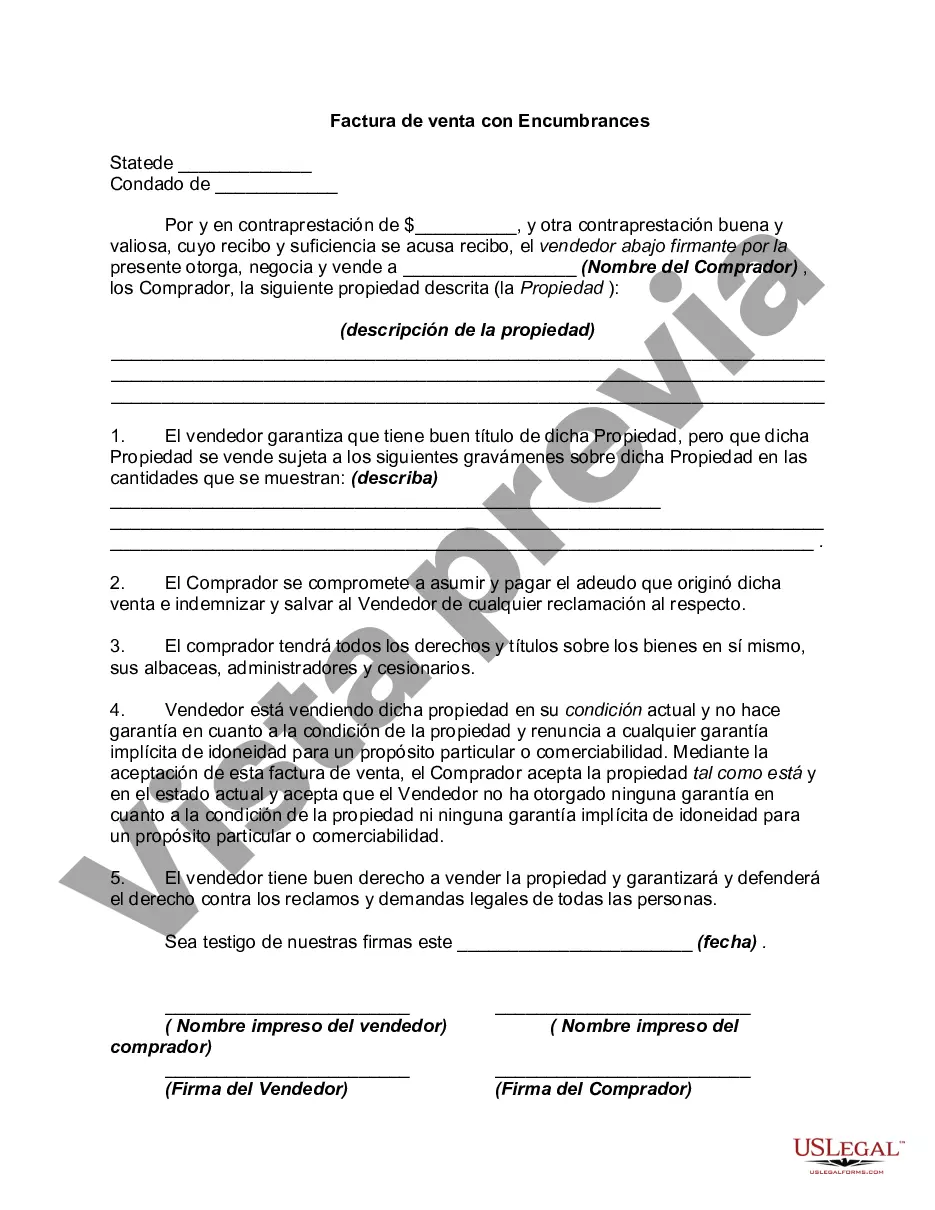

A Bill of Sale with encumbrances means that whatever product is being sold has some sort of lien, mortgage, or monies owing, and the Buyer is agreeing that they will take on these obligations upon purchase.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

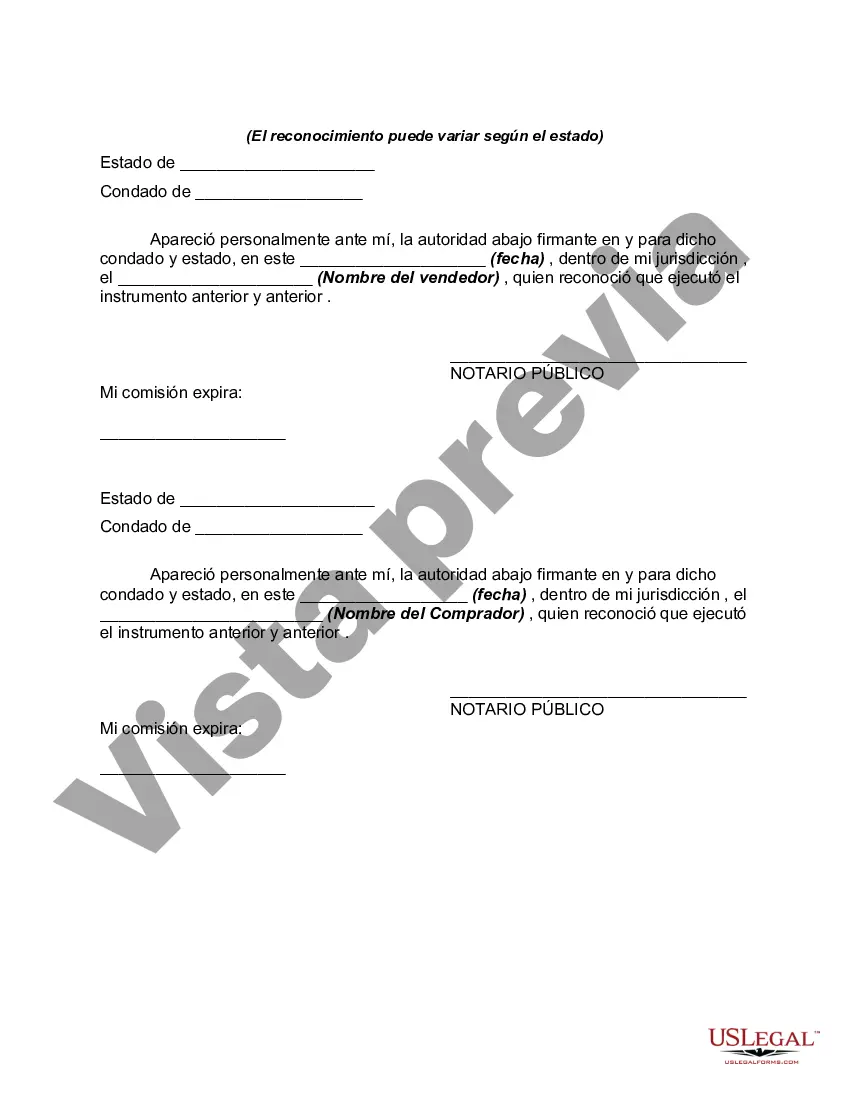

The Massachusetts Bill of Sale with Encumbrances is a legal document that serves as proof of transfer of ownership of a personal property or vehicle while also acknowledging the presence of any outstanding liens or encumbrances on the property. This document is crucial in protecting the interests of both the buyer and the seller. When selling a personal property or vehicle in Massachusetts, it is important to disclose any existing encumbrances, such as mortgages, loans, or any other financial claims against the property. Buyers have the right to know about these encumbrances as they might affect the property's title or ownership status. The Massachusetts Bill of Sale with Encumbrances includes the following key information: 1. Parties Involved: The legal names, addresses, and contact information of both the buyer and the seller. 2. Description of the Property: A detailed description of the property being sold, including any unique identifiers such as serial numbers, make, model, year, and vehicle identification number (VIN) for vehicles. 3. Purchase Price: The agreed-upon purchase price, in both numerical and written form, that the buyer will pay to the seller for the property. 4. Encumbrances: A section explicitly stating all outstanding liens, encumbrances, or financial claims against the property. This includes details of the encumbrances, such as the name of the entity or individual holding the lien, the amount owed, and any specific terms or conditions related to the lien. Different types of Massachusetts Bill of Sale with Encumbrances may exist based on the type of property being sold. Some common variations include: 1. Vehicle Bill of Sale with Encumbrances: Specifically used for the sale of motor vehicles, this document will include additional details like the vehicle's make, model, year, and VIN, as well as any existing liens or encumbrances related to the vehicle. 2. Personal Property Bill of Sale with Encumbrances: This type of bill of sale is used when selling personal property that may have financial claims against it, such as heavy machinery, equipment, or even vessels. It will include a detailed description of the property, any unique identifiers, and the encumbrance information. By utilizing a Massachusetts Bill of Sale with Encumbrances, buyers can make informed decisions about their purchase, ensuring that they are aware of any encumbrances and how it might impact the property's ownership. Likewise, sellers can protect themselves by providing accurate and transparent information about any financial claims tied to the property.The Massachusetts Bill of Sale with Encumbrances is a legal document that serves as proof of transfer of ownership of a personal property or vehicle while also acknowledging the presence of any outstanding liens or encumbrances on the property. This document is crucial in protecting the interests of both the buyer and the seller. When selling a personal property or vehicle in Massachusetts, it is important to disclose any existing encumbrances, such as mortgages, loans, or any other financial claims against the property. Buyers have the right to know about these encumbrances as they might affect the property's title or ownership status. The Massachusetts Bill of Sale with Encumbrances includes the following key information: 1. Parties Involved: The legal names, addresses, and contact information of both the buyer and the seller. 2. Description of the Property: A detailed description of the property being sold, including any unique identifiers such as serial numbers, make, model, year, and vehicle identification number (VIN) for vehicles. 3. Purchase Price: The agreed-upon purchase price, in both numerical and written form, that the buyer will pay to the seller for the property. 4. Encumbrances: A section explicitly stating all outstanding liens, encumbrances, or financial claims against the property. This includes details of the encumbrances, such as the name of the entity or individual holding the lien, the amount owed, and any specific terms or conditions related to the lien. Different types of Massachusetts Bill of Sale with Encumbrances may exist based on the type of property being sold. Some common variations include: 1. Vehicle Bill of Sale with Encumbrances: Specifically used for the sale of motor vehicles, this document will include additional details like the vehicle's make, model, year, and VIN, as well as any existing liens or encumbrances related to the vehicle. 2. Personal Property Bill of Sale with Encumbrances: This type of bill of sale is used when selling personal property that may have financial claims against it, such as heavy machinery, equipment, or even vessels. It will include a detailed description of the property, any unique identifiers, and the encumbrance information. By utilizing a Massachusetts Bill of Sale with Encumbrances, buyers can make informed decisions about their purchase, ensuring that they are aware of any encumbrances and how it might impact the property's ownership. Likewise, sellers can protect themselves by providing accurate and transparent information about any financial claims tied to the property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.