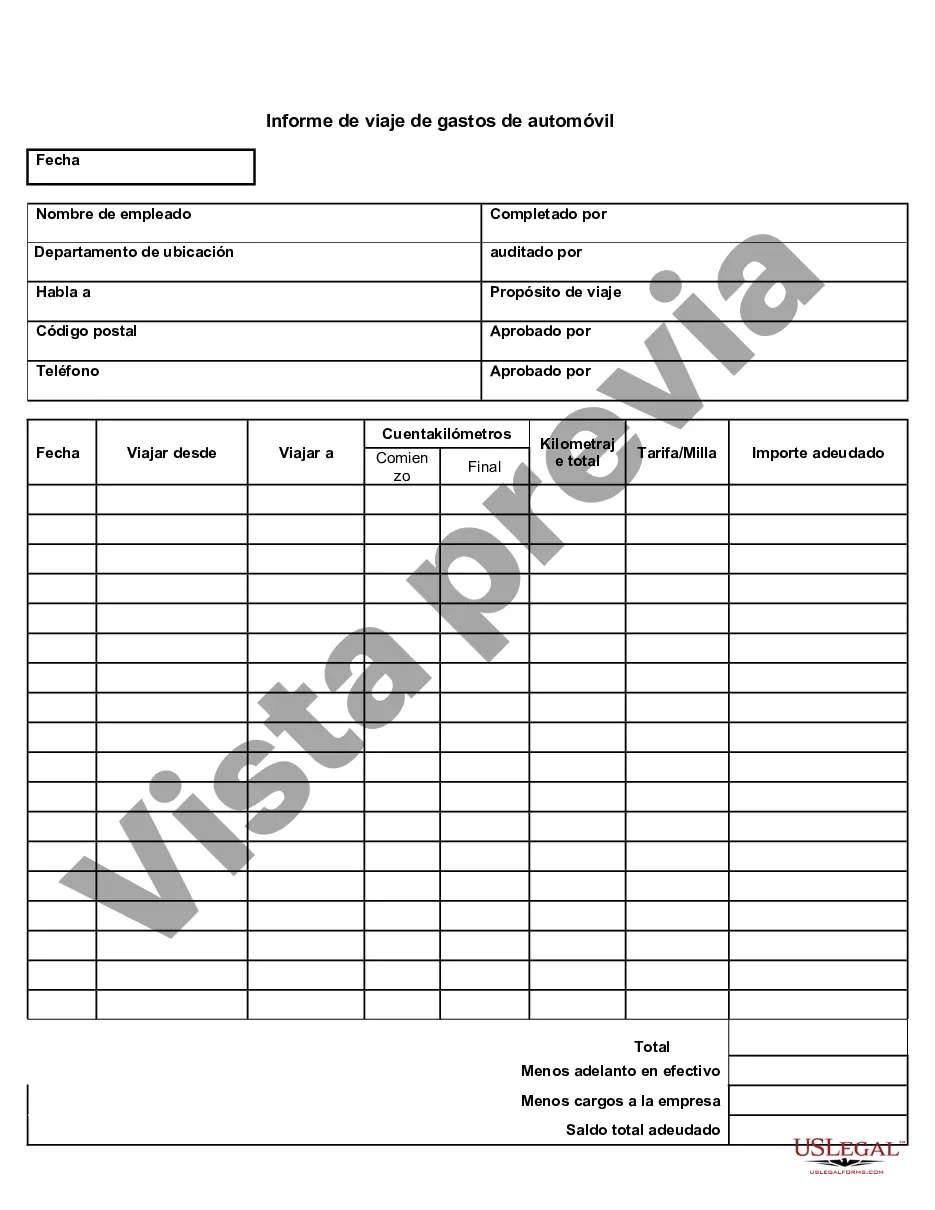

Keywords: Massachusetts, Auto Expense Travel Report, types, detailed description: The Massachusetts Auto Expense Travel Report is a comprehensive document used to track and report all auto-related expenses incurred during official business travel within the state of Massachusetts. It serves as a vital tool for employees, employers, and accounting personnel to ensure accurate reimbursement and proper accounting for travel-related expenses. This expense report captures a wide range of expenses related to the use of an automobile during official business travel in Massachusetts. It includes expenses such as fuel, tolls, parking fees, repairs, maintenance, insurance, and vehicle rental charges. The report also takes into account mileage and vehicle usage, providing a detailed breakdown of travel distances, locations, and purposes. One of the types of Massachusetts Auto Expense Travel Report is the Standard Mileage Rate Report. This report automatically calculates reimbursable expenses using the standard mileage rate set by the Internal Revenue Service (IRS). It takes into account the number of miles driven for business purposes and multiplies it by the current standard mileage rate to determine the reimbursement amount. Another type of Massachusetts Auto Expense Travel Report is the Actual Expense Report. This report requires the employee to provide detailed receipts and documentation for each individual expense incurred during business travel. It includes expenses such as fuel receipts, parking receipts, toll receipts, repair invoices, and maintenance costs. The actual expense report allows for a more accurate and specific reimbursement, providing a thorough breakdown of each expense category. The Massachusetts Auto Expense Travel Report not only benefits employees by ensuring they are properly reimbursed for their business-related auto expenses, but it also assists employers in accurately recording and accounting for these expenses. It helps organizations adhere to proper financial reporting standards and maintain transparency in expense tracking. In conclusion, the Massachusetts Auto Expense Travel Report is a vital tool for tracking and reporting all auto-related expenses incurred during official business travel within the state. Whether using the Standard Mileage Rate or the Actual Expense method, this report ensures accurate reimbursement and proper accounting, benefiting both employees and employers alike.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Informe de viaje de gastos de automóvil - Auto Expense Travel Report

Description

How to fill out Massachusetts Informe De Viaje De Gastos De Automóvil?

You may commit hrs on the Internet trying to find the authorized file format that meets the state and federal demands you want. US Legal Forms offers a huge number of authorized varieties that are examined by professionals. It is simple to down load or print the Massachusetts Auto Expense Travel Report from your services.

If you already possess a US Legal Forms bank account, you can log in and click the Down load option. Following that, you can total, edit, print, or indicator the Massachusetts Auto Expense Travel Report. Each and every authorized file format you get is your own permanently. To acquire another backup of the obtained form, visit the My Forms tab and click the related option.

If you use the US Legal Forms site initially, adhere to the straightforward recommendations under:

- Initially, ensure that you have chosen the right file format for your area/metropolis of your liking. Browse the form description to ensure you have selected the right form. If readily available, utilize the Preview option to check throughout the file format also.

- If you wish to get another variation of your form, utilize the Research area to get the format that meets your needs and demands.

- When you have discovered the format you want, click Buy now to move forward.

- Choose the costs plan you want, type your accreditations, and register for a free account on US Legal Forms.

- Complete the transaction. You can utilize your Visa or Mastercard or PayPal bank account to cover the authorized form.

- Choose the format of your file and down load it for your gadget.

- Make modifications for your file if required. You may total, edit and indicator and print Massachusetts Auto Expense Travel Report.

Down load and print a huge number of file themes making use of the US Legal Forms Internet site, that provides the most important selection of authorized varieties. Use specialist and condition-certain themes to take on your company or individual needs.