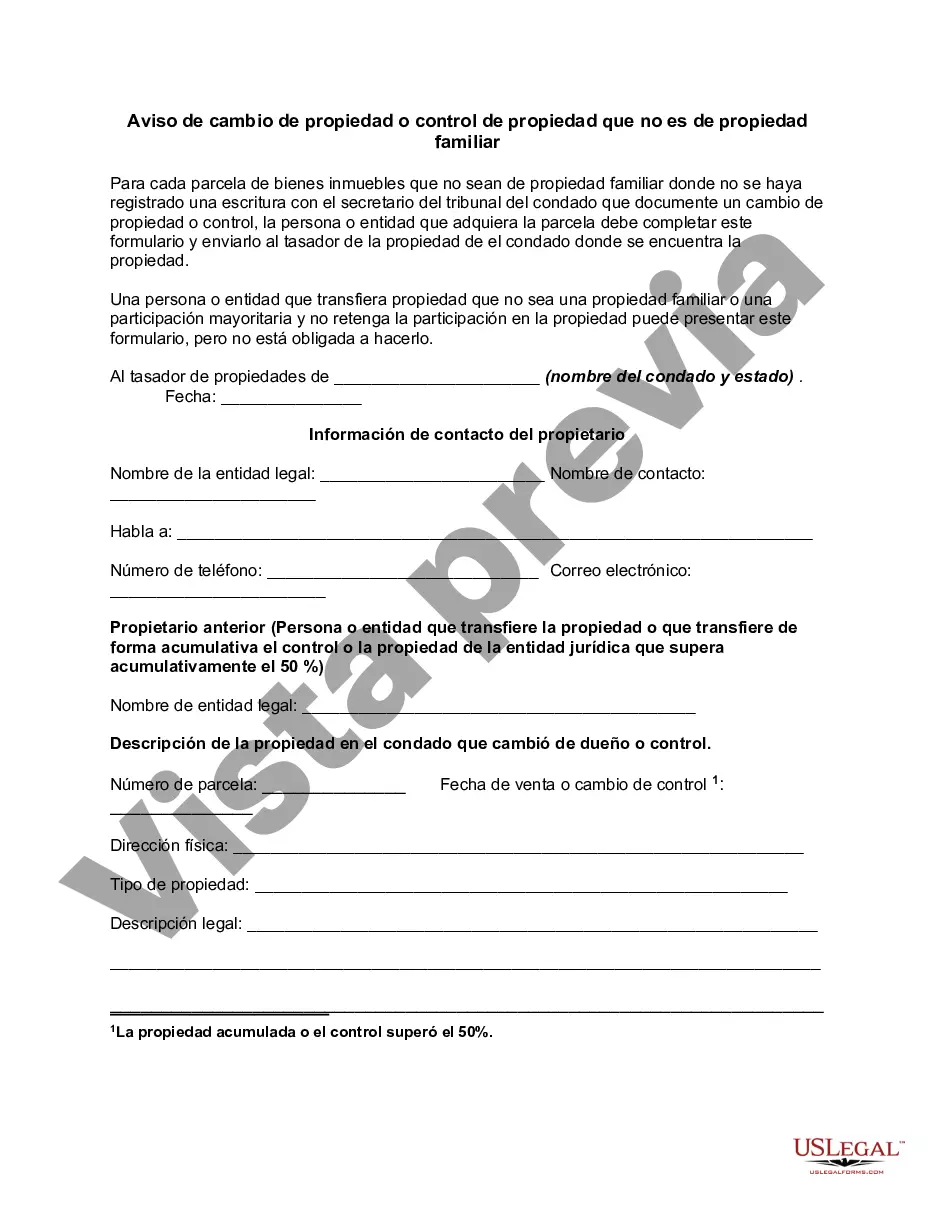

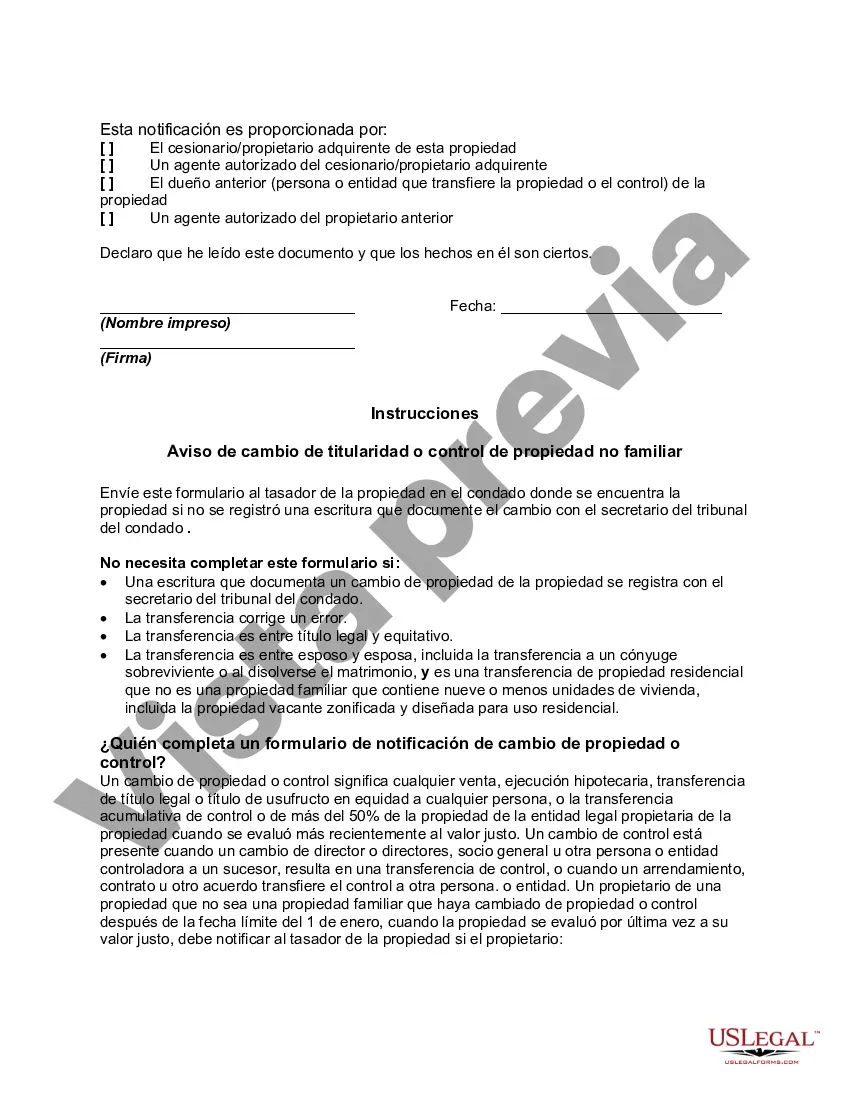

For each parcel of non-homestead real property where a deed has not been recorded with the county clerk of court documenting a change of ownership or control, the person or entity who acquires the parcel may have to complete a form similar to this and send it to the property appraiser of the county where the property is located.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Massachusetts Notice of Change of Ownership or Control Non-Homestead Property is a legally required document that notifies the local assessor's office and other relevant parties about a change in ownership or control of non-homestead property within the state of Massachusetts. This notice is significant as it ensures proper tax assessment and billing procedures are followed. When a property owner sells, transfers, or otherwise changes ownership or control of non-homestead property, it is essential to file this notice. Failure to do so may result in incorrect tax assessments or penalties. The notice provides crucial information to the local assessors, allowing them to update property records and assess taxes accurately. The Massachusetts Department of Revenue (FOR) offers several types of Notice of Change of Ownership or Control Non-Homestead Property forms, depending on the specific circumstances. These forms include: 1. Form NCI — Non-Controlling Interest: Use this form when there is a transfer or change of controlling interest in a property that is not classified as a homestead property. 2. Form NOT — Out-of-Town Transfer: This form is used when the property is situated in one Massachusetts city or town, but the transfer or sale involves parties located outside that particular jurisdiction. 3. Form FA — Flow of Assets: In cases where the transfer of property ownership results from the flow of assets from one entity to another, such as through a merger or acquisition, this form is used. 4. Form PTA — Partial Termination Agreement: When there is a termination or partial termination of a property arrangement, this form is used to notify the assessors of the change. 5. Form COE CHP — Change of Entity, Change of Homestead Property: This form is specific to homestead properties and is used to report any change in ownership or control involving such properties. These Massachusetts Notice of Change of Ownership or Control Non-Homestead Property forms can be obtained from the FOR's official website or by visiting the local assessor's office. It is crucial to complete these forms accurately, providing all required information, including the property address, new owner's details, transaction specifics, and any supporting documentation required by the form. By filing this notice promptly and accurately, property owners ensure compliance with Massachusetts state laws and facilitate smooth tax assessment and billing processes for both themselves and the local assessors.The Massachusetts Notice of Change of Ownership or Control Non-Homestead Property is a legally required document that notifies the local assessor's office and other relevant parties about a change in ownership or control of non-homestead property within the state of Massachusetts. This notice is significant as it ensures proper tax assessment and billing procedures are followed. When a property owner sells, transfers, or otherwise changes ownership or control of non-homestead property, it is essential to file this notice. Failure to do so may result in incorrect tax assessments or penalties. The notice provides crucial information to the local assessors, allowing them to update property records and assess taxes accurately. The Massachusetts Department of Revenue (FOR) offers several types of Notice of Change of Ownership or Control Non-Homestead Property forms, depending on the specific circumstances. These forms include: 1. Form NCI — Non-Controlling Interest: Use this form when there is a transfer or change of controlling interest in a property that is not classified as a homestead property. 2. Form NOT — Out-of-Town Transfer: This form is used when the property is situated in one Massachusetts city or town, but the transfer or sale involves parties located outside that particular jurisdiction. 3. Form FA — Flow of Assets: In cases where the transfer of property ownership results from the flow of assets from one entity to another, such as through a merger or acquisition, this form is used. 4. Form PTA — Partial Termination Agreement: When there is a termination or partial termination of a property arrangement, this form is used to notify the assessors of the change. 5. Form COE CHP — Change of Entity, Change of Homestead Property: This form is specific to homestead properties and is used to report any change in ownership or control involving such properties. These Massachusetts Notice of Change of Ownership or Control Non-Homestead Property forms can be obtained from the FOR's official website or by visiting the local assessor's office. It is crucial to complete these forms accurately, providing all required information, including the property address, new owner's details, transaction specifics, and any supporting documentation required by the form. By filing this notice promptly and accurately, property owners ensure compliance with Massachusetts state laws and facilitate smooth tax assessment and billing processes for both themselves and the local assessors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.