A Massachusetts Promissory Note and Security Agreement with regard to the sale of an automobile from one individual to another is a legally binding document that outlines the terms and conditions of a loan agreement for the purchase of a vehicle. This agreement serves as evidence of the obligation for the buyer to repay the seller, who acts as the lender under this arrangement. The Promissory Note portion of the document details the specifics of the loan, including the principal amount borrowed, interest rate, repayment schedule, and any other relevant terms. It specifies the payment due dates, whether they are installments or a lump sum, and whether there are any late fees or penalties for non-payment. The Security Agreement is an important component of this document, as it establishes a lien on the automobile being sold. It provides security and protection for the lender in case the borrower defaults on the loan. The security interest granted allows the lender to repossess the vehicle if the terms of the agreement are not met. There are various types of Massachusetts Promissory Note and Security Agreements pertaining to the sale of an automobile, including: 1. Traditional Promissory Note and Security Agreement: This is a standard agreement commonly used in private transactions where one individual is financing the purchase of a vehicle from another individual. 2. Conditional Sales Contract: Sometimes referred to as a hire-purchase agreement or installment sales contract, this agreement outlines the terms of a loan where the ownership of the vehicle is retained by the seller until the buyer fulfills the payment obligations. 3. Lease Agreement with Option to Purchase: This type of agreement combines a lease agreement and an option to buy the vehicle at the end of the lease term. It includes provisions for lease payments and outlines the terms and conditions for exercising the option to purchase. 4. Chattel Mortgage: This agreement allows the buyer to take possession of the vehicle upon signing while the lender retains a security interest in the vehicle until the loan is fully repaid. Once the loan is paid off, the lender releases the mortgage, and the buyer becomes the vehicle's legal owner. When entering into a Promissory Note and Security Agreement in Massachusetts, it is crucial for both parties to carefully review and understand the terms and conditions. It may be wise to consult with a legal professional to ensure compliance with Massachusetts state laws and to protect the interests of both parties involved in the transaction.

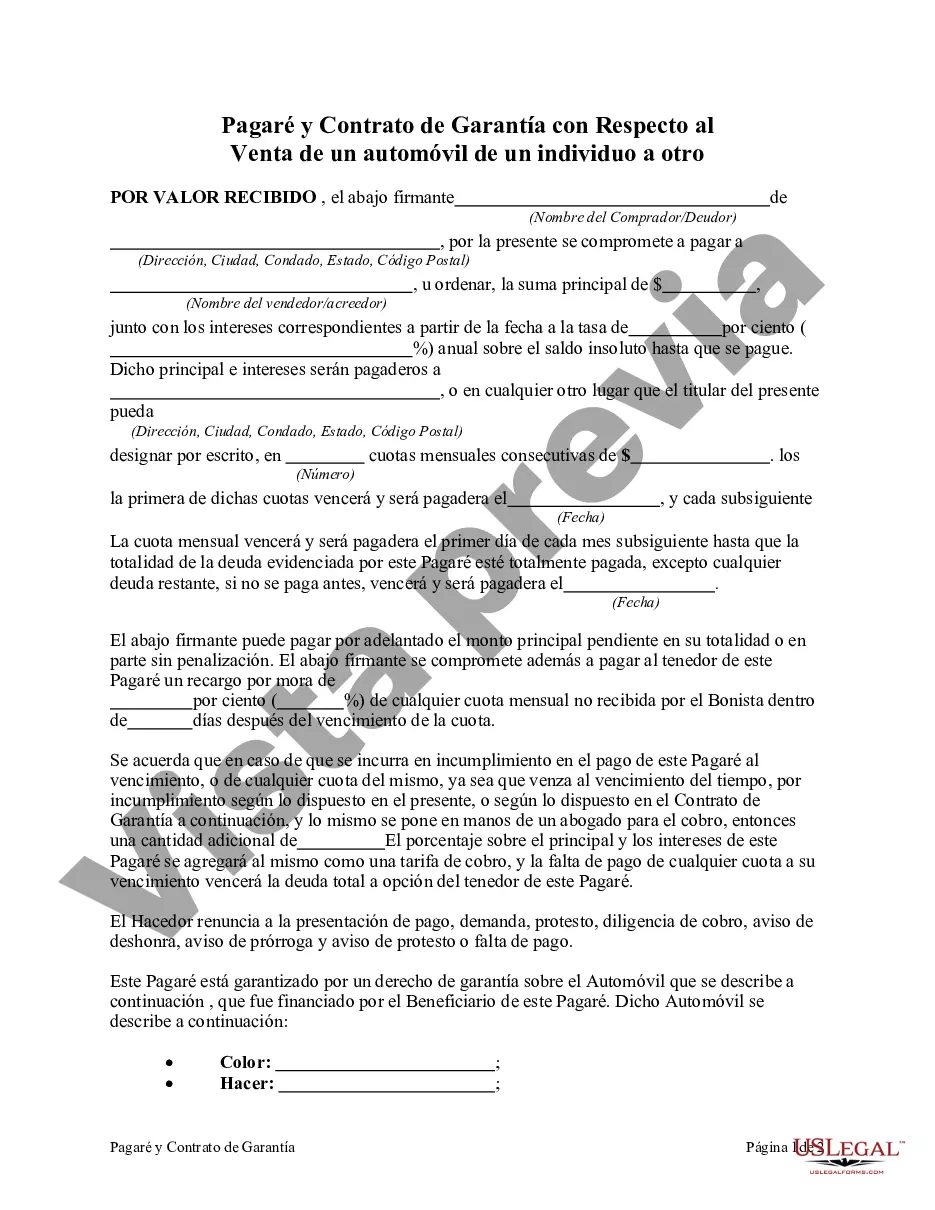

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Pagaré y contrato de garantía con respecto a la venta de un automóvil de un individuo a otro - Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another

Description

How to fill out Massachusetts Pagaré Y Contrato De Garantía Con Respecto A La Venta De Un Automóvil De Un Individuo A Otro?

It is possible to commit hrs on the web searching for the authorized file design that fits the federal and state needs you will need. US Legal Forms supplies a huge number of authorized forms that happen to be evaluated by pros. You can easily download or printing the Massachusetts Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another from your service.

If you have a US Legal Forms profile, it is possible to log in and click on the Acquire option. Following that, it is possible to total, change, printing, or sign the Massachusetts Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another. Each authorized file design you acquire is your own property permanently. To acquire yet another copy associated with a bought develop, go to the My Forms tab and click on the related option.

If you are using the US Legal Forms website the very first time, adhere to the simple recommendations under:

- Initially, make certain you have chosen the correct file design for that county/town of your choosing. Read the develop outline to ensure you have chosen the right develop. If accessible, take advantage of the Preview option to search through the file design too.

- If you wish to find yet another edition of your develop, take advantage of the Lookup field to find the design that meets your needs and needs.

- When you have found the design you want, simply click Buy now to move forward.

- Choose the rates program you want, key in your references, and sign up for a merchant account on US Legal Forms.

- Complete the financial transaction. You can use your charge card or PayPal profile to pay for the authorized develop.

- Choose the format of your file and download it to your product.

- Make adjustments to your file if necessary. It is possible to total, change and sign and printing Massachusetts Promissory Note and Security Agreement with Regard to the Sale of an Automobile from One Individual to Another.

Acquire and printing a huge number of file themes using the US Legal Forms website, which offers the largest selection of authorized forms. Use expert and status-certain themes to take on your small business or person needs.