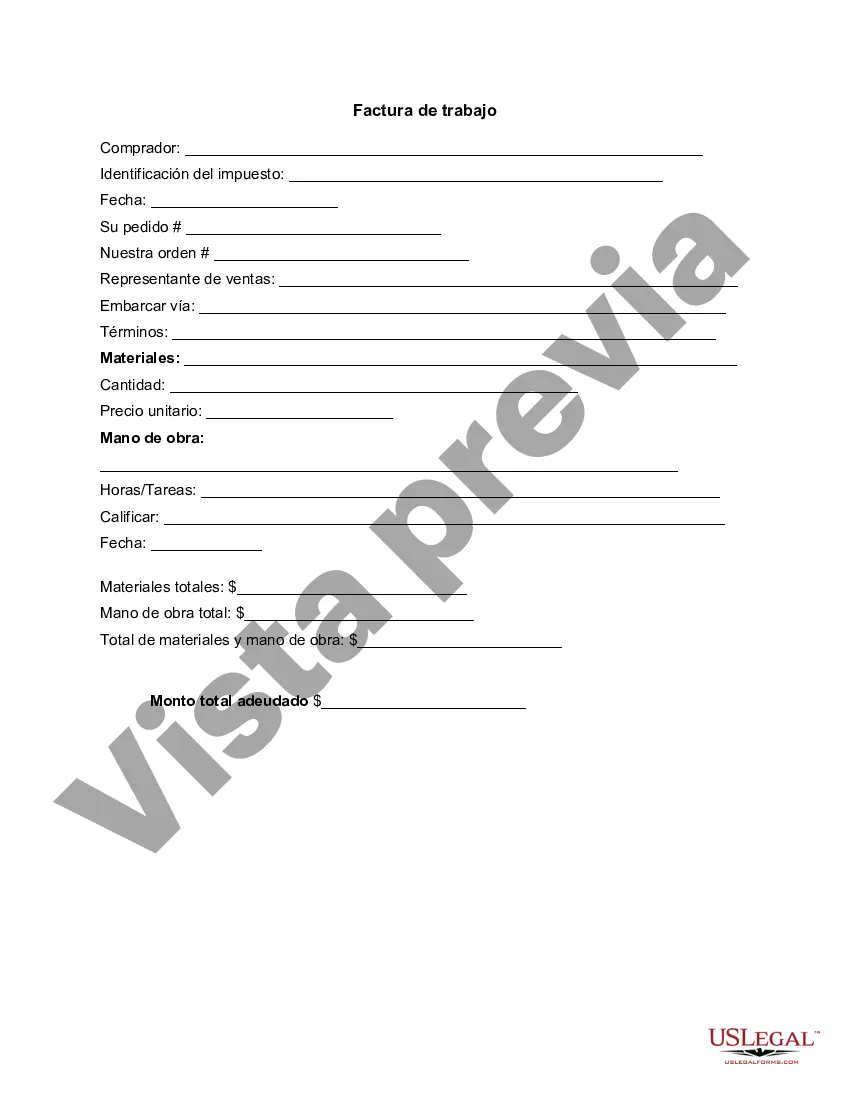

A Massachusetts invoice template for farmers is a structured document that simplifies the billing process for farmers in Massachusetts. It serves as a professional and organized tool for generating invoices that accurately reflect the products or services provided by farmers to their customers. This template is specifically designed to cater to the specific accounting requirements and regulations applicable to farmers in Massachusetts. Using a Massachusetts invoice template for farmers ensures that all essential details and legal information are included, such as: 1. Contact Information: The template includes the farmer's name, business address, phone number, and email address, helping establish clear communication channels with customers. 2. Customer Information: It allows for the easy integration of customer details, including their name, address, contact information, and any specific billing requirements they may have. 3. Invoice Number and Date: Each invoice generated using the template will have a unique numerical identifier and the date when it was created. This helps in tracking invoice and maintaining a proper record-keeping system. 4. Line Item Description: The template provides designated sections for a comprehensive breakdown of the products or services rendered. Farmers can list the item description, quantity supplied, unit price, and total price. This enables clear transparency and avoids any confusion regarding the billed amount. 5. Taxes and Discounts: For compliance with Massachusetts tax regulations, the template includes sections to calculate applicable taxes. Additionally, if any discounts or promotions are being offered to customers, they can also be itemized. 6. Terms and Conditions: Vital for legal purposes, the template includes a section where the farmer can outline terms and conditions, including payment due dates, late payment penalties, and ownership or liability disclaimers. Types of Massachusetts Invoice Templates for Farmers: 1. Goods Invoice Template: Specifically designed for farmers who primarily sell physical products like fruits, vegetables, meat, dairy products, etc. 2. Service Invoice Template: Tailored for farmers who provide services such as crop harvesting, maintenance, or consulting services. 3. Recurring Invoice Template: Ideal for farmers who have regular customers or subscription-based products or services, allowing for automated monthly billing. 4. VAT Invoice Template: For farmers subject to the Massachusetts Value Added Tax (VAT) system, this template helps calculate and document the applicable taxes. 5. Estimation Invoice Template: Useful for farmers who need to provide cost estimates to potential customers before beginning a project or service. In conclusion, a Massachusetts invoice template for farmers streamlines the invoicing process, ensuring accurate and legally compliant billing. It brings efficiency to financial transactions and helps farmers maintain a professional image while keeping track of their business finances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Plantilla de factura para granjero - Invoice Template for Farmer

Description

How to fill out Massachusetts Plantilla De Factura Para Granjero?

You are able to commit hours online looking for the legitimate file template that fits the federal and state demands you want. US Legal Forms gives 1000s of legitimate varieties that happen to be evaluated by professionals. You can easily down load or print the Massachusetts Invoice Template for Farmer from your support.

If you already possess a US Legal Forms bank account, you are able to log in and click on the Download button. Afterward, you are able to complete, edit, print, or sign the Massachusetts Invoice Template for Farmer. Each and every legitimate file template you acquire is the one you have forever. To obtain yet another version associated with a purchased develop, go to the My Forms tab and click on the related button.

If you work with the US Legal Forms web site initially, keep to the simple directions below:

- Very first, ensure that you have chosen the correct file template to the region/area that you pick. Browse the develop outline to ensure you have chosen the correct develop. If offered, make use of the Review button to appear throughout the file template at the same time.

- If you want to discover yet another edition of the develop, make use of the Lookup industry to discover the template that fits your needs and demands.

- When you have identified the template you desire, click on Buy now to move forward.

- Choose the costs plan you desire, type your accreditations, and sign up for your account on US Legal Forms.

- Full the purchase. You may use your bank card or PayPal bank account to purchase the legitimate develop.

- Choose the formatting of the file and down load it to the gadget.

- Make changes to the file if required. You are able to complete, edit and sign and print Massachusetts Invoice Template for Farmer.

Download and print 1000s of file layouts while using US Legal Forms Internet site, which provides the largest variety of legitimate varieties. Use specialist and status-particular layouts to deal with your company or personal demands.