Massachusetts Checklist — Key Employee Life Insurance is a crucial insurance coverage designed to protect businesses against unforeseen financial loss caused by the death of a key employee. It serves as a risk management tool for businesses who heavily rely on key personnel for their operations and success. Key Employee Life Insurance policies in Massachusetts provide financial security to organizations by compensating them for losses incurred due to the death of a key employee. This insurance coverage ensures that businesses can carry on their operations smoothly without facing significant disruptions or financial hardships in the absence of a key contributor. It addresses the financial uncertainties that arise from the loss of a crucial team member and allows businesses to retain stability during challenging times. Typically, Massachusetts Checklist — Key Employee Life Insurance policies cover the following aspects: 1. Death Benefit: A lump sum payment is made to the business upon the death of the insured key employee. The amount of the benefit is determined based on the impact and financial loss that the organization may suffer as a result of the key employee's absence. The proceeds from the policy can be utilized to offset financial obligations, recruit and train a replacement, or cover any other necessary expenses. 2. Policy Ownership: The business is usually the owner and beneficiary of the policy. This ensures that the organization has control over the insurance coverage and can utilize the benefits according to its specific needs. 3. Premium Payments: The organization pays the premiums for the key employee life insurance policy. The premiums are determined based on factors such as the age, health, and role of the insured key employee, as well as the policy duration and coverage amount. 4. Tax Considerations: In most cases, the premiums paid for key employee life insurance coverage are not tax-deductible. However, the death benefit received by the business is typically tax-free, providing valuable financial relief in times of loss. 5. Policy Duration: Key Employee Life Insurance policies can have different durations depending on the needs of the business. Common options include term policies with a fixed period or permanent policies that provide coverage for the employee's entire lifetime. Companies can choose the duration based on their specific requirements and the expected timeline for the employee's contribution to the organization. It is important to note that while key employee life insurance may sound similar to individual life insurance, it serves a different purpose. Individual life insurance aims to provide financial protection for the insured person's family or dependents, whereas key employee life insurance protects the business itself from financial loss. In summary, Massachusetts Checklist — Key Employee Life Insurance is a vital risk management tool for businesses, safeguarding their financial stability in the event of the death of a key employee. It provides financial security by compensating the organization with a death benefit, which can be used to address various business needs in the absence of the key employee. Additionally, it offers tax advantages and flexible policy durations to suit specific business requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Lista de verificación: seguro de vida para empleados clave - Checklist - Key Employee Life Insurance

Description

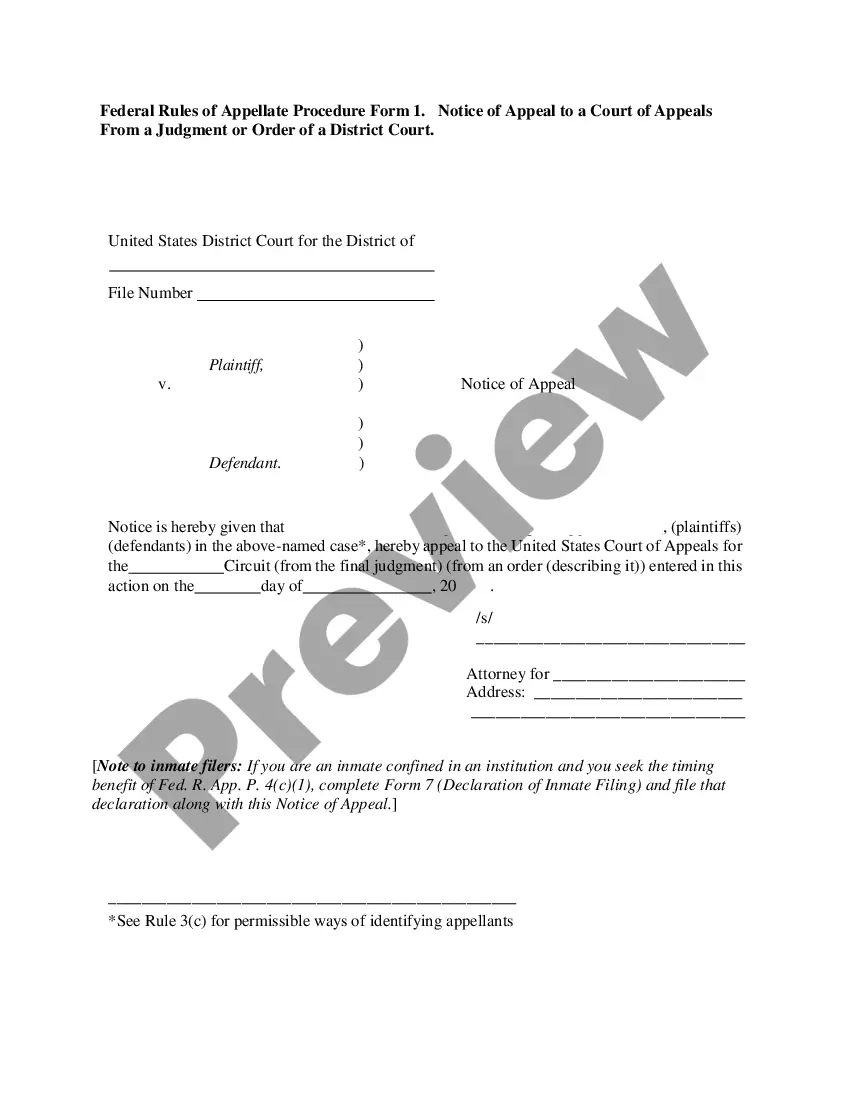

How to fill out Massachusetts Lista De Verificación: Seguro De Vida Para Empleados Clave?

Choosing the best legal record template could be a have a problem. Obviously, there are a lot of layouts available on the Internet, but how do you discover the legal form you need? Utilize the US Legal Forms web site. The service delivers a large number of layouts, like the Massachusetts Checklist - Key Employee Life Insurance, that you can use for organization and private needs. All the types are checked by experts and satisfy state and federal needs.

Should you be previously signed up, log in in your accounts and click on the Download key to get the Massachusetts Checklist - Key Employee Life Insurance. Make use of accounts to check with the legal types you possess purchased earlier. Proceed to the My Forms tab of the accounts and acquire one more version of the record you need.

Should you be a new user of US Legal Forms, here are basic recommendations that you should stick to:

- First, be sure you have chosen the proper form for your metropolis/area. You may look over the shape utilizing the Review key and look at the shape outline to make sure this is basically the best for you.

- If the form will not satisfy your preferences, take advantage of the Seach discipline to get the appropriate form.

- Once you are sure that the shape is suitable, click the Buy now key to get the form.

- Opt for the pricing strategy you want and type in the necessary information. Build your accounts and pay for your order with your PayPal accounts or credit card.

- Select the submit format and down load the legal record template in your device.

- Comprehensive, revise and produce and sign the attained Massachusetts Checklist - Key Employee Life Insurance.

US Legal Forms will be the biggest local library of legal types where you can discover different record layouts. Utilize the service to down load expertly-manufactured papers that stick to express needs.