Title: Understanding the Massachusetts Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift Introduction: In the state of Massachusetts, nonprofit church corporations are required to follow specific guidelines outlined by the Massachusetts General Laws (MEL) when acknowledging gifts received. These guidelines ensure transparency and accountability in the acknowledgment process, allowing both the donor and the church corporation to maintain proper records. In this article, we delve into the details of the Massachusetts Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift, exploring its purpose, requirements, and potential types. I. Purpose of Massachusetts Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift II. Requirements for a Valid Acknowledgment III. Different Types of Massachusetts Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift A. Cash or Monetary Donations B. In-Kind Donations C. Non-Cash/Non-Monetary Donations D. Property or Real Estate Donations I. Purpose of Massachusetts Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift: The Massachusetts Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift serves several essential purposes for both the church corporation and the donor: — Records the acknowledgment of a gift: This document provides written proof that the church corporation acknowledges the receipt of a gift from a donor. — Ensures tareducibilityty: The acknowledgment helps donors claim tax deductions for their charitable contributions. — Establishes a legally binding record: A valid acknowledgment safeguards the interests of both parties in any future dispute regarding the gift or its intent. II. Requirements for a Valid Acknowledgment: To be considered valid, a Massachusetts Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift must include the following details: — The church corporation's legal name and address — The donor's legal name and contact information — A description of the gift (including type, quantity, and any conditions attached) — The dattariffif— - A statement confirming that no goods or services were provided in exchange for the donation (if applicable) — A statement about whether any goods or services were provided by the church corporation and their fair market value, if applicable — The signature of an authorized representative of the church corporation III. Different Types of Massachusetts Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift: A. Cash or Monetary Donations: When a donor contributes money to a nonprofit church corporation, a specific acknowledgment for cash or monetary donations must be provided. This acknowledgment details the amount donated, the currency, and any additional conditions or restrictions. B. In-Kind Donations: In-kind donations refer to gifts of goods or services rather than monetary contributions. Acknowledgments for in-kind donations should include a detailed description of the donated items, their fair market value, and any restrictions or limitations imposed by the donor. C. Non-Cash/Non-Monetary Donations: Non-cash donations encompass gifts like stocks, securities, or other non-monetary assets. Acknowledgments for non-cash donations should specify the type of asset donated, its fair market value, and any conditions or restrictions associated with the gift. D. Property or Real Estate Donations: When a donor contributes property or real estate to a nonprofit church corporation, the acknowledgment should provide a comprehensive description of the property, including its location, fair market value, and any stipulations or limitations set by the donor. It may also require additional documentation, such as a professional property appraisal. Conclusion: Understanding the Massachusetts Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift is crucial for both nonprofit church corporations and donors. By adhering to the specific requirements, church corporations can maintain accurate records and fulfill their legal obligations. Likewise, donors can protect their rights and enjoy potential tax benefits by ensuring the acknowledgment is provided and retained for their charitable contributions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Acuse de recibo de una donación por parte de una corporación eclesiástica sin fines de lucro - Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift

Description

How to fill out Massachusetts Acuse De Recibo De Una Donación Por Parte De Una Corporación Eclesiástica Sin Fines De Lucro?

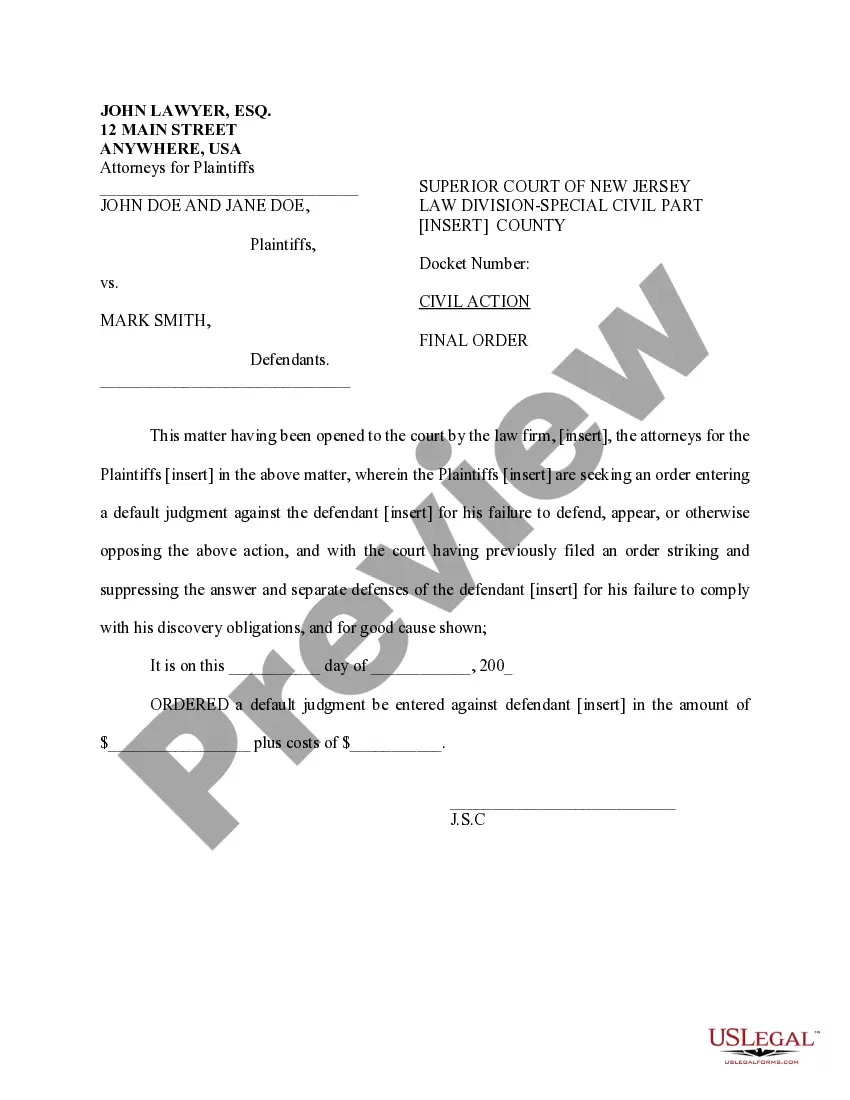

Discovering the right legitimate file design might be a have difficulties. Needless to say, there are a variety of layouts available online, but how can you obtain the legitimate form you need? Make use of the US Legal Forms web site. The services provides a large number of layouts, for example the Massachusetts Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift, which can be used for enterprise and private needs. All the varieties are checked out by professionals and satisfy federal and state demands.

Should you be presently listed, log in to the account and click the Obtain option to have the Massachusetts Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift. Use your account to search through the legitimate varieties you possess purchased earlier. Go to the My Forms tab of your respective account and acquire one more duplicate in the file you need.

Should you be a whole new customer of US Legal Forms, allow me to share straightforward instructions for you to follow:

- Very first, ensure you have chosen the proper form for your personal city/area. You may check out the shape using the Preview option and look at the shape description to guarantee it will be the right one for you.

- In the event the form fails to satisfy your expectations, use the Seach industry to discover the proper form.

- Once you are positive that the shape is proper, go through the Buy now option to have the form.

- Choose the rates strategy you want and enter the required info. Design your account and pay money for your order utilizing your PayPal account or Visa or Mastercard.

- Pick the data file format and download the legitimate file design to the system.

- Full, edit and produce and signal the attained Massachusetts Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift.

US Legal Forms is definitely the biggest collection of legitimate varieties in which you can see a variety of file layouts. Make use of the company to download appropriately-manufactured paperwork that follow express demands.