Revenue sharing is a funding arrangement in which one government unit grants a portion of its tax income to another government unit. For example, provinces or states may share revenue with local governments, or national governments may share revenue with provinces or states. Laws determine the formulas by which revenue is shared, limiting the controls that the unit supplying the money can exercise over the receiver and specifying whether matching funds must be supplied by the receiver.

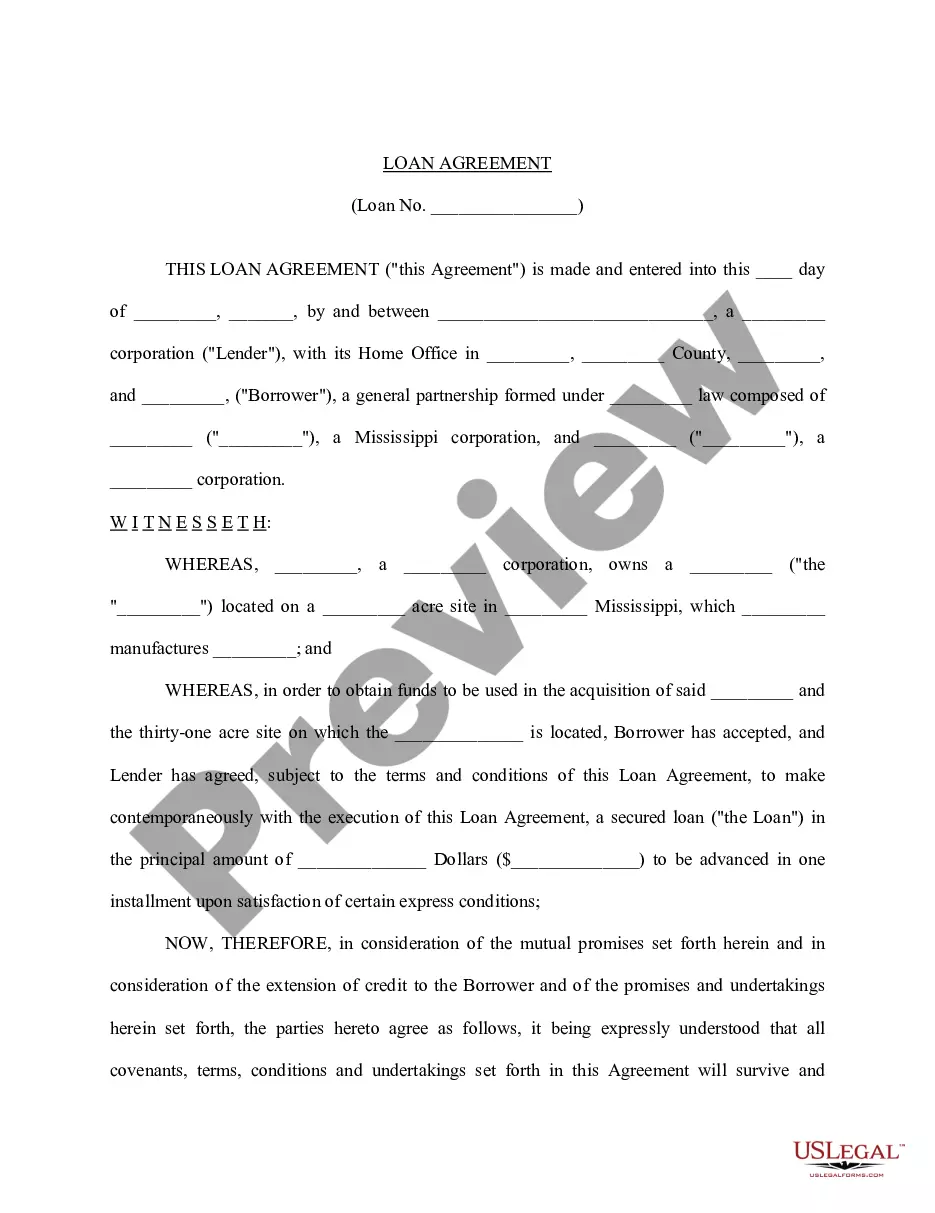

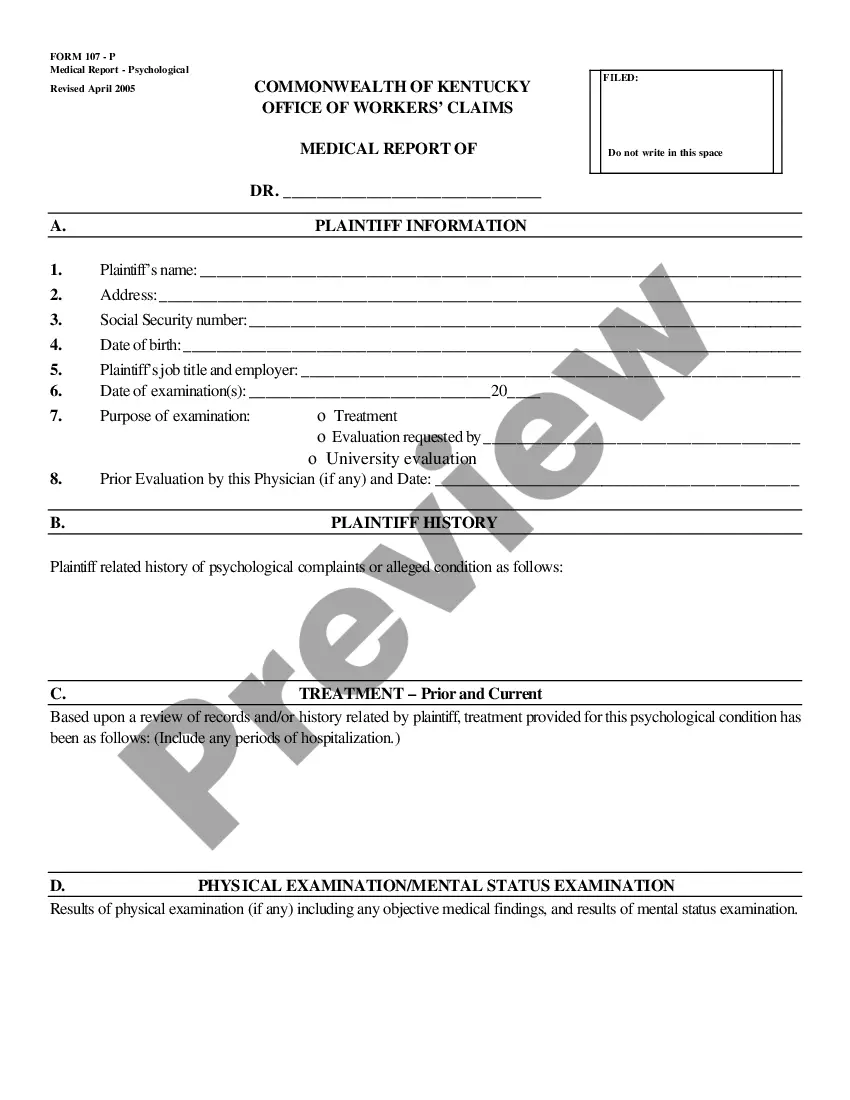

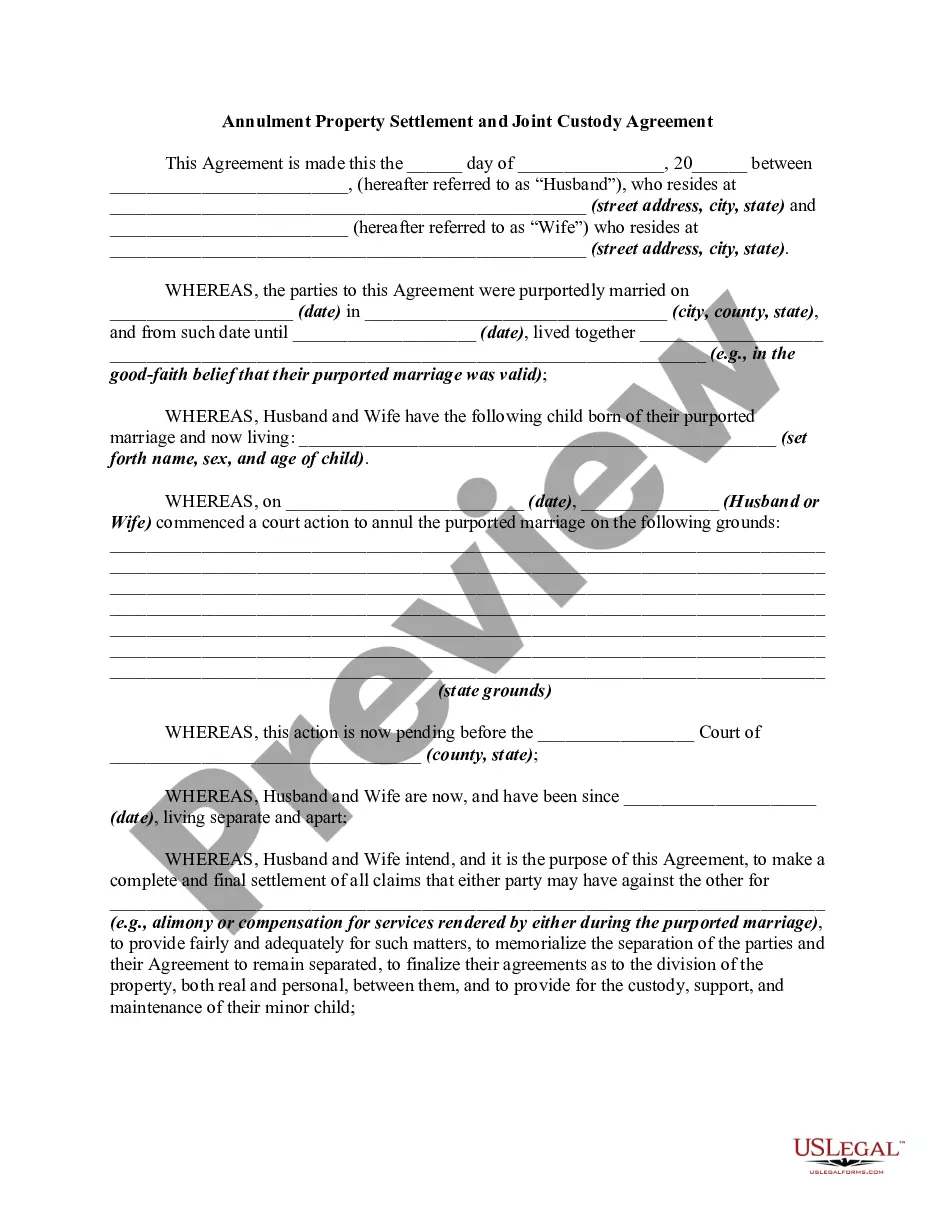

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.