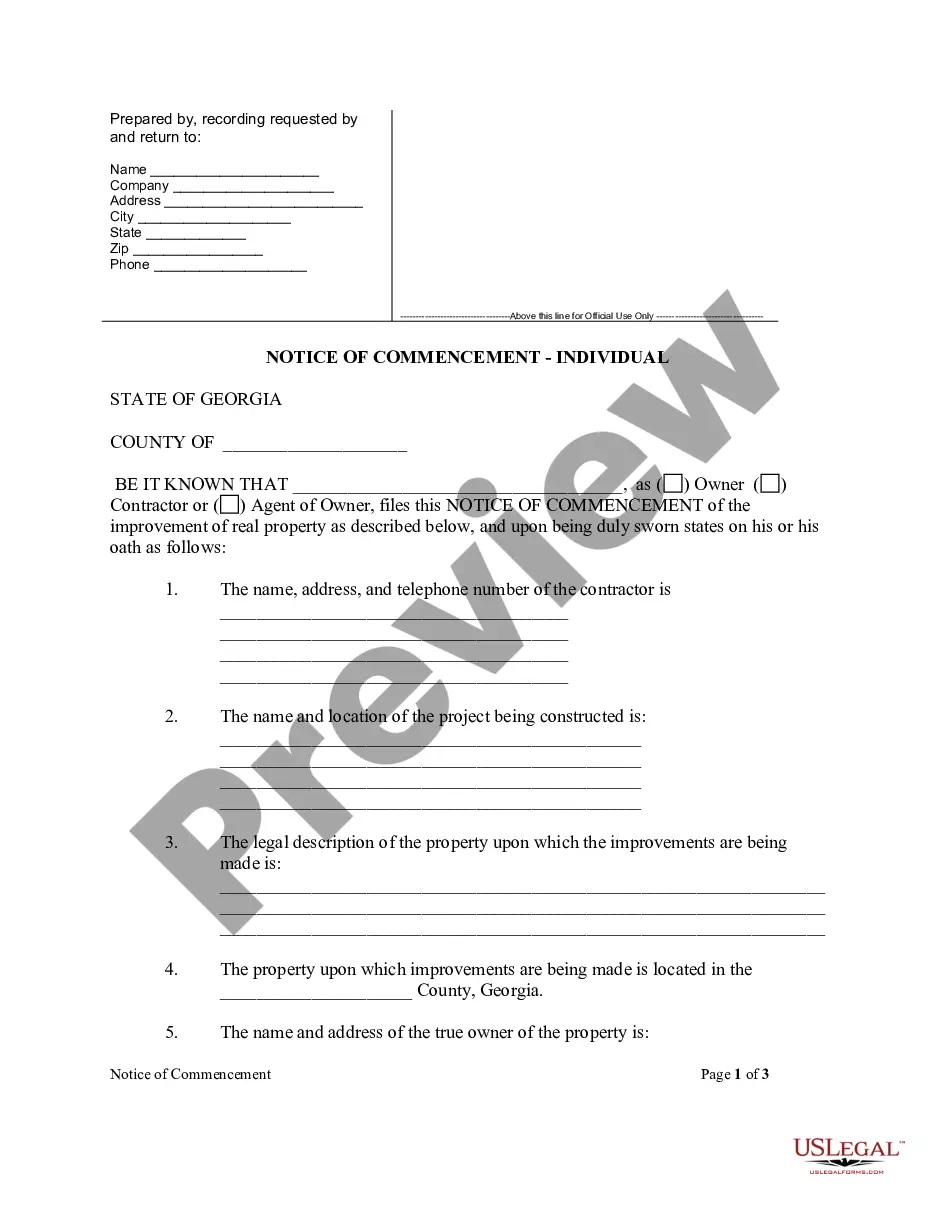

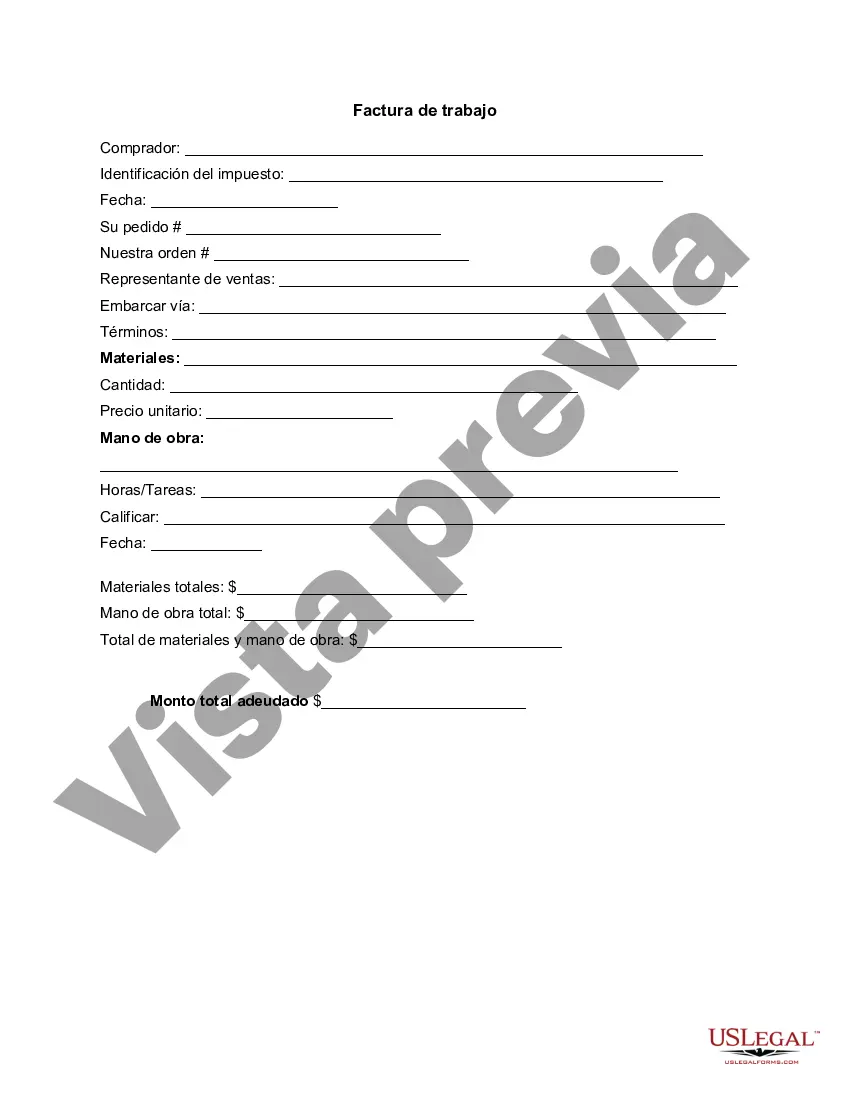

Massachusetts Invoice Template for Receptionist: A Comprehensive Overview A Massachusetts invoice template for receptionists is a standardized document used to formally request payment for the services provided by receptionists in Massachusetts-based businesses. These templates are specifically tailored to meet the legal requirements and regulations set forth by the state's government, ensuring accuracy and compliance with tax laws. Keywords: Massachusetts invoice template, receptionist invoice, template for receptionist, payment request, Massachusetts businesses, legal requirements, tax laws, compliance. Receptionists play a crucial role within organizations by managing various administrative tasks, including answering phone calls, scheduling appointments, greeting visitors, and maintaining a professional and organized front office. As part of their responsibilities, receptionists often need to create invoices to bill clients or customers for services rendered. In Massachusetts, it is important to use a specific invoice template designed for receptionists to ensure adherence to state regulations. By utilizing these templates, receptionists can streamline the invoicing process, save time, and maintain consistency in the format and content of their invoices. These templates typically include sections such as: 1. Header: The top of the invoice contains the receptionist's name, address, contact information, and the invoice number, which aids in tracking and reference purposes. 2. Client Information: This section captures essential details related to the client or customer, including their name, address, and contact information. It is crucial to include accurate information to facilitate smooth communication and payment processing. 3. Description of Services: Here, the receptionist outlines the services provided, along with specific details such as the date and time of each service rendered, the duration, and any additional notes relevant to the explanation of the service. 4. Itemized Charges: If applicable, this section breaks down each service rendered and the corresponding charges. It is important to clearly state the unit price, quantity, and total cost for each itemized service to provide transparency to the client. 5. Total Amount Due: The grand total of all charges is calculated and clearly displayed to indicate the exact amount owed by the client or customer. This section may also mention any applicable discounts, taxes, or additional fees. 6. Payment Terms and Methods: The template may include a section to specify the due date for payment, acceptable modes of payment (e.g., cash, credit card, or check), and any late payment penalties or interest rates in alignment with Massachusetts regulations. Different types of Massachusetts invoice templates for receptionists may be designed to cater to specific industries or incorporate industry-specific terms and requirements. Some variations may include medical receptionist invoice templates, dental receptionist invoice templates, legal receptionist invoice templates, and general receptionist invoice templates, among others. Overall, using a Massachusetts invoice template for receptionists enhances professionalism, ensures accurate billing, and facilitates smoother payment processes. Receptionists can focus on providing exceptional services while efficiently managing the business side of their responsibilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Plantilla de factura para recepcionista - Invoice Template for Receptionist

Description

How to fill out Massachusetts Plantilla De Factura Para Recepcionista?

If you have to comprehensive, down load, or print out legitimate record layouts, use US Legal Forms, the most important variety of legitimate kinds, which can be found online. Make use of the site`s simple and hassle-free research to discover the files you need. A variety of layouts for enterprise and person functions are categorized by classes and claims, or key phrases. Use US Legal Forms to discover the Massachusetts Invoice Template for Receptionist within a couple of mouse clicks.

In case you are already a US Legal Forms consumer, log in to your account and click the Obtain key to get the Massachusetts Invoice Template for Receptionist. You may also access kinds you formerly delivered electronically in the My Forms tab of your own account.

Should you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the shape for your right metropolis/region.

- Step 2. Make use of the Preview option to check out the form`s content material. Do not forget about to read through the description.

- Step 3. In case you are unhappy with all the develop, utilize the Look for industry at the top of the display to locate other variations of your legitimate develop design.

- Step 4. Upon having located the shape you need, click on the Get now key. Opt for the prices program you choose and include your accreditations to register on an account.

- Step 5. Approach the deal. You can use your charge card or PayPal account to finish the deal.

- Step 6. Select the format of your legitimate develop and down load it on your gadget.

- Step 7. Full, revise and print out or sign the Massachusetts Invoice Template for Receptionist.

Each legitimate record design you buy is the one you have permanently. You may have acces to every single develop you delivered electronically within your acccount. Go through the My Forms segment and decide on a develop to print out or down load once again.

Compete and down load, and print out the Massachusetts Invoice Template for Receptionist with US Legal Forms. There are thousands of skilled and status-specific kinds you can utilize for your enterprise or person needs.