Massachusetts Agreement for Wedding Photography Services

Description

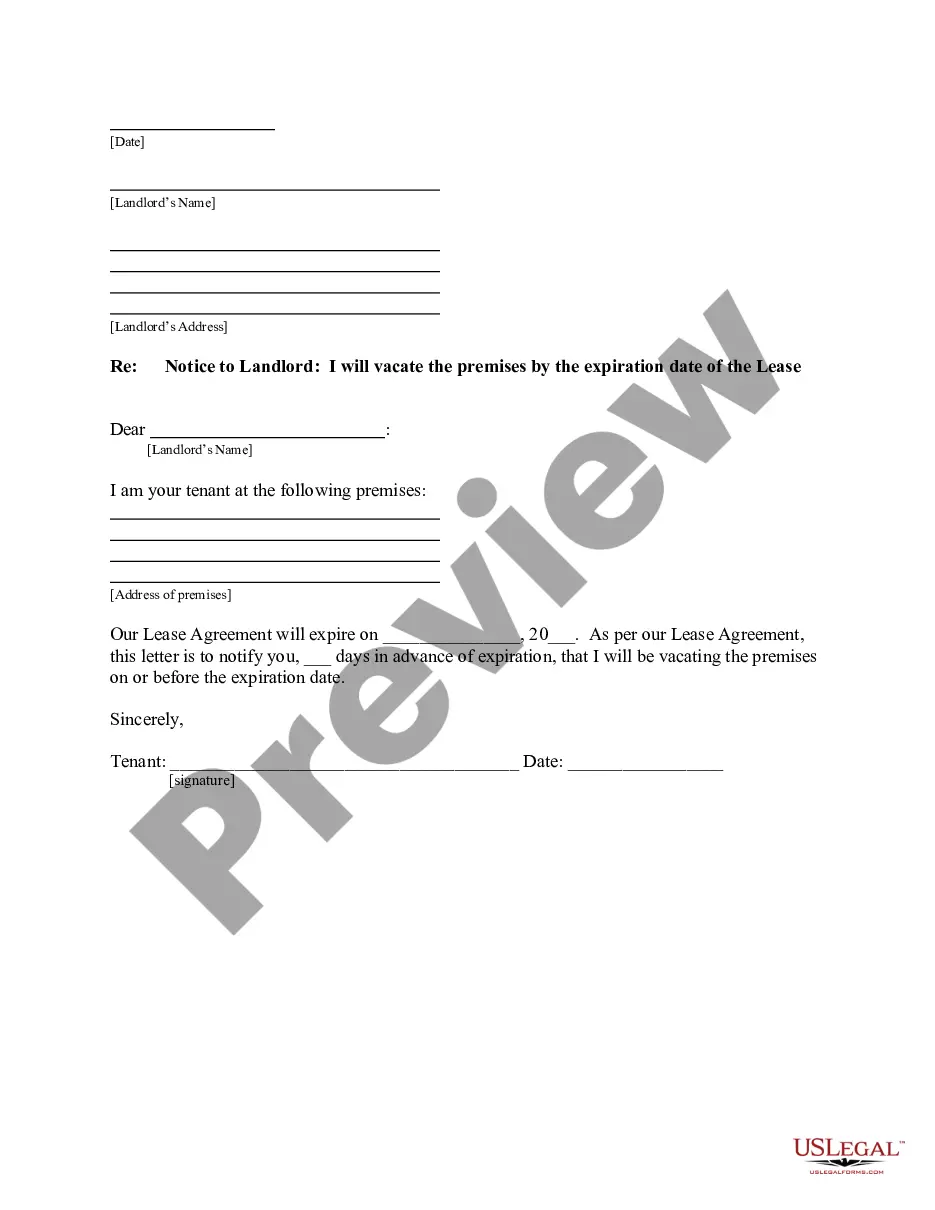

How to fill out Agreement For Wedding Photography Services?

You have the capability to devote multiple hours online attempting to locate the valid document template that meets the federal and state requirements you require.

US Legal Forms offers thousands of legal forms that are assessed by experts.

You can acquire or print the Massachusetts Agreement for Wedding Photography Services from this service.

If available, use the Review button to view the document template as well. If you wish to acquire another version of your form, utilize the Search area to find the template that fits your needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the Massachusetts Agreement for Wedding Photography Services.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, verify that you have chosen the correct document template for your area/city that you select.

- Review the form details to ensure you have selected the proper form.

Form popularity

FAQ

A photographer's transfers of pictures solely in a digital file via the Internet would not be subject to Massachusetts sales tax because it would not involve a transfer of tangible personal property as contemplated by G.L. c. 64H, § 1.

What Should Photography Contracts Include?Copyright Ownership and Transfer of Use Rights.Payment Schedule.Cancellation Policy.Summary of What Each Side Will Deliver.Start Date of Photography Contract and Shoot Date (If Applicable)Full Contact Information and Names for Client and Your Business.More items...

Labor and service charges are also taxable if they result in the creation of products. Sales of photographs and related items are treated the same as other products and are generally taxable unless a specific exemption or exclusion applies.

The Massachusetts sales tax is 6.25% of the sales price or rental charge of tangible personal property (including gas, electricity, and steam) or certain telecommunications services1 sold or rented in Massachusetts.

Don't Live Without Contracts Rachel's rule of thumb is that everyone should have a contract at every shoot. You can shoot without a model release, but you should never shoot without a photography contract. So many photographers do the opposite, she says.

Top 9 Things to Include in Your Wedding Photography ContractRescheduling Clause for Clients.Rescheduling Clause for Wedding Photographer.Delivery Timeline.Outdoor Wedding Venues.Wedding Venue Restrictions.Crew Meals and Breaks.Damage to Equipment.Copyright.More items...

In Massachusetts, a 6.25% sales tax is imposed on all services performed in the state. Unlike Connecticut and New York, business and professional services in Massachusetts are presumed taxable unless specifically exempt by state statute.

Most wedding photography packages include a combination of the following elements:Photography coverage on the day.A second photographer.A pre-wedding photo session.A USB stick.A certain number of digital photographs.A certain number of prints.An online Gallery.A wedding album.More items...

What Should Photography Contracts Include?Copyright Ownership and Transfer of Use Rights.Payment Schedule.Cancellation Policy.Summary of What Each Side Will Deliver.Start Date of Photography Contract and Shoot Date (If Applicable)Full Contact Information and Names for Client and Your Business.More items...

You may need a city license to operate your photography business in a particular locale, whether you are a resident, or not. Get the best jobs in sent to your inbox daily.