In Massachusetts, the Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting is a crucial legal document that allows the governing board of a nonprofit church corporation to make important decisions without convening a physical meeting. This type of consent offers flexibility while maintaining compliance with legal regulations. When utilizing the Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting, specific keywords play a significant role in addressing the requirements and procedures. Here is a detailed description of this document with relevant keywords: 1. Non-Profit Church Corporation: A legal entity formed to carry out religious or charitable purposes, organized under Massachusetts law, typically registered as a non-profit organization with tax-exempt status. 2. Board of Trustees: The elected or appointed individuals responsible for overseeing the affairs and governance of the church corporation. They hold fiduciary duties and are entrusted with decision-making and planning. 3. Consent to Action: A formal agreement signed by board members in lieu of assembling for a physical meeting. It allows the board to approve specific matters, ensuring progress even without direct personal interaction. 4. Massachusetts: Indicates the jurisdiction for which this Consent to Action is applicable. Specific regulations and legal frameworks within Massachusetts govern the actions of church corporations. The types of Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting may vary based on the decisions at hand. Some common ones include: 1. Consent to Action for Financial Matters: This type of consent authorizes the board of trustees to make financial decisions relevant to the church corporation, such as approving the annual budget, authorizing expenditures, or entering contractual agreements. 2. Consent to Action for Property Matters: When the church corporation needs to buy, sell, or lease property, this consent grants the board the authority to pursue these transactions, ensuring compliance with applicable real estate laws. 3. Consent to Action for Governance Matters: This consent addresses matters related to the functioning and structure of the church corporation, including the election or removal of board members, changes to the bylaws, or amending the articles of incorporation. 4. Consent to Action for Legal Matters: In situations that require legal action, such as litigation, forming partnerships, or engaging in lobbying activities, this consent empowers the board to make decisions and take appropriate steps. By utilizing the Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting, church corporations in Massachusetts can ensure effective decision-making and maintain compliance with the state's legal requirements. It provides a flexible solution while promoting transparency and responsible governance within the nonprofit organization.

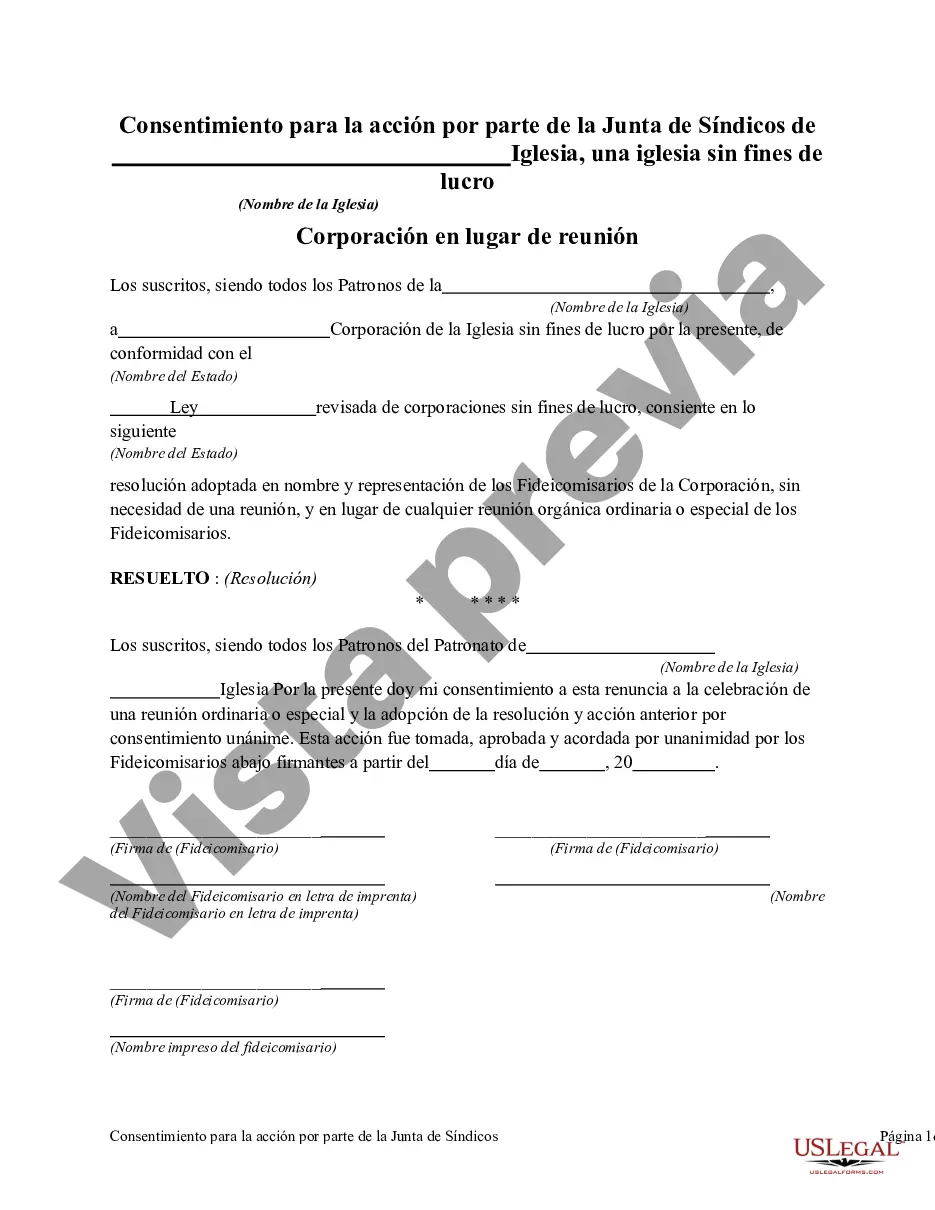

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Consentimiento para la acción por parte de la junta directiva de una corporación eclesiástica sin fines de lucro en lugar de una reunión - Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting

Description

How to fill out Massachusetts Consentimiento Para La Acción Por Parte De La Junta Directiva De Una Corporación Eclesiástica Sin Fines De Lucro En Lugar De Una Reunión?

If you need to comprehensive, obtain, or produce authorized file themes, use US Legal Forms, the biggest variety of authorized kinds, which can be found online. Take advantage of the site`s simple and hassle-free look for to find the files you require. Numerous themes for business and personal functions are sorted by classes and claims, or keywords. Use US Legal Forms to find the Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting in just a couple of click throughs.

Should you be currently a US Legal Forms consumer, log in to your account and click on the Obtain option to get the Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting. Also you can gain access to kinds you formerly acquired within the My Forms tab of your account.

If you use US Legal Forms initially, follow the instructions under:

- Step 1. Make sure you have selected the form to the appropriate area/nation.

- Step 2. Use the Preview solution to look through the form`s content material. Don`t forget about to read the outline.

- Step 3. Should you be unhappy with the form, utilize the Lookup field at the top of the monitor to discover other types of the authorized form format.

- Step 4. Upon having identified the form you require, click on the Get now option. Select the pricing strategy you prefer and put your qualifications to register for the account.

- Step 5. Procedure the transaction. You can utilize your credit card or PayPal account to finish the transaction.

- Step 6. Select the file format of the authorized form and obtain it on your own system.

- Step 7. Comprehensive, change and produce or indication the Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting.

Every authorized file format you acquire is the one you have for a long time. You may have acces to every single form you acquired in your acccount. Go through the My Forms area and choose a form to produce or obtain once more.

Contend and obtain, and produce the Massachusetts Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting with US Legal Forms. There are millions of specialist and condition-certain kinds you can utilize for the business or personal demands.