The Massachusetts Cash Receipts Journal is an essential document used by businesses in Massachusetts to track their cash inflows accurately. It serves as a systematic record of all cash receipts, providing a comprehensive overview of the financial transactions involving cash within a specified period. This journal plays a crucial role in managing finances, tax compliance, and auditing purposes. The Massachusetts Cash Receipts Journal typically contains several key elements. Firstly, it includes a column to record the date of each cash receipt, ensuring transactions are logged chronologically. This allows for easy tracking and reference in case of any disputes or discrepancies. The next column in the Cash Receipts Journal is reserved for capturing crucial details like the source or description of cash inflow. Whether its payments received from customers, loan proceeds, interest income, or any other cash inflow, this column ensures clarity in identifying the origin of each receipt. Moreover, the cash receipts amount is recorded in another designated column. This column ensures that the accurate monetary value of each cash inflow is documented, minimizing calculation errors and facilitating efficient record-keeping. Additionally, the Massachusetts Cash Receipts Journal often includes separate columns for different cash inflow categories. These categories can vary depending on the nature of the business or specific industry requirements. Commonly used categories may include cash sales, accounts receivable payments, cash from investments, and miscellaneous cash receipts. The presence of these categorized columns aids in organizing and analyzing cash inflows based on various sources, helping businesses to gain valuable insights into their revenue streams. Furthermore, some businesses might maintain additional columns in their Cash Receipts Journal for specific purposes, such as tracking sales tax collected or allocating cash receipts to different departments or projects within the company. These customizations enhance the journal's versatility and make it more tailored to a particular business's needs. It is important to note that while the Massachusetts Cash Receipts Journal primarily captures cash inflows, it complements the Cash Disbursements Journal, which records cash outflows. Together, these two journals provide a comprehensive overview of a business's cash transactions and enable accurate monitoring of its financial health. In conclusion, the Massachusetts Cash Receipts Journal is a vital tool for businesses to maintain organized, detailed records of their cash receipts. By accurately documenting the date, source, amount, and categorization of cash inflows, this journal facilitates efficient financial management, tax compliance, and auditing processes. Its customization options allow businesses to adapt the journal to their specific needs, ensuring comprehensive tracking of cash receipts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Diario de recibos de efectivo - Cash Receipts Journal

Description

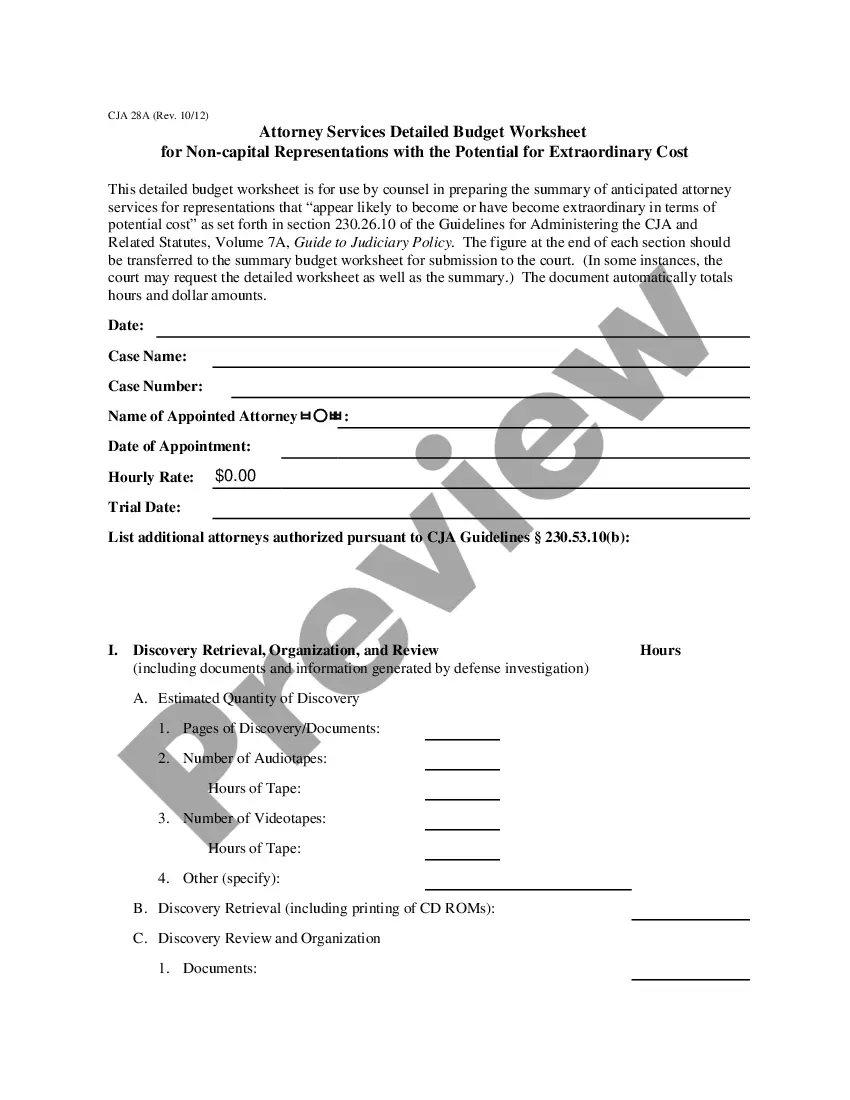

How to fill out Massachusetts Diario De Recibos De Efectivo?

If you want to comprehensive, obtain, or printing legal file web templates, use US Legal Forms, the largest collection of legal types, that can be found online. Use the site`s basic and handy lookup to find the documents you want. A variety of web templates for business and person functions are sorted by categories and claims, or search phrases. Use US Legal Forms to find the Massachusetts Cash Receipts Journal within a few clicks.

If you are already a US Legal Forms client, log in in your account and then click the Down load key to find the Massachusetts Cash Receipts Journal. Also you can accessibility types you previously downloaded inside the My Forms tab of your respective account.

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for your correct metropolis/nation.

- Step 2. Take advantage of the Review choice to look over the form`s information. Do not neglect to read the outline.

- Step 3. If you are not happy together with the develop, use the Look for field on top of the screen to discover other variations of the legal develop design.

- Step 4. When you have identified the form you want, click on the Get now key. Pick the pricing prepare you like and add your credentials to sign up for the account.

- Step 5. Method the purchase. You may use your credit card or PayPal account to finish the purchase.

- Step 6. Choose the file format of the legal develop and obtain it on your system.

- Step 7. Total, revise and printing or sign the Massachusetts Cash Receipts Journal.

Each and every legal file design you buy is your own property eternally. You have acces to each and every develop you downloaded within your acccount. Select the My Forms portion and select a develop to printing or obtain once more.

Compete and obtain, and printing the Massachusetts Cash Receipts Journal with US Legal Forms. There are thousands of specialist and condition-certain types you can utilize to your business or person needs.

Form popularity

FAQ

In your journal, you will want to record:The transaction date.Notes about the transaction.Check number (if applicable)Amount.Cash receipt account types (e.g., accounts receivable)Any sales discounts.

Example of Cash Receipt Journal Investment of capital by the owner of a business is recorded in cash receipts, sale of an asset for cash is recorded in cash receipts, all kinds of collections from credit customers are recorded in cash receipts, collection of bank interest, dividend.

A cash payment journal is a special journal that allows you to record all cash payments - that is, all transactions during which you spend funds. For example, if you paid cash to any of your creditors, you would record it in your cash payment journal.

A Cash receipts journal is a specialized accounting journal and it is referred to as the main entry book used in an accounting system to keep track of the sales of items when cash is received, by crediting sales and debiting cash and transactions related to receipts.

Explanation. The cash receipts journal is used to record all transactions involving the receipt of cash, including transactions such as cash sales, the receipt of a bank loan, the receipt of a payment on account, and the sale of other assets such as marketable securities.

In your journal, you will want to record:The transaction date.Notes about the transaction.Check number (if applicable)Amount.Cash receipt account types (e.g., accounts receivable)Any sales discounts.

A cash receipts journal (CRJ) records transactions that involve payments received with cash. Source documents would probably be receipts and cheque butts. The CRJ records the cash inflow of a business.

A cash receipts journal is used by companies to record all cash received from any source. This includes cash sales, receipt of funds from a bank loan, payments from customer accounts, and the sale of assets.

More info

Analytics Podcast Databases Podcast Programming Podcast Web Application Podcast Web Service Library Articles Books Topics Index Site Archive Podcast Podcast Podcast Management Best Practices Podcast Interviews Podcast Audio Editing Podcast Music Publishing Podcast Web Development Podcast Please note that these links go to the current version of the content.