Massachusetts Expense Report: A Comprehensive Overview of Expense Reporting in the State Keywords: Massachusetts, expense report, reimbursement, expenses, guidelines, documentation, receipts, submission, processing, types. Introduction: The Massachusetts Expense Report is a crucial document used by public employees, contractors, and other individuals who incur expenses on behalf of the state. It serves as a means of requesting reimbursement for eligible expenditures and ensuring proper financial accountability. This detailed description explores the purpose, guidelines, documentation requirements, submission process, and different types of Massachusetts Expense Reports. Purpose: The primary purpose of the Massachusetts Expense Report is to facilitate the reimbursement of expenses incurred while conducting official state business. It ensures adherence to budgetary constraints, transparency, and accountability of public funds. By filling out an expense report accurately, individuals can request reimbursement promptly, helping to maintain financial integrity. Guidelines and Documentation: Massachusetts Expense Reports adhere to established guidelines to ensure consistency and accuracy. These guidelines typically include instructions on eligible expenses, acceptable documentation, and reporting procedures. To comply with these guidelines, individuals must store receipts and other supporting documents related to their expenses. Receipts should contain specific information, such as the vendor's name, date of purchase, description of items/services, and the total amount paid. Submission and Processing: Submitting an expense report in Massachusetts generally involves completing a standardized form provided by the state or using an online platform specifically designed for expense submissions. The completed form, along with the supporting documentation, must be submitted to the appropriate department or office responsible for expense reimbursements. The processing time may vary, but efforts are made to expedite the review and approval process to ensure timely reimbursements. Types of Massachusetts Expense Reports: 1. Travel Expense Report: This type of expense report focuses on reimbursable expenses incurred during official state travel. It covers costs like transportation, lodging, meals, parking, and other related expenses. 2. Business Expense Report: The business expense report encompasses expenses associated with conducting official state business locally, such as meals during business meetings, office supplies, communication expenses, and more. 3. Research Expense Report: This expense report specifically caters to individuals involved in research-related activities. It includes reimbursements for expenses like research materials, laboratory supplies, participant incentives, travel, and conference attendance fees. 4. Miscellaneous Expense Report: This category encompasses various non-specific expenses that may not fall into the predefined expense types. It covers items or services that are essential for official state operations but do not fit into the aforementioned categories. In conclusion, the Massachusetts Expense Report plays a critical role in facilitating the reimbursement process, ensuring fiscal accountability, and promoting transparent financial management. By following the guidelines, documenting expenses appropriately, and selecting the relevant expense type, individuals can expedite the reimbursement process and contribute to the effective handling of public funds.

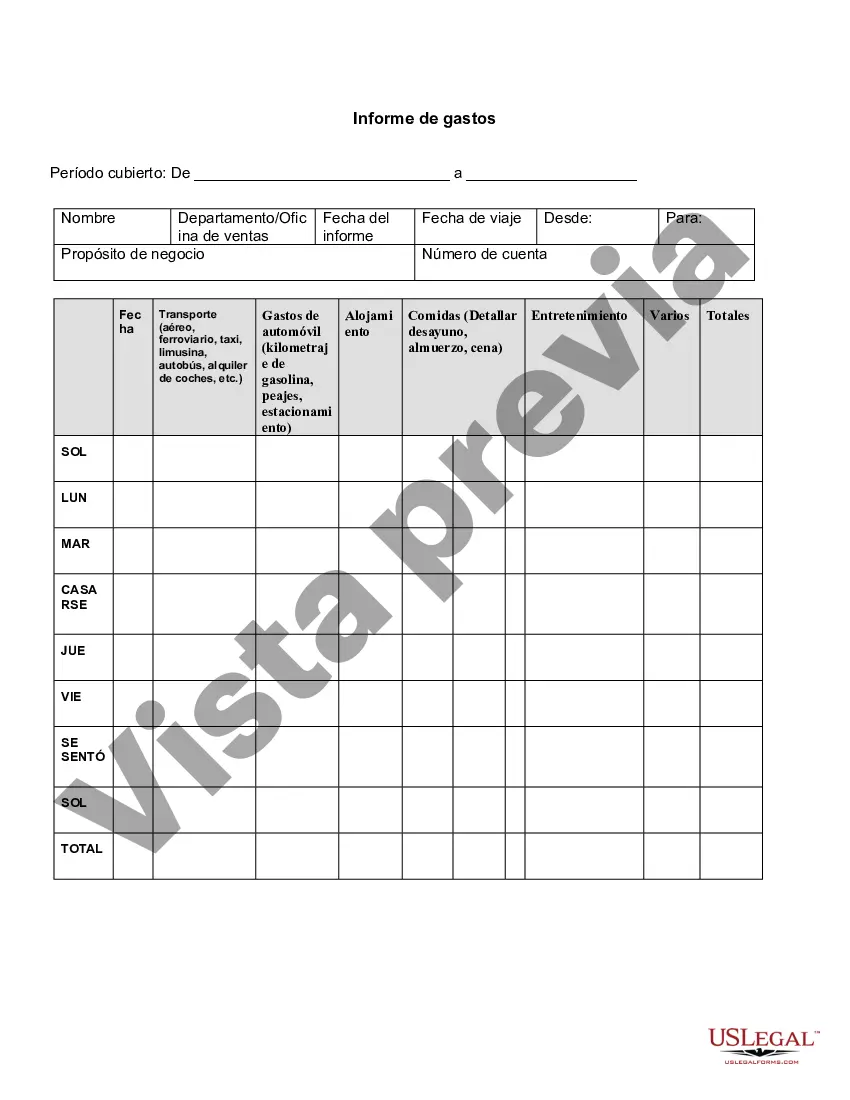

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Informe de gastos - Expense Report

Description

How to fill out Massachusetts Informe De Gastos?

If you need to complete, down load, or print legal file themes, use US Legal Forms, the biggest variety of legal types, that can be found on the web. Make use of the site`s simple and handy research to find the documents you want. Numerous themes for enterprise and individual functions are sorted by types and states, or keywords and phrases. Use US Legal Forms to find the Massachusetts Expense Report within a couple of clicks.

Should you be currently a US Legal Forms consumer, log in for your account and click on the Obtain key to find the Massachusetts Expense Report. You can also gain access to types you earlier acquired inside the My Forms tab of the account.

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that right city/land.

- Step 2. Make use of the Review solution to check out the form`s content. Never forget about to learn the outline.

- Step 3. Should you be not happy together with the develop, take advantage of the Research industry near the top of the screen to find other models of your legal develop format.

- Step 4. Upon having found the form you want, select the Buy now key. Select the rates prepare you prefer and put your references to register to have an account.

- Step 5. Method the purchase. You may use your charge card or PayPal account to accomplish the purchase.

- Step 6. Pick the file format of your legal develop and down load it on your system.

- Step 7. Full, change and print or indication the Massachusetts Expense Report.

Each and every legal file format you get is your own property eternally. You have acces to every develop you acquired within your acccount. Click the My Forms segment and pick a develop to print or down load once more.

Contend and down load, and print the Massachusetts Expense Report with US Legal Forms. There are many specialist and state-specific types you can utilize for the enterprise or individual needs.