Massachusetts Checklist — Leasing vs. Purchasing: A Comprehensive Guide to Making the Right Decision When it comes to acquiring property or assets in Massachusetts, individuals and businesses often face the decision of whether to lease or purchase. Understanding the advantages and disadvantages of each option is vital in making an informed choice. This Massachusetts Checklist — Leasing vs. Purchasing aims to provide clarity by listing key factors and considerations, ensuring that you navigate through the process successfully. 1. Financial Considerations: — Budget: Determine the amount you can allocate for the property or asset. — Cash flow: Evaluate your financial capabilities to make regular lease payments or handle monthly mortgage installments. — Tax implications: Understand the tax benefits and deductions associated with leasing or purchasing. 2. Long-term Goals: — Flexibility: Leasing allows for easier relocation or expansion as it involves shorter-term commitments. — Equity: Purchasing provides an opportunity to build equity and gain ownership rights over time. — Investment returns: Examine the potential return on investment over the long run in both leasing and purchasing scenarios. 3. Maintenance and Repairs: — Responsibilities: Know who will be responsible for maintenance and repairs — the landlord or the property owner. - Costs: Evaluate the potential costs involved in each option and weigh them against your budget and preferences. 4. Customization and Control: — Design and layout: Assess whether leasing or purchasing allows necessary customization to align with your specific needs. — Control: Determine the level of control desired over the property or asset, as purchasing generally offers more autonomy than leasing. 5. Market Analysis: — Assess the current market conditions in Massachusetts to determine which option, leasing or purchasing, is more advantageous based on the availability, demand, and pricing trends. Types of Massachusetts Checklist — Leasing vs. Purchasing: 1. Residential Property Checklist — Leasing vs. Purchasing: Focuses on the considerations specific to individuals looking to lease or buy a house, apartment, or condominium in Massachusetts. 2. Commercial Property Checklist — Leasing vs. Purchasing: Designed for businesses weighing the pros and cons of leasing or purchasing office spaces, retail locations, or industrial properties in Massachusetts. 3. Vehicle Leasing vs. Purchasing Checklist: Tailored for individuals or businesses in Massachusetts deliberating whether to lease or buy vehicles, including cars, trucks, or commercial fleets. Utilize this Massachusetts Checklist — Leasing vs. Purchasing as a guide to ensure thorough evaluation of your options, enabling you to make a well-informed decision that aligns with your unique circumstances and goals. Remember to consult professionals such as real estate agents, attorneys, or financial advisors when necessary to ensure a smooth and successful transaction.

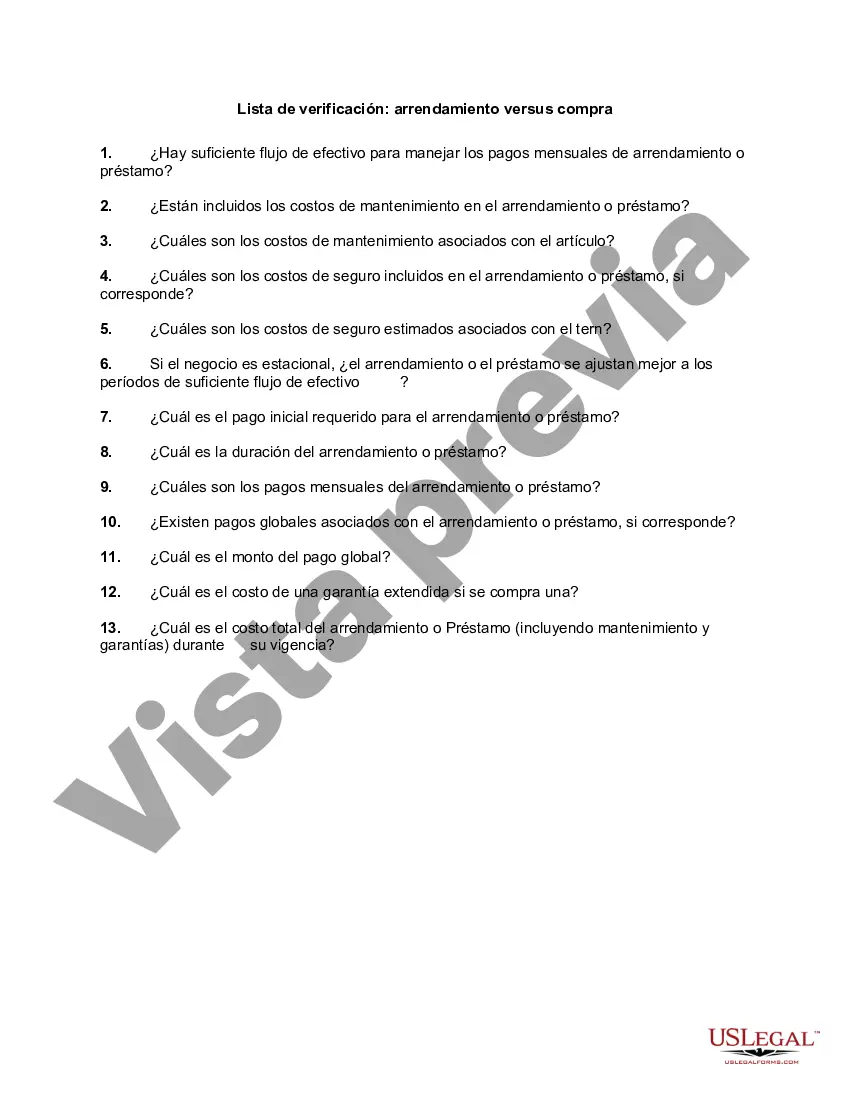

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Lista de verificación: arrendamiento versus compra - Checklist - Leasing vs. Purchasing

Description

How to fill out Massachusetts Lista De Verificación: Arrendamiento Versus Compra?

Choosing the right authorized document template could be a battle. Of course, there are plenty of web templates available on the Internet, but how will you discover the authorized develop you want? Use the US Legal Forms site. The service offers a huge number of web templates, for example the Massachusetts Checklist - Leasing vs. Purchasing, which can be used for business and private requires. Each of the kinds are inspected by experts and meet up with state and federal demands.

In case you are currently registered, log in in your bank account and click on the Down load key to get the Massachusetts Checklist - Leasing vs. Purchasing. Make use of your bank account to check from the authorized kinds you might have purchased in the past. Visit the My Forms tab of the bank account and have another version from the document you want.

In case you are a new end user of US Legal Forms, here are straightforward instructions that you can follow:

- Very first, ensure you have selected the proper develop for your metropolis/area. It is possible to check out the shape making use of the Preview key and read the shape outline to guarantee it will be the best for you.

- If the develop is not going to meet up with your needs, utilize the Seach field to discover the proper develop.

- When you are certain the shape is acceptable, click the Purchase now key to get the develop.

- Pick the pricing strategy you desire and enter in the necessary info. Build your bank account and purchase the transaction using your PayPal bank account or Visa or Mastercard.

- Opt for the file structure and acquire the authorized document template in your device.

- Total, revise and print out and signal the obtained Massachusetts Checklist - Leasing vs. Purchasing.

US Legal Forms is definitely the greatest catalogue of authorized kinds where you can discover different document web templates. Use the company to acquire professionally-made paperwork that follow express demands.