Massachusetts Assignment of Interest in Trust is a legal document that allows a person, known as the assignor, to transfer their interest in a trust to another party, referred to as the assignee. This assignment can involve different types of trusts, including revocable trusts, irrevocable trusts, living trusts, testamentary trusts, and charitable trusts. When an individual or entity assigns their interest in a trust, they essentially transfer their rights, control, and ownership of the trust assets to the assignee. The assignee becomes the new beneficiary of the trust and assumes all responsibilities and powers associated with managing and administering the trust assets. There are various reasons why someone might choose to execute a Massachusetts Assignment of Interest in Trust. For instance, an individual may want to pass on their trust assets to someone else, such as a family member or a friend, after they pass away. By assigning their interest in the trust, they can ensure that their chosen beneficiary receives the trust assets according to their wishes. Another scenario where an assignment might occur is when a trust beneficiary decides to transfer their interest to another person or entity for financial or personal reasons. This transfer could be a result of a business transaction, debt settlement, or estate planning strategy. It is important to note that different types of trusts may have specific requirements and formalities for executing an assignment. For instance, while a revocable trust may allow the assignor to freely transfer their interest, an irrevocable trust might only permit transfers under certain circumstances and with the consent of all trust beneficiaries. Executing a Massachusetts Assignment of Interest in Trust typically involves drafting a written agreement that clearly outlines the terms and conditions of the assignment. The document should include details such as the names and addresses of the assignor and assignee, the trust's name, the effective date of the assignment, and a statement indicating the assignor's intent to transfer their interest in the trust. To make the assignment legally valid and enforceable, it is crucial to have the document signed, witnessed, and notarized in accordance with Massachusetts laws. It is also recommended consulting with an attorney experienced in trust and estate matters to ensure compliance with all legal requirements and to address any potential tax implications. In conclusion, a Massachusetts Assignment of Interest in Trust is a valuable tool for individuals looking to transfer their rights and ownership of trust assets to another party. Whether it be to achieve specific estate planning goals or meet financial objectives, executing an assignment must be done in accordance with applicable laws and the particular requirements of the trust involved.

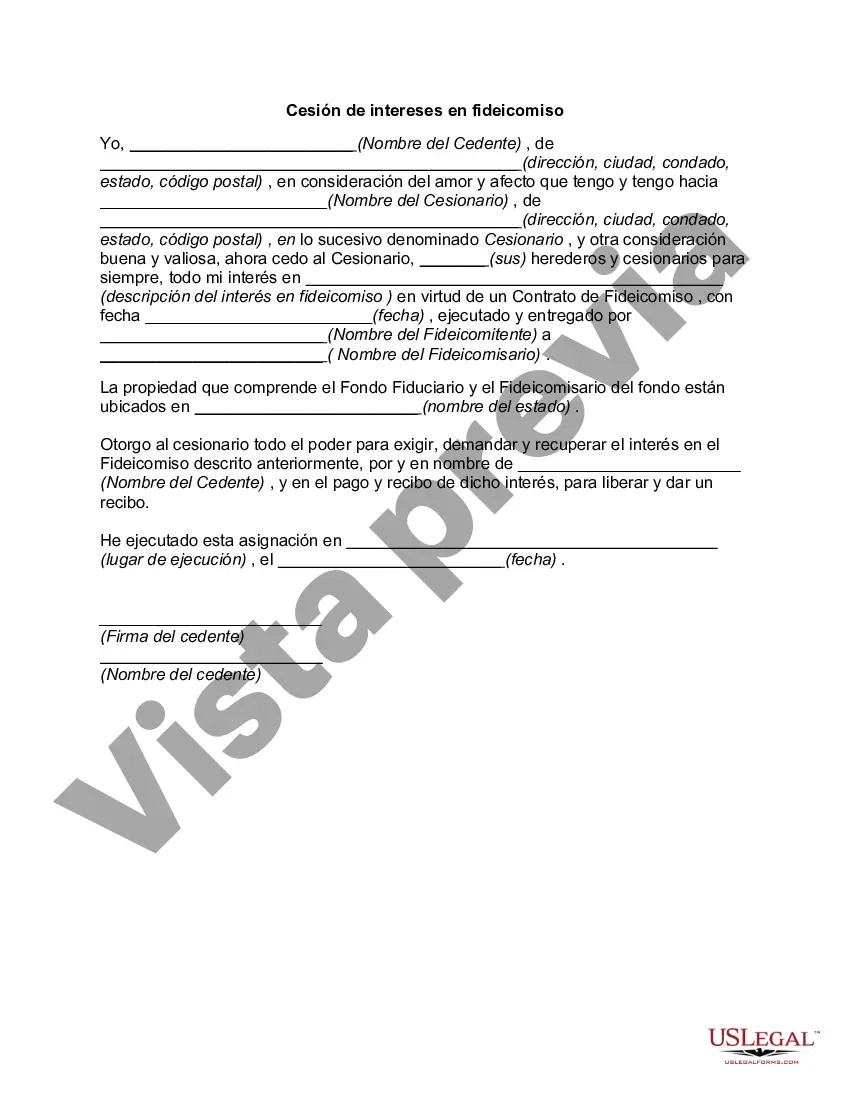

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Massachusetts Cesión de intereses en fideicomiso - Assignment of Interest in Trust

Description

How to fill out Massachusetts Cesión De Intereses En Fideicomiso?

If you want to complete, acquire, or print lawful document web templates, use US Legal Forms, the greatest selection of lawful types, that can be found on-line. Use the site`s simple and easy convenient search to get the papers you need. Different web templates for enterprise and specific uses are sorted by groups and claims, or keywords and phrases. Use US Legal Forms to get the Massachusetts Assignment of Interest in Trust with a few clicks.

When you are already a US Legal Forms customer, log in for your accounts and click on the Acquire switch to get the Massachusetts Assignment of Interest in Trust. You can even entry types you earlier delivered electronically inside the My Forms tab of your respective accounts.

If you are using US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have selected the form for that proper metropolis/land.

- Step 2. Make use of the Review choice to look through the form`s articles. Do not forget about to learn the outline.

- Step 3. When you are not happy using the type, make use of the Look for discipline towards the top of the monitor to get other versions of the lawful type format.

- Step 4. After you have identified the form you need, go through the Buy now switch. Pick the costs strategy you choose and include your credentials to register on an accounts.

- Step 5. Procedure the deal. You may use your credit card or PayPal accounts to finish the deal.

- Step 6. Select the structure of the lawful type and acquire it on your own product.

- Step 7. Complete, revise and print or sign the Massachusetts Assignment of Interest in Trust.

Every lawful document format you get is your own property forever. You may have acces to each and every type you delivered electronically with your acccount. Go through the My Forms portion and decide on a type to print or acquire yet again.

Compete and acquire, and print the Massachusetts Assignment of Interest in Trust with US Legal Forms. There are many specialist and condition-specific types you can utilize for your enterprise or specific requires.