specific legal requirements or purposes. For example, in divorce cases, there may be separate affidavits for each spouse, allowing for a comprehensive understanding of both parties' financial positions. Additionally, certain licenses or permits may require a specialized affidavit focusing on specific financial information relevant to that particular application. In summary, the Massachusetts Affidavit of Financial Holdings or Net Worth — Assets and Liabilities is a crucial legal document utilized in various circumstances to assess an individual's financial status. It requires complete disclosure of assets, liabilities, income, and expenses, aiding in fair decision-making during legal proceedings.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.