Massachusetts Checklist Rerecordrd Keepingng is an essential aspect of maintaining the financial health and regulatory compliance of any business or organization. In Massachusetts, there are several key record keeping requirements that need to be followed to ensure smooth operations and adherence to local laws. This detailed checklist will guide you through the essential record keeping tasks and provide an overview of the different types of record keeping in Massachusetts. 1. Business Entity Documents: — Keep copies of your business formation documents, such as articles of organization, certificates of incorporation, and operating agreements. — Maintain an updated list of members, directors, officers, and relevant contact information. — Store copies of your business licenses, permits, and any amendments or changes made over time. 2. Tax Records: — Maintain comprehensive records of all federal, state, and local tax filings, including income tax returns, sales tax returns, employment tax records, and property tax filings. — Keep copies of any correspondence or notices received from tax authorities. 3. Employee Records: — Maintain personnel files for all current and former employees, including employment contracts, offer letters, tax forms (W-4, I-9), performance evaluations, training records, and disciplinary actions if applicable. — Store payroll records, such as timesheets, wage rates, deductions, benefits, and any relevant payroll tax filings. — Keep documentation related to employee benefits, insurance, and retirement plans. 4. Financial Records: — Maintain accurate and organized financial records, including bank statements, canceled checks, invoices, receipts, and expense reports. — Keep track of all business transactions, such as sales and purchase records, contracts, lease agreements, and loan agreements. — Store financial statements and reports, including balance sheets, profit and loss statements, cash flow statements, and auditing records. 5. Permits and Licenses: — Keep copies of all permits and licenses required to conduct business in Massachusetts, such as business licenses, professional licenses, environmental permits, and occupational health and safety certifications. — Maintain records of any inspections, renewals, or modifications related to permits and licenses. 6. Contracts and Agreements: — Keep copies of all contracts and agreements your business has entered into, including vendor contracts, client agreements, partnership agreements, lease agreements, and supplier contracts. — Store records of any modifications, amendments, or terminations of these contracts. 7. Intellectual Property: — Maintain documentation related to intellectual property rights, such as patents, trademarks, copyrights, and trade secrets. — Keep records of any licenses, assignments, or registrations related to intellectual property assets. Different Types of Massachusetts Checklist — Key Record Keeping: 1. Massachusetts Checklist for Small Businesses: — This checklist ensures that small businesses in Massachusetts fulfill all necessary record keeping requirements, including documentation specific to their industry or sector. 2. Massachusetts Checklist for Nonprofit Organizations: — Nonprofit organizations have additional record keeping obligations, such as keeping track of donations, grant applications, volunteer agreements, and fundraising activities. 3. Massachusetts Checklist for Healthcare Providers: — Healthcare providers, including doctors' offices, hospitals, and clinics, have specific record keeping requirements related to patient health information, HIPAA compliance, medical billing, and insurance claims. 4. Massachusetts Checklist for Construction Companies: — Construction companies must maintain records related to permits, licenses, contracts, subcontractor agreements, building codes compliance, and workplace safety regulations. By following this comprehensive Massachusetts Checklist — Key Record Keeping, entities can ensure compliance, efficient operations, and timely access to valuable records for their business or organization.

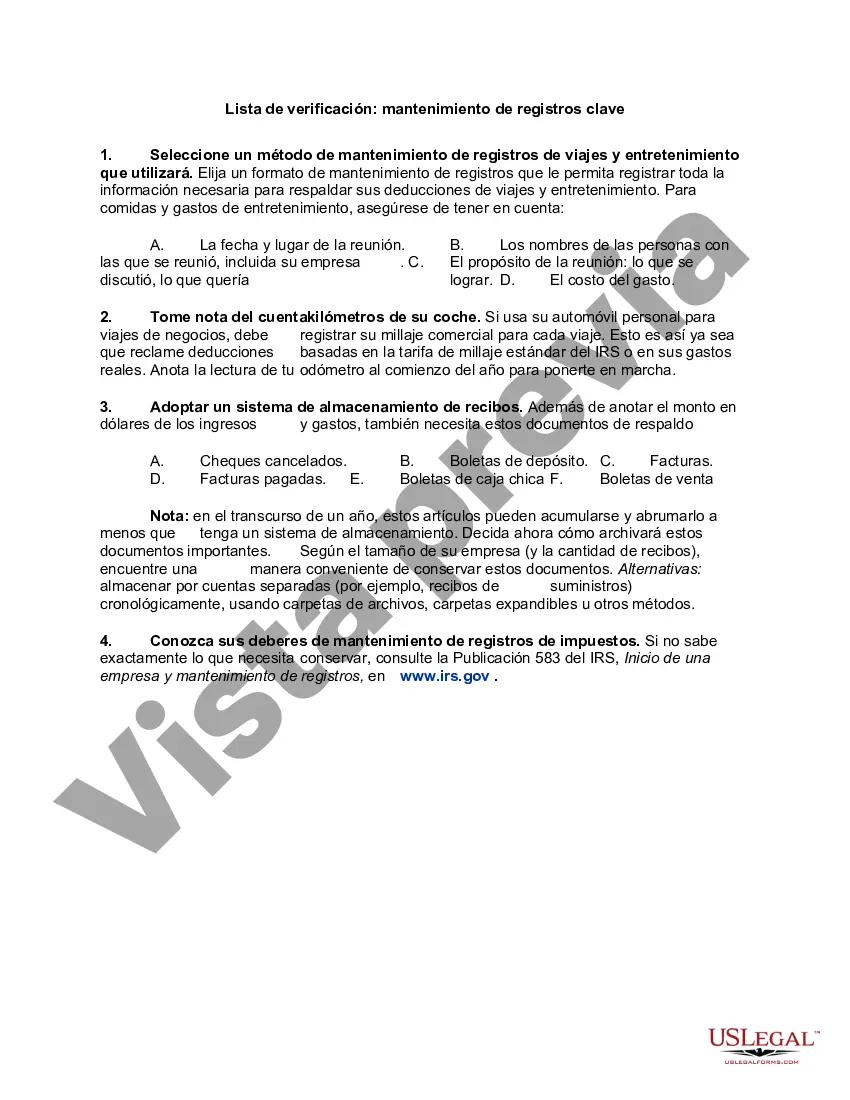

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Lista de verificación: mantenimiento de registros clave - Checklist - Key Record Keeping

Description

How to fill out Massachusetts Lista De Verificación: Mantenimiento De Registros Clave?

Finding the right authorized papers web template can be a battle. Needless to say, there are plenty of themes available on the net, but how do you discover the authorized form you will need? Make use of the US Legal Forms internet site. The service provides 1000s of themes, for example the Massachusetts Checklist - Key Record Keeping, which you can use for company and personal requires. All of the types are inspected by pros and meet federal and state demands.

When you are currently signed up, log in to the bank account and click the Acquire switch to have the Massachusetts Checklist - Key Record Keeping. Utilize your bank account to check from the authorized types you possess ordered formerly. Go to the My Forms tab of your bank account and obtain another backup in the papers you will need.

When you are a new consumer of US Legal Forms, allow me to share basic guidelines that you can stick to:

- Very first, make certain you have chosen the appropriate form for your personal area/area. You can examine the shape while using Preview switch and study the shape description to make certain this is basically the right one for you.

- In case the form does not meet your requirements, make use of the Seach discipline to obtain the proper form.

- When you are sure that the shape is acceptable, go through the Get now switch to have the form.

- Opt for the pricing program you want and type in the necessary information. Make your bank account and purchase an order using your PayPal bank account or Visa or Mastercard.

- Pick the file formatting and down load the authorized papers web template to the device.

- Complete, edit and produce and signal the attained Massachusetts Checklist - Key Record Keeping.

US Legal Forms is the biggest library of authorized types in which you will find numerous papers themes. Make use of the service to down load skillfully-created files that stick to express demands.